The Russell 2000, home to some of the riskiest stocks on the market, has been on a tear — and a spate of Wall Street strategists say the rally is just getting started.

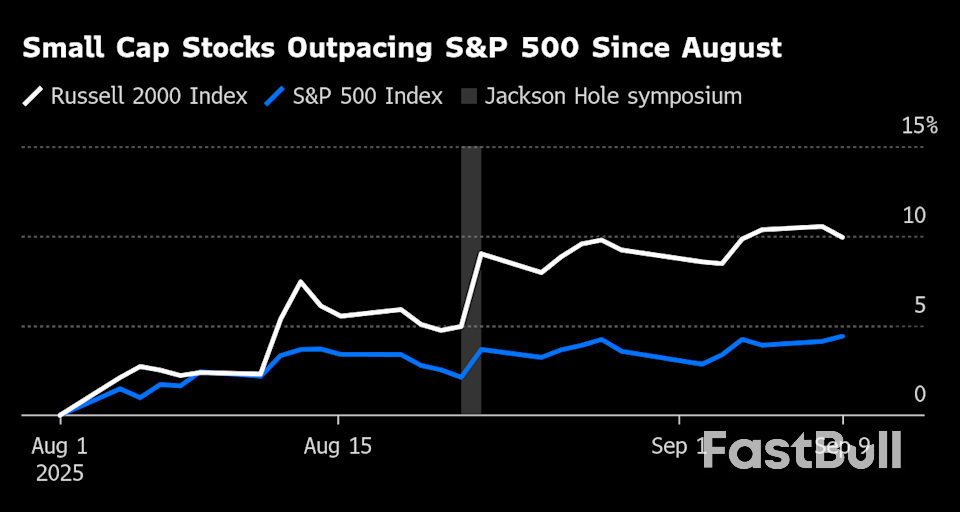

The gauge of small cap stocks has jumped almost 10% since the end of July, doubling the advance by the S&P 500. A bottom-up aggregation of price targets shows analysts expect the run of outperformance to continue over the next year. They see the potential for a 20% advance in the Russell 2000, compared with calls for an 11% jump in the S&P 500, according to data compiled by Bloomberg.

The call is a bold one, going by recent history. Small caps have lagged behind bigger companies every year since 2020, and even after the latest surge still trail the S&P 500 in 2025. The logic behind the prediction is that expected Federal Reserve rate cuts will lower borrowing costs for companies in the Russell 2000 enough to meaningfully boost margins. The analysts expect the bull market in US stocks, powered so far mostly by large caps, to broaden to smaller companies as Fed easing supports a still-strong economy.

“These are the most sensitive companies to the US economy,” said Michael Casper, senior US equity strategist at Bloomberg Intelligence, noting that interest rate cuts may be the catalyst that wins the sector more support from Wall Street. “All of a sudden, consensus starts to show some love toward small cap companies.”

Thursday’s market reaction to inflation and jobs data underscored the optimism. A largely in-line reading on prices and further signs that the labor market is weakening bolstered bets the Fed will cut rates next week and again later this year. The Russell 2000 jumped 1.2% while the S&P 500 added 0.7%.

Morgan Stanley’s Michael Wilson said in a research note Monday that Fed cuts could spur the “next leg” of the bull market and lift small cap stocks. He upgraded small caps to neutral from underweight earlier this month but said he still needs to see a jump in the group’s earnings revisions breadth before going all in.

So far this reporting season, things have gone in the right direction. Second quarter earnings came in above estimates for more than 60% of stocks in the Russell 2000, and the results beat top-line estimates by 130 basis points on average, data compiled by Bloomberg Intelligence show.

The combination of earnings growth, rate cuts and low valuations is “a pretty good collection of things for mid- to small-caps rally,” Tom Hainlin, national investment strategist at US Bank NA, said by phone. Goldman Sachs Chief US Equity Strategist David Kostin sounded a similar note.

The group has been “underappreciated” this year as “almost every equity class is trading a valuation premium to their 20-year averages” except for the US mid-cap value stocks and small caps, according to Emily Roland and Matt Miskin, co-chief investment strategists at Manulife John Hancock Investments.

The rally since August has pushed the Russell 2000’s price-to-earnings ratio to levels slightly higher than the index’s long-term average, though not to an extent that is cause for concern, according to Bank of America’s Jill Carey Hall.

“Small caps are no longer cheap vs. history, but remain the least-stretched size segment and still trade at a wide historical discount to large caps,” Carey Hall, equity and quant strategist at BofA, said in a Monday note. She sees “potential for a further re-rating.”

The options market also shows investors getting bullish about the prospects for small caps to extend their rally. Cboe Global Markets data shows options positioning is more bullish for the Russell 2000 than for the S&P 500.

“This makes sense as investors buy protection where they have exposure,” including in the large-cap space, “and upside calls where they are underweight and where they see potential for catch-up,” said Mandy Xu, vice president and head of derivatives market intelligence at Cboe.

RBC Capital Markets’ Lori Calvasina noted that passive flows into US small caps have turned positive. Still Calvasina, the firm’s head of US equity strategy, cautioned that the small-cap rally needs “signs that the economic backdrop is exiting sluggish territory and turning hot.” The space has also seen multiple breakouts since the Covid-19 pandemic, only to be eclipsed by the tech sector and larger cap peers in recent years.

Still, Barclays analysts urged investors to prefer tech and small caps in a Wednesday research note “for their strong earnings momentum,” and proclaimed, “Small caps are a big deal.”

Source: Bloomberg