UK Mortgage Approvals Dipped in October Amid Tax Rise Fears

Demand for home loans fell slightly in October as prospective buyers put decisions on ice amid fears of tax rises targeting the UK property market in the budget.

Demand for home loans fell slightly in October as prospective buyers put decisions on ice amid fears of tax rises targeting the UK property market in the budget.

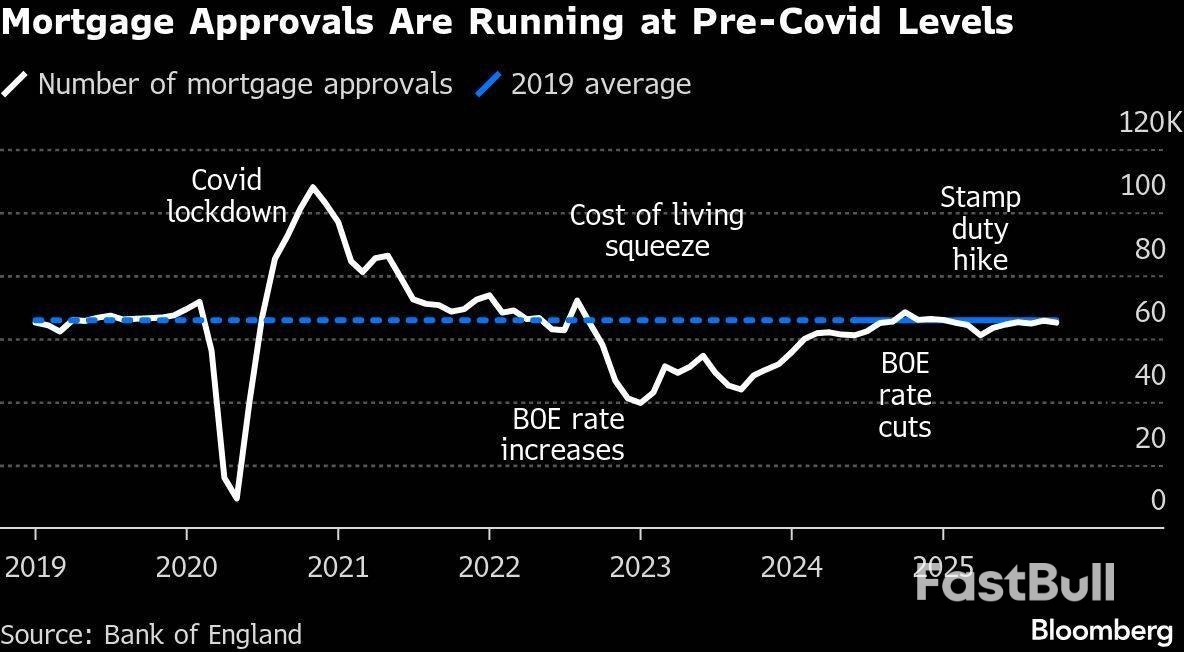

The number of mortgage approvals dipped to 65,018 from 65,647 in September, the Bank of England (BOE) said on Monday. The figure was nonetheless higher than the 64,500 economists forecast, pointing to underlying resilience.

The figures provide further evidence of the dampening effect that pre-budget speculation had on the housing market as rumours swirled that Chancellor of the Exchequer Rachel Reeves would impose wealth taxes on high value homes in an attempt to fill a hole in her budget plans. Such a move would have hit homeowners in London and the South East especially hard.

In the event, her statement on Nov 26 was not as sweeping for the property market as had been feared, with the main measure being a new levy on homes worth over £2 million (RM10.92 million). That's raised hopes the market may pick up some momentum in the months ahead.

In boost for borrowers, inflation appears to have peaked and the BOE is expected to deliver a further interest-rate cut later this month.

"Aspects of that uncertainty have now passed and the Bank of England looks on course to cut the base rate in December," said Simon Gammon, managing partner at Knight Frank Finance. "This should allow lenders to keep trimming mortgage rates, and we expect some pent up demand to be released as we move into a stronger spring selling season,"

Actual mortgage lending fell to £4.3 billion from £5.2 billion as gross lending declined a repayments of debt jumped, the BOE said.

Separate BOE figures show consumers borrowed £1.1 billion of unsecured debt on balance in October, down from £1.4 billion the month before. While budget jitters likely continued into November, some shoppers may have geared up for Black Friday discounts at the end of the month and the start of the Christmas shopping season.

Reeves' budget was seen as supportive for consumers. While it delivered another hefty tax hike as anticipated, much of the pain is deferred for several years. She backtracked on raising income tax rates and opted instead for a "stealth tax" that could go relatively unnoticed for now. There was also help with household bills.

In a further sign of caution ahead of the budget, households put an extra £6.8 billion into bank and building society accounts in October, above the £5.9 billion average of the previous six months.

They deposited an additional £5.5 billion into interest-bearing sight deposit accounts and £300 million into interest-bearing time deposit accounts, the BOE said. There was also a £4.2 billion surge into ISAs, spurred by accurate speculation about the chancellor lowering the cap on the amount of cash Britons can save in the tax-free accounts.

In the corporate sector, private non-financial companies repaid £4.8 billion of finance in October, the highest level of net repayments since October 2023.

"Overall, today's money and credit data gives a picture of nervousness ahead of the budget," said Thomas Pugh, chief economist at RSM UK. "Given growth was just 0.1% q/q in Q3, there is a real risk of stagnation in Q4."