Yen Rallies on Intervention Rumors, But Can It Break 150?

The yen soared on intervention speculation, but its lasting rally faces doubt amid mixed US signals, structural flows, and Japan's election.

Speculation of a coordinated U.S.-Japan currency intervention has sent the yen soaring against the dollar, but market analysts remain uncertain if the rally has enough momentum to push past the 150 mark, especially with a lower house election scheduled for February 8.

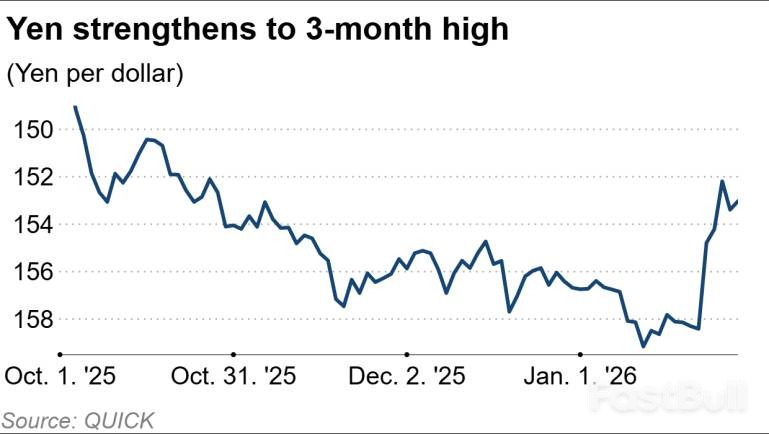

In under a week, the yen staged a dramatic comeback, strengthening over 4% from 159 to 152 against the dollar and reaching a three-month high. On Friday morning, the currency was trading in the 152 to 153 range.

This sharp reversal follows a period of weakness for the yen, which intensified after Sanae Takaichi became prime minister in October. Her expansionary fiscal policy and a recent call for a snap election, combined with the Bank of Japan's monetary policy outlook, had created significant selling pressure on the currency.

Figure 1: The USD/JPY exchange rate chart shows the yen's dramatic appreciation in early 2026, falling from near 158 to the 152 level and hitting a three-month high.

The Threat of Coordinated Action Moves Markets

The yen's rapid ascent began as traders grew alert to a potential intervention. The speculation was fueled by reports of a "rate check" conducted by the New York Federal Reserve and pointed comments from Japanese authorities. A rate check, where monetary officials inquire about foreign exchange price quotes from banks, is often seen as a prelude to direct market intervention.

"We will take appropriate action as necessary in close cooperation with U.S. authorities," Japanese Finance Minister Satsuki Katayama stated on Tuesday.

Although official data has not confirmed an actual intervention, the mere possibility has been enough to shift market sentiment.

"Governments don't always need to pull the trigger to move markets," explained Stefan Angrick, head of Japan and frontier market economics at Moody's Analytics. "The credible threat of coordinated action can be enough to move exchange rates, especially when Japan and the U.S. act together."

Doubts Emerge Over Sustained Yen Strength

Despite the market's reaction, official U.S. comments have been mixed. President Donald Trump said he was comfortable with the dollar's value, telling reporters, "The dollar is doing great."

Further dampening intervention speculation, U.S. Treasury Secretary Scott Bessent said on Wednesday that Washington was "absolutely not" intervening to support the yen.

Toru Suehiro, chief economist at Daiwa Securities, noted that while Trump seemed to downplay the dollar's fall, he also signaled he would not want it to decline further, hoping the currency will "seek its own level." Suehiro interprets this to mean a weaker dollar is not yet a major issue for the U.S. administration.

"He deems a further depreciation as undesirable," Suehiro said. "I expect for statements supporting the dollar to gradually come out and there will likely be no actual intervention to buy the yen and sell the dollar."

Structural Flows and the Limits of Intervention

While some analysts expect the yen could temporarily rise beyond the 150 threshold, few predict a sustained strengthening trend, particularly if Prime Minister Takaichi solidifies her power in the upcoming election.

A report from BofA analysts highlighted that short-term accounts have been selling the yen, partly over concerns about Japan's fiscal health. They noted, "Systematic accounts are notably long USD/JPY, with potential unwind triggers estimated around 153.3-155.1."

However, the report also emphasized that the major investment flows out of Japan over the past decade are "more structural." These include:

• Outbound foreign direct investment

• Public pension fund rotation into foreign securities

• Household purchases of foreign assets

These flows are considered "less cyclical or speculative" and would likely not be reversed by a currency intervention.

David Rolley, co-head of global fixed income at Loomis Sayles, forecasts that the yen will remain range-bound. "I don't expect it to go back to 158 but I'm not sure if it can break 150 either," he commented. Rolley added that a break below 148, a level where the yen traded for months last year, "would be a different world" and could signal a "yen bull market," but "that's not where we are yet."

Policy Outlook: Fiscal Strain vs. Rate Hikes

Looking ahead, political uncertainty could weigh on the yen. Michael Wan, senior currency analyst at MUFG Bank, said that in the near term, "the yen could see some modest underperformance given the uncertainty on the policy direction and outcomes of the upcoming snap election."

However, Wan also stressed that a joint intervention would be a significant development. "I think we will probably not revisit the sharp yen selling pressures we saw over the past two months," he said.

For a fundamental, medium-term shift away from yen selling, Wan argues that Japan must address its negative real interest rates and clarify "the pace of BOJ rate hikes, beyond U.S. rates and the U.S. dollar."

Analysts at Goldman Sachs, led by strategist George Cole, echoed this sentiment. They warned that if intervention is preferred over tighter monetary or fiscal policy, any relief for the yen and Japanese government bonds (JGBs) "may be short-lived." With JGB yields already soaring to multi-decade highs, Goldman Sachs concluded that fiscal restraint is likely the "fastest policy route to boost both JGBs and JPY durably."