USD/JPY Technical: Eyeing The Ascending Range Support of 145.50

Today’s Tokyo inflation data and August consumer confidence figures reinforce expectations of a potential 25-basis-point rate hike by the Bank of Japan in October, as it continues along its path of monetary policy normalization.

Today’s Tokyo inflation data and August consumer confidence figures reinforce expectations of a potential 25-basis-point rate hike by the Bank of Japan in October, as it continues along its path of monetary policy normalization.

Tokyo inflation and Japan consumer confidence support another BoJ rate hike

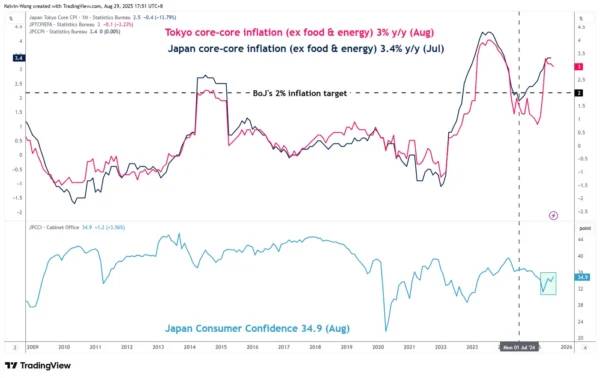

Fig. 1: Tokyo core-core inflation & Japan Consumer Confidence as of Aug 2025 (Source: TradingView)

Tokyo core-core inflation (excluding food and energy) rose by 3% y/y in August, a slight slowdown from July’s print of 3.1% but still well above BoJ’s long-term inflation target of 2% (see Fig. 1).

Japan’s consumer confidence index improved further to 34.9 in August from its current year-to-month low of 31.2 printed in April. This marked the highest reading since January seen across all the components; overall livelihood (32.7 vs 31.4 in July), income growth expectations (39.4 vs 38.5), employment outlook (39.3 vs 37.6), and willingness to purchase durable goods (28 vs 27.4).

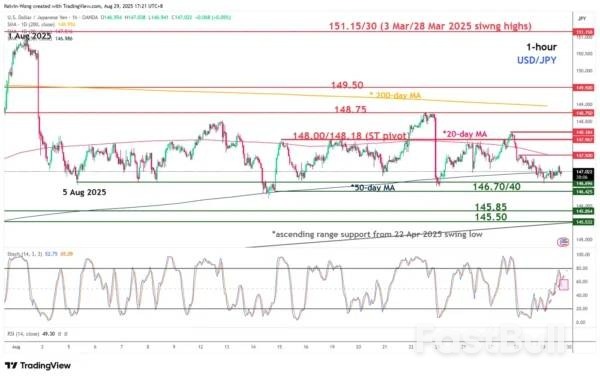

Fig. 2: USD/JPY minor trend as of 29 Aug 2025 (Source: TradingView)

Preferred trend bias (1-3 days)

Bearish bias below 148.00/148.18 key short-term pivotal resistance.

A break below 146.40 intermediate support (minor swing low area of 14 August 2025) opens the scope for a further potential slide towards the next supports at 145.85 (minor swing lows of 8 July/10 July/24 July 2025) and 145.50 (the lower boundary of the ascending range configuration) (see Fig. 2).

Key elements

- Price actions of the USD/JPY have traded back below its 20-day moving average, and it is now challenging the 50-day moving average.

- The USD/JPY is still oscillating within a medium-term ascending range configuration since the 22 April 2025 low of 139.90.

- The hourly Stochastic oscillator is now attempting to shape a bearish breakdown from its parallel ascending support, which suggests a potential resurgence of bearish momentum conditions at least in the short term.

Alternative trend bias (1 to 3 days)

The key near-term risk event is the upcoming release of July’s US core PCE inflation, along with personal income and spending data later today, which will play a pivotal role in shaping Federal Reserve rate cut expectations ahead of the September FOMC meeting.

A clearance above 148.18 invalidates the bearish scenario and sees a squeeze up towards the upper limit of the medium-term ascending range configuration for the next intermediate resistance to come in at 148.75 (also close to the 200-day moving average).