U.S. stocks closed modestly lower on Monday, weighed down by a jump in Treasury yields and economic data that showed tariffs remained a drag on the manufacturing sector, as investors looked toward the Federal Reserve's policy announcement next week.

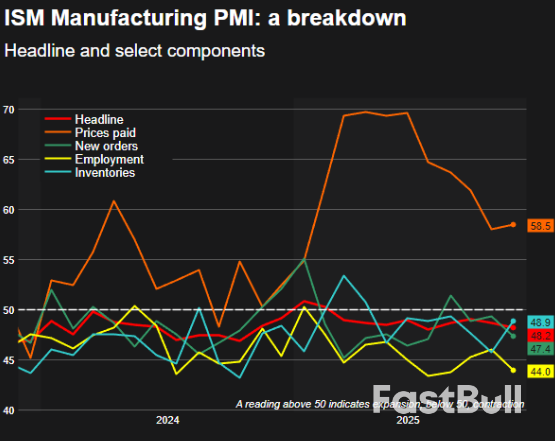

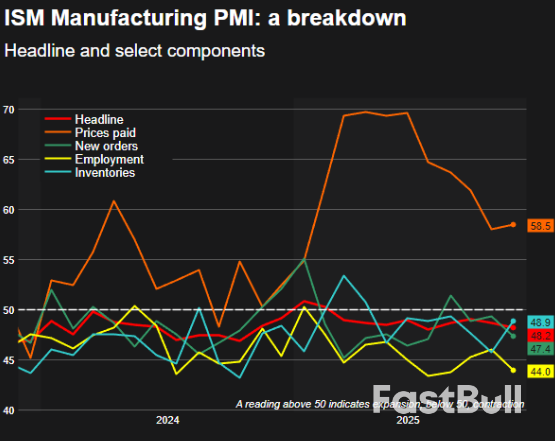

The Institute for Supply Management's survey showed U.S. manufacturing contracted for the ninth straight month in November, as factories dealt with slumping orders and higher prices as the effect from tariffs lingered.

Markets have largely priced in a rate cut from the Fed at the conclusion of its two-day policy meeting on December 10. They are pricing in an 85.4% chance of a 25 basis-point cut, according to CME's FedWatch Tool.

"The market actually is still obviously earnings-driven, we went through earnings season, but now it's the Fed," said Joe Saluzzi, partner, co-founder and head of Equity Market Structure Research and co-head of Equity Trading at Themis Trading in Chatham, New Jersey.

"I see no reason why the uptrend doesn't continue, at least, not as quickly, but maybe more of a grind up to the end of the year."

According to preliminary data, the S&P 500 (.SPX) lost 34.44 points, or 0.50%, to end at 6,814.65 points, while the Nasdaq Composite (.IXIC) lost 88.92 points, or 0.38%, to 23,276.76. The Dow Jones Industrial Average (.DJI) fell 411.46 points, or 0.86%, to 47,304.96. While many policymakers have struck a cautious tone, dovish signals from a few key voting members in recent weeks, along with reports that White House economic adviser Kevin Hassett is a leading contender to succeed Fed Chair Jerome Powell, have heightened expectations for further monetary easing in the months ahead.

Powell is scheduled to speak after the market close but is unlikely to address monetary policy due to the proximity to the central bank's policy meeting.

"I guess they'll look for hints of anything that he could say, but it looks like it's a done deal," said Saluzzi.

Investors are also waiting for a delayed September report on the Personal Consumption Expenditures Price Index, the Fed's preferred inflation gauge, due on Friday.

Despite expectations for a cut, U.S. Treasury yields were higher on Monday following weakness in Japanese and European government bonds in the wake of comments from Bank of Japan Governor Kazuo Ueda, who signaled that conditions were aligning for a possible rate hike. Bond yields move inversely to prices.

The rise in yields weighed on S&P 500 sectors such as real estate (.SPLRCR) and utilities (.SPLRCU), which are seen by many investors as bond proxies.

Coinbase (COIN.O) and U.S.-listed shares of Bitfarms were among the crypto stocks that showed significant weakness, as bitcoin stumbled and dropped below $85,000. The crypto market has lost more than $1 trillion in value since hitting a record of around $4.3 trillion, according to CoinGecko.

Strategy (MSTR.O), the world's largest holder of the cryptocurrency, ended lower after tumbling as much as 12% during the session. It cut its earnings forecast for 2025, citing a weak run in bitcoin.

Big-box retailers were in focus on Cyber Monday, with shoppers expected to spend $14.2 billion online, according to Adobe Analytics. Shares of Walmart (WMT.N) and Target (TGT.N) both advanced modestly.

Synopsys (SNPS.O) jumped after AI chip leader Nvidia (NVDA.O) said it had invested $2 billion in the semiconductor design software provider.

Source: Reuters