UK Parliament Probes New Stablecoin Rules

UK lawmakers scrutinize stablecoin rules, assessing systemic impact and regulatory proportionality.

The UK's House of Lords has launched a formal inquiry into proposed regulations for stablecoins, putting new rules from the Bank of England (BoE) and the Financial Conduct Authority (FCA) under the microscope.

The Financial Services Regulation Committee is now seeking input from the public, industry participants, and experts on the plans. Submissions are open until March 11.

House of Lords Scrutinizes Stablecoin Framework

The inquiry will investigate the potential impact of stablecoins on traditional banking and payments. It will also weigh the opportunities and risks associated with their increasing adoption in the UK.

According to Baroness Noakes, chair of the committee, lawmakers will assess whether the frameworks proposed by the BoE and FCA are "measured and proportionate responses" to the evolving stablecoin market. The committee is also scheduled to hold a public hearing to take oral evidence.

The UK Parliament's Financial Services Regulation Committee has issued a public call for evidence for its inquiry into stablecoin regulation.

Bank of England's Plan for Systemic Stablecoins

This parliamentary review comes as UK authorities work to finalize their approach to digital asset oversight. The Bank of England has identified advancing stablecoin regulation as a top priority for 2026, alongside work on its Digital Securities Sandbox and tokenized collateral.

Sasha Mills, the BoE's executive director of financial market infrastructure, confirmed that the central bank is collaborating with the FCA on a regime for "systemic stablecoins." The goal is to ensure these digital assets meet the same standards as other forms of money in the UK economy.

"We aim to finalise the regime for systemic stablecoins, working side-by-side with the FCA, by the end of this year," Mills stated at the Tokenisation Summit.

The proposed framework includes providing systemic stablecoin issuers with access to a deposit account at the Bank of England. Mills also noted that a liquidity facility is being considered to act as a backstop for these issuers.

What Defines a 'Systemic' Stablecoin?

The BoE defines systemic stablecoins as pound sterling-denominated tokens used for payments that could pose a risk to financial stability.

According to a consultation paper published in November 2025, these stablecoins would be required to be fully backed, with at least 40% of their reserves held in deposits at the BoE.

Mills also raised concerns that widespread stablecoin use could reduce commercial bank deposits, potentially leading to a reduction in credit supplied to the "real economy."

UK's Broader Crypto Regulatory Timeline

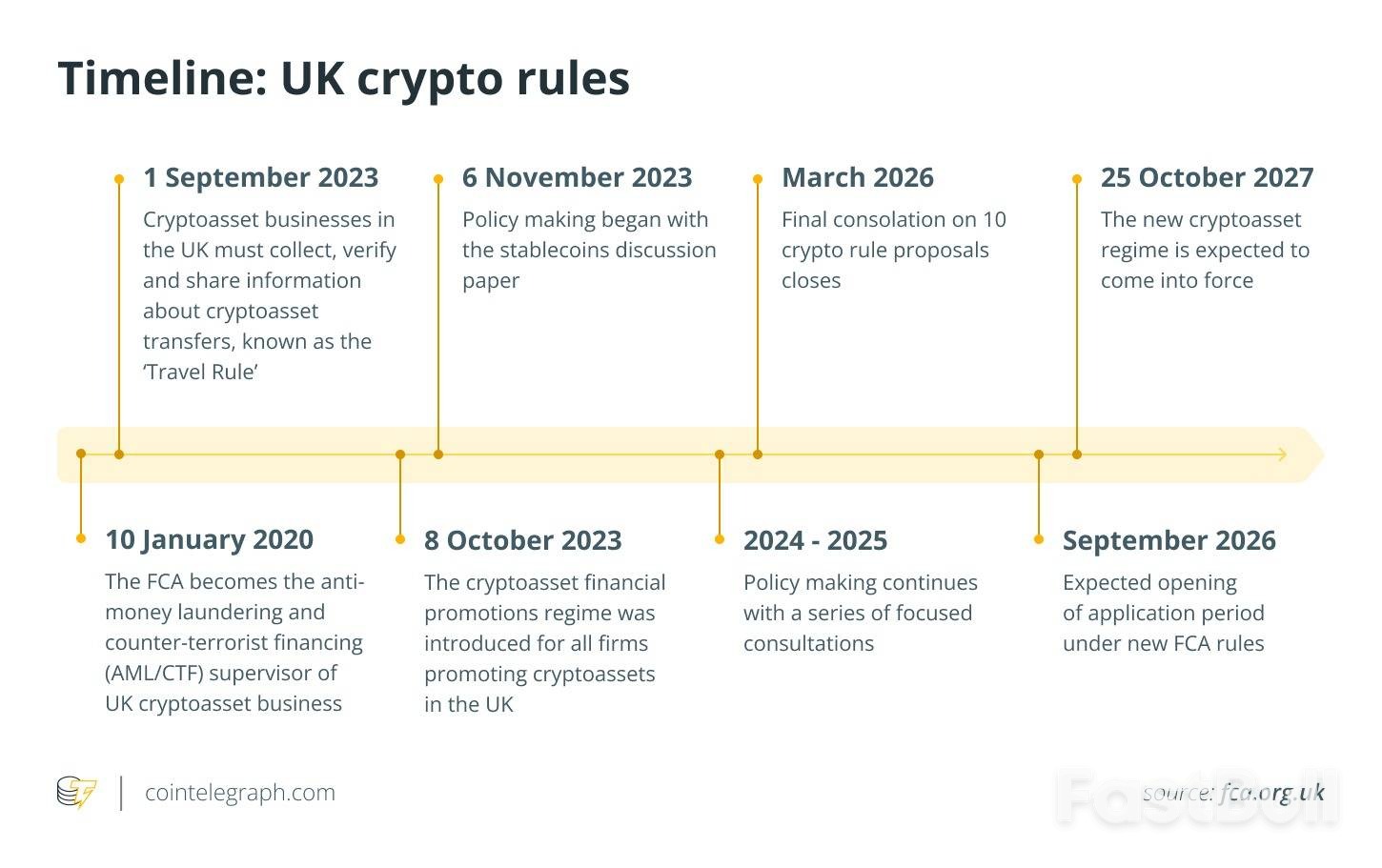

The stablecoin inquiry is part of a wider regulatory push. The FCA recently released a final consultation detailing 10 proposals for the crypto market, a process expected to conclude in March. The full implementation of these rules is targeted for October 2027.

A timeline showing the UK's phased approach to crypto asset regulation, from 2020 through the planned full implementation in October 2027.

A Centralized Approach: How the UK Differs from the US

The UK's strategy would centralize crypto regulation under the FCA, which oversees both securities and commodities.

This contrasts with the approach in the United States, where the proposed CLARITY Act aims to draw a clear line between the jurisdictions of the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) regarding digital assets.