US Job Market Is Now 'no Hire, More Fire'

The U.S. labor market has been characterized as a 'no hire, no fire' landscape for much of the past year. But 'no hire, more fire' increasingly looks more accurate, providing further ammunition for the Federal Reserve to cut interest rates.

The U.S. labor market has been characterized as a 'no hire, no fire' landscape for much of the past year. But 'no hire, more fire' increasingly looks more accurate, providing further ammunition for the Federal Reserve to cut interest rates.

Retail giant Amazon on Tuesday announced 14,000 layoffs, with more to come next year, while delivery service UPS revealed that it has cut a whopping 48,000 employees over the past year. The reasons cited include protecting margins, employing more artificial intelligence, and reversing pandemic-era over-hiring.

These aren't the only eye-opening announcements recently: around 25,000 workers are being let go at Intel, 15,000 at Microsoft, and 11,000 at Accenture. The Trump administration is also firing swathes of government workers.

In total, U.S. employers announced almost 950,000 job cuts in the January-September period, according to global placement firm Challenger, Gray & Christmas, with the top affected sectors being government, tech and retail.

While most of that was earlier in the year, these figures suggest the labor market is truly cracking, lending credence to Fed Chair Jerome Powell's view that downside risks to employment outweigh upside risks to inflation.

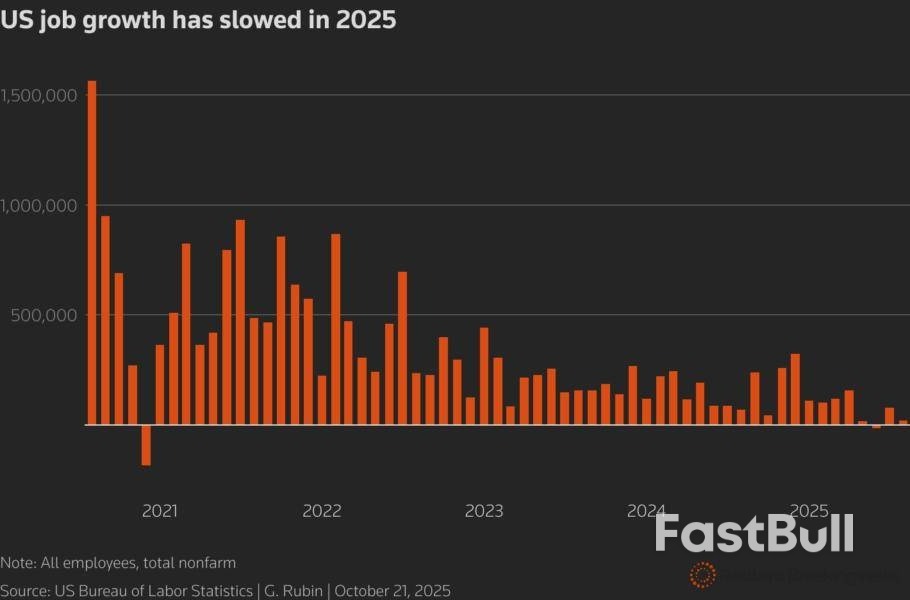

Thomson ReutersUS job growth has slowed in 2025

FLYING BLIND

The Fed resumed its interest rate-cutting cycle in September after a nine-month hiatus and is expected to continue easing into next year due to concerns about labor market weakness.

While the unemployment rate hasn't risen much, that is mainly because cooling demand for workers has been offset by shrinking labor supply, as the Trump administration has cracked down on immigration and increased deportations.

In normal times, job cuts at individual firms might not be on policymakers' radar. But these are not normal times. We're in the midst of the second-longest government shutdown in U.S. history. This has prevented the release of almost all labor market data – including monthly payrolls, the unemployment rate, job openings and labor turnover (JOLTS) and weekly jobless claims – for four weeks. Fed officials are flying blind.

With no official incoming data for guidance, specific corporate announcements could take on extra significance.

Troy Ludtka, senior U.S. economist at SMBC Nikko Securities Americas, says the Amazon and UPS announcements may not move the policy dial just yet, but they should confirm Fed officials' "anxieties" over the labor market. "The question now is, just how aggressive will other companies be in reducing headcount?"

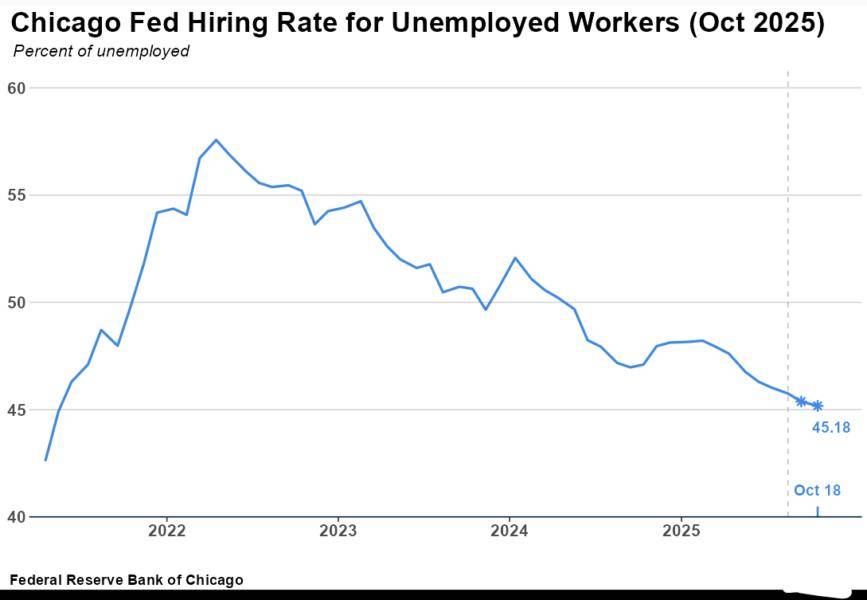

Thomson ReutersU.S. hiring rate for unemployed workers - Chicago Fed

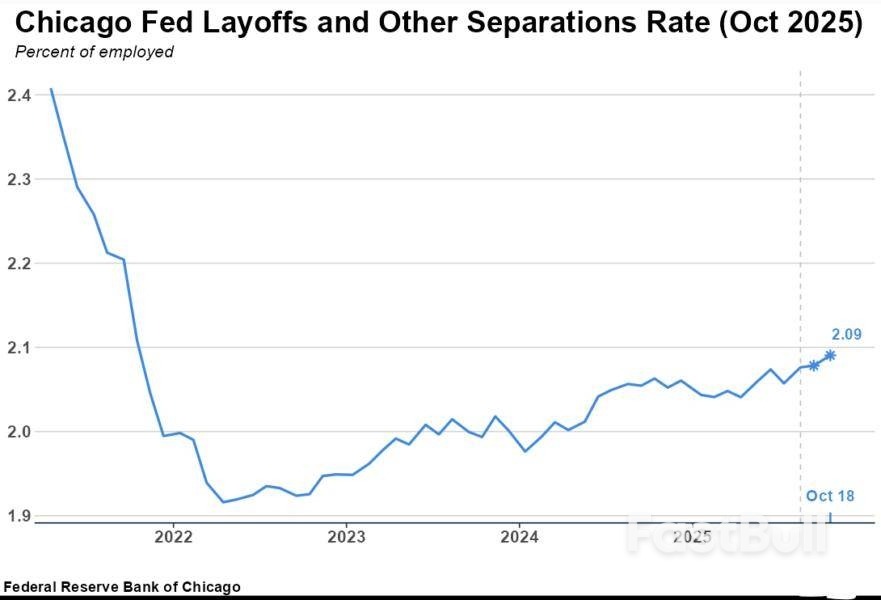

Thomson ReutersU.S. layoffs and job separation rate - Chicago Fed

WARNING BELLS

As the Fed waits for the answer to that question, the few official economic indicators available are already ringing warning bells.

The Chicago Fed's economic model – which uses private data when official government statistics are unavailable – showed that 'Layoffs and Other Separations' as a share of employed workers are grinding higher and that the 'Hiring for Unemployed Workers' as a share of total unemployed is falling. Both of these are levels not seen for four years.

Meanwhile, U.S. private payrolls increased by an average of just 14,250 jobs in the four weeks ending October 11, the ADP National Employment Report's weekly preliminary estimate showed on Tuesday. ADP, which usually publishes monthly reports, said it will now publish weekly preliminary estimates every Tuesday, based on its high-frequency data.

That's a paltry increase, effectively signaling no job growth at all – although it is better than the 32,000 decline in ADP's last monthly report for September.

All told, the labor market picture appears to justify lower interest rates. But easier policy is not without risks. Wall Street, led by tech and AI stocks, is booming, with financial conditions the loosest in years. And inflation is still a full percentage point above the Fed's target.

Rate cuts may be well-intentioned, with the goal of protecting potentially millions of workers at risk of losing their jobs, but easing will pour fuel on the ongoing 'melt up' rally. So while it remains unclear how much these cuts will actually support the labor market, they are almost certain to boost wealthy asset holders' portfolios.

What we also know for sure is that the more companies announce sweeping layoffs, the more likely the Fed is to act.