Will Trump Get His Rate Cuts In 2026?

Despite incremental dovish shifts in the makeup of the FOMC voters, early 2026 is still likely to bring a pause to the Fed's easing cycle.

Despite incremental dovish shifts in the makeup of the FOMC voters, early 2026 is still likely to bring a pause to the Fed's easing cycle.

FOMC, Federal Reserve Key Points

- The Fed may shift to a slightly more dovish or centrist outlook heading into the new year based on the rotating cast of FOMC voters.

- The bigger shift will be at the top: Chairman Powell's term ends in May, leaving an opening at the top for President Trump to nominate a more dovish successor early next year.

- Despite these dovish shifts, early 2026 is still likely to bring a pause to the central bank's easing cycle.

"New Year, New You" the saying goes, but for traders, the more salient phrase may be more along the lines of "New Fed, New Markets."

The FOMC will enter 2026 with a fresh slate of regional bank presidents and a leadership transition on the horizon, developments that could shift the markets current expectations for interest rate cuts at the world's most important central bank.

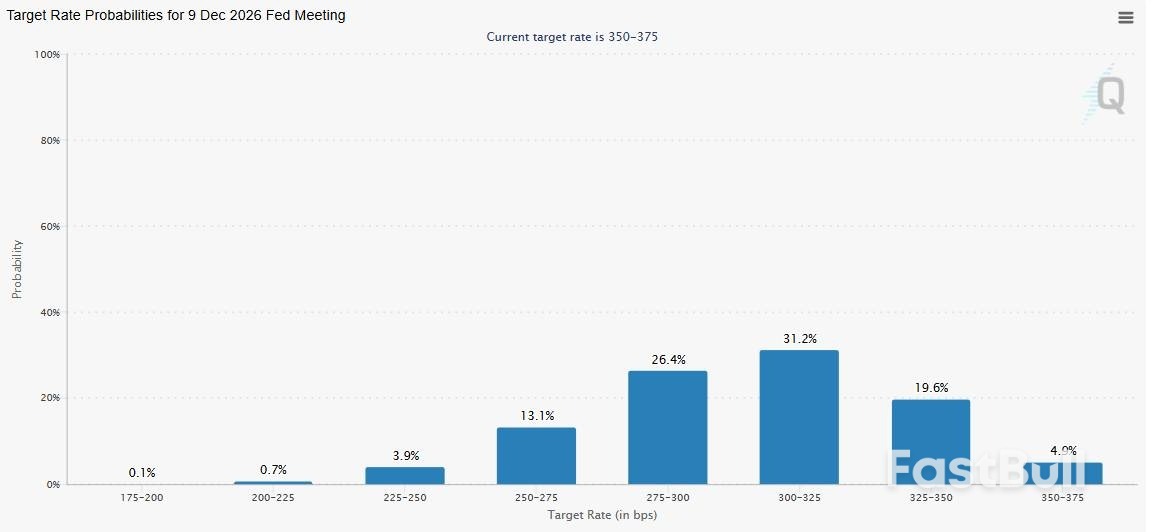

As the chart below shows, traders are currently pricing in a wide range between one and four 25bps interest rate cuts by the Fed in 2026, presenting clear trading opportunities for traders who are able to successfully handicap the outcome:

Source: CME FedWatch

FOMC Voter Changes in 2026: Who's In and Who's Out?

When it comes to the usual rotating voters, four Reserve Bank presidents will rotate off the FOMC in the new year: Susan Collins (Boston), Austan Goolsbee (Chicago), Alberto Musalem (St. Louis), and Jeff Schmid (Kansas City).

Their replacements are Anna Paulson (Philadelphia), Beth Hammack (Cleveland), Lorie Logan (Dallas), and Neel Kashkari (Minneapolis).

On balance, the outgoing voters lean hawkish (less inclined to cut interest rates overall. Recent quotes from the outgoing presidents follow:

- Susan Collins (hawkish lean): "Policy remains restrictive and that's appropriate for now."

- Alberto Musalem (hawkish lean): "[There is] limited room for further cuts"

- Jeff Schmid (outright hawk): "Inflation is still too high and policy is only modestly restrictive." (also note his dissents against the most recent two interest rate cuts)

- Austan Goolsbee (centrist/hawkish lean): "I expect more cuts in 2026 than most of my colleagues." (note this came after a dissent against the December rate cut in favor of waiting for more data)

Meanwhile, the new voters are more balanced, with two leaning hawkish and two more dovish:

- Anna Paulson (dovish lean): "I'm more concerned about weakening employment than lingering inflation." (She also noted that tariff-driven price pressures should fade, signaling openness to insurance cuts.)

- Neel Kashkari (centrist/dovish lean): "I supported additional cuts because tariffs are a one-off shock and the labor market is cooling."

- Beth Hammack (hawk): "We should take the recent inflation improvement with a grain of salt and keep policy slightly more restrictive until we're confident."

- Lorie Logan (hawk): "Further cuts risk moving policy into accommodative territory while core services inflation remains sticky."

Overall, the regular voter rotation could shift the Fed to a slightly more dovish or centrist outlook heading into the new year, though the move is likely to be marginal and economic data will still take precedence over broad ideological leans.

2026 FOMC Shift: The Leadership Wildcard

As you've no doubt heard, the bigger shift could be at the top: Chairman Powell's second four-year term ends in May, leaving an opening at the top for President Trump to nominate a(n almost certainly more dovish) successor early next year.

Names floated include Kevin Hassett, Kevin Warsh, and Chris Waller. Hassett and Warsh are widely viewed as favoring a more aggressive easing stance, citing growth risks and political priorities. Waller, meanwhile, has leaned hawkish historically but could pivot under a Trump mandate for faster cuts.

Beyond the appointment of a new Chairman in January, readers should also be aware that Trump-appointed Governor Stephen Miran exits January 31, 2026. In his so-far short tenure at the Fed, Miran has repeatedly dissented in favor of large 50bps rate cuts, making him the most dovish voice on the Board. In all likelihood, his replacement will reinforce a pro-easing tilt. Combined with a new Chair, this could shift the seven-member Board toward a majority favoring quicker normalization, even if regional presidents urge caution.

Despite these dovish shifts, early 2026 is still likely to bring a pause to the central bank's easing cycle, with the potential for interest rate cuts to accelerate through the middle of the year on the back of a new, more dovish Chairman, especially if employment data continues to deteriorate.