Summary:U.S. markets show strong headline gains but wide YTD dispersion, with large caps leading, smaller stocks lagging, muted returns elsewhere, and Fed minutes signaling a slower, more cautious path for rate cuts.

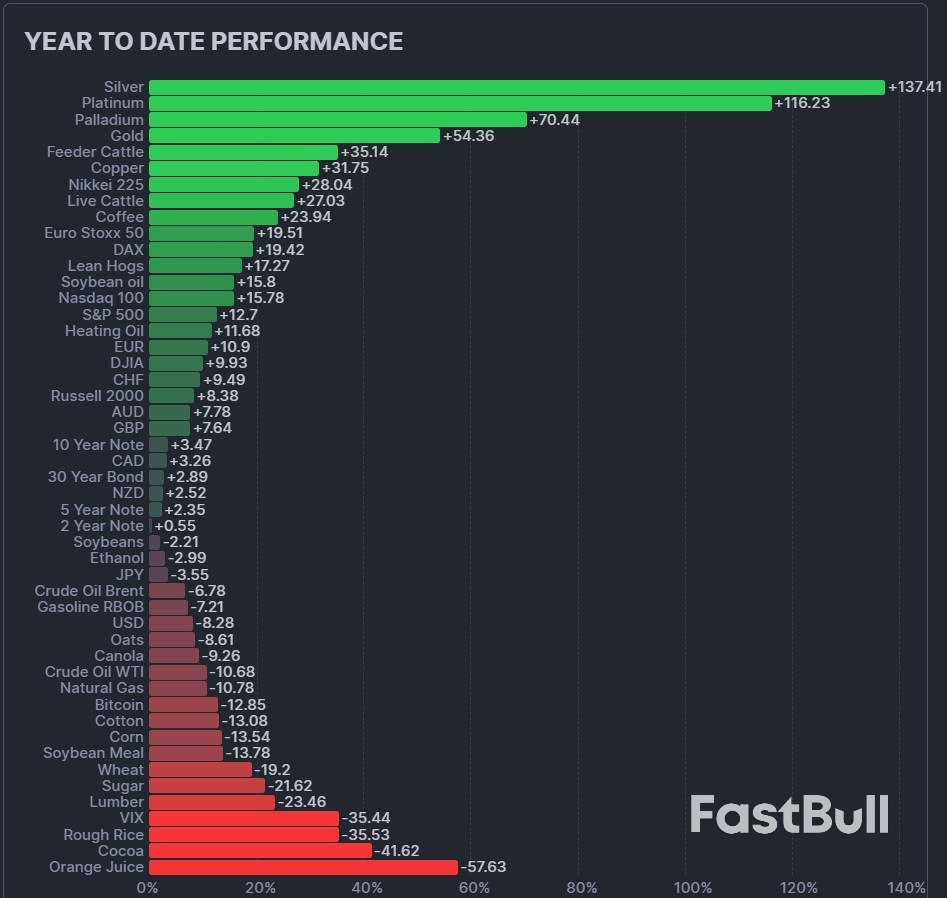

YTD returns across major U.S. asset classes continue to reflect a highly concentrated market. The Finviz chart below does a nice job illustrating YTD returns across a wide array of futures contracts. Large-caps dominate YTD equity returns, while small- and mid-cap stocks lag amid tighter financial conditions and slower earnings growth.

Outside of equities, YTD returns have been more muted. Bonds have stabilized as yields eased from their highs, offering modest diversification benefits, while cash remains competitive thanks to elevated short-term rates. Commodities and real assets have delivered mixed YTD returns as global growth slows and inflation pressures fade.

The takeaway is clear: YTD returns viewed at a high level mask wide dispersion beneath the surface, making positioning and diversification far more critical than broad market exposure.

Fed Minutes Point to a Slower Path for Rate Cuts

Minutes from the Fed’s December meeting show policymakers growing more cautious about cutting rates further in early 2026. Several officials noted that the decision to ease in December was “finely balanced,” with some preferring to hold rates steady as inflation progress shows signs of stalling.

While labor market conditions have softened, economic growth and consumer spending remain resilient, complicating the policy outlook. As a result, many participants favored keeping rates unchanged for “some time” while assessing incoming data. That stance aligns with the Fed’s projections, which point to a slower and more data-dependent path for future cuts.

Source: investing

Copyright © 2026 FastBull Ltd

News, historical chart data, and fundamental company data are provided by FastBull Ltd.

Risk Warnings and Disclaimers

You understand and acknowledge that there is a high degree of risk involved in trading. Following any strategies or investment methods may lead to potential losses. The content on the site is provided by our contributors and analysts for information purposes only. You are solely responsible for determining whether any trading assets, securities, strategy, or any other product is suitable for investing based on your own investment objectives and financial situation.