US Manufacturing Surveys Mixed In October; Prices Down, Production Up

"...lift the hood and the picture is not so healthy."

Amid the month-long vacuum of macro data, thanks to the shutdown, 'soft' survey data has become almost the only leg left standing to judge the economy by (absent the housing data).

Following better-than-expected prints across Europe, and beats in Brazil and Canada, this morning's S&P Global US Manufacturing PMI rose more than expected to 52.5 (52.2 exp), up from 52.0 - tracking hard data higher.

That signaled a third successive month that the S&P Global PMI has posted above the critical 50.0 no-change mark and indicative of a solid improvement in operating conditions that was in line with the survey's trend pace.

The PMI was supported in October by concurrent and accelerated gains in both output and new orders.

Production was increased at a solid pace, whilst the gain in new orders was the best recorded in 20 months. Growth in new work has been registered consistently throughout the year to date, albeit to varying degrees, and panelists noted in October an uplift in market demand and success in securing new contracts. However, October's growth was increasingly reliant on the domestic market as new export orders faltered.

BUT...

...as usual in the baffle 'em with bullshit world, ISM's US Manufacturing PMI missed expectations, falling from 49.1 to 48.7 (worse than the 49.5 exp) - the 8th straight month of contraction (below 50)

Source: Bloomberg

"US manufacturers reported a solid start to the fourth quarter with production rising at an increased rate in response to an encouragingly robust jump in new orders," according to Chris Williamson, Chief Business Economist at S&P Global Market Intelligence.

"However, lift the hood and the picture is not so healthy."

"Most worrying is the unprecedented rise in unsold stock reported in October, widely linked to weaker than anticipated sales to customers, especially in export markets, which could trigger a downshifting of production in the coming months unless demand revives.

Indeed, ISM shows prices falling fast and new orders and employment improving MoM (though both below 50 - contracting).

The index of prices paid for raw materials fell 3.9 points to 58, the lowest since the start of the year. Since a recent peak in April, during the height of the tariffs rollout, the price gauge has dropped nearly 12 points...

Source: Bloomberg

Companies have also become less optimistic about the year ahead, with sentiment back down close to the gloomy levels seen around the April tariff announcements.

"US trade policy uncertainties are again a big factor in dampening business spirits, with tariff policies being increasingly blamed both on rising export losses and import supply chain disruptions.

These export and import worries are being exacerbated by more domestically focused political concerns, including the federal shutdown, which are manifesting themselves most prominently in consumer-focused industries."

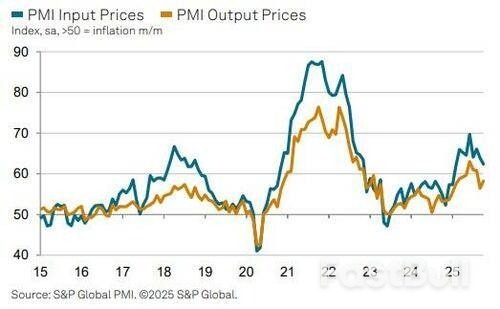

Tariffs remained a key source of higher input costs during October with S&P Global's latest data showing another round of historically elevated inflation – albeit the lowest since February.

Selling prices were raised markedly in response, and to a quicker degree than September's recent low.

Finally, Williamson notes that business confidence among producers of consumer goods is now down to its lowest for two years "as firms growing increasingly worried about household spending in the US and falling sales to consumers in export markets."