Trump's Rate War: Why the Fed Can't Tame Long-Term Yields

Trump's demand for lower long-term rates clashes with the Fed's limited control, as inflation and fiscal worries keep yields elevated.

Donald Trump has intensified his campaign to force the Federal Reserve into cutting interest rates, but his focus has pivoted from the Fed's policy rate to the long-term borrowing costs that directly impact voters. This shift presents a major challenge for his Fed Chair nominee, Kevin Warsh, who may find it impossible to deliver.

The stakes are high for millions of Americans facing steep mortgage rates and for Trump himself, as his success in the November midterm elections could hinge on addressing the "affordability crisis." Treasury Secretary Scott Bessent has voiced a desire for a 10-year Treasury yield starting with a "3," a level only briefly seen during Trump's second term. The White House has consistently blamed current Fed Chair Jerome Powell for this, but that argument misses the mark.

The Fed's Limited Control Over Long-Term Rates

The Federal Reserve’s direct power is primarily over the short-term Fed funds rate. While this rate serves as a foundation for credit card, auto, and business loans, it's the benchmark 10-year Treasury yield that truly dictates long-term borrowing costs like mortgages—and the Fed has very little control over it.

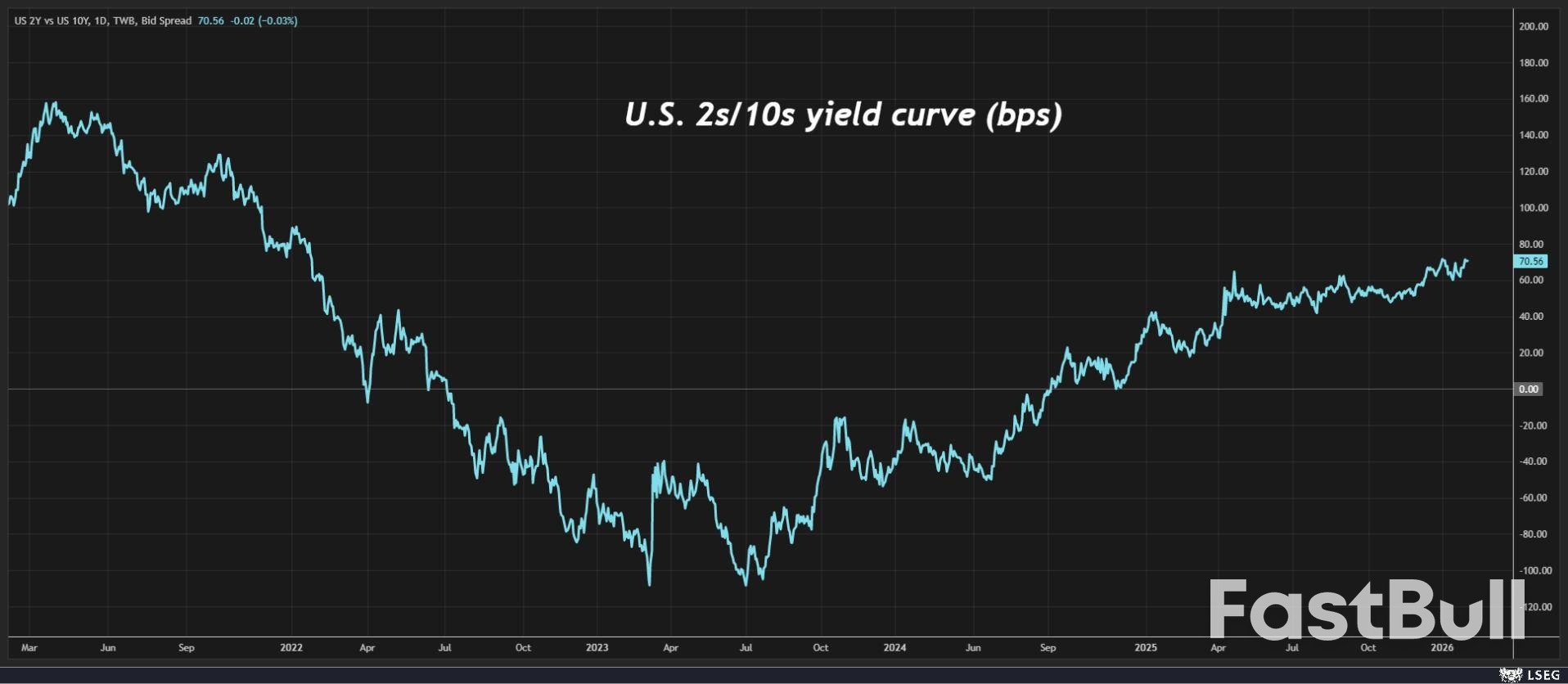

A clear example of this disconnect occurred late last year when Powell's Fed cut its policy rate by 75 basis points. Instead of falling, the 10-year Treasury yield actually climbed, now hovering around 4.30%. This has caused the yield curve to "steepen," widening the gap between short- and long-term yields to its largest in four years.

Figure 1: The spread between 2-year and 10-year Treasury yields has steepened significantly, reversing its earlier inversion and signaling rising investor concern over long-term inflation.

While a steeper curve can signal a healthy, normalizing economy, today's trend may point to a darker outlook for long-term inflation and interest rates.

The Real Drivers: Inflation and the "Term Premium"

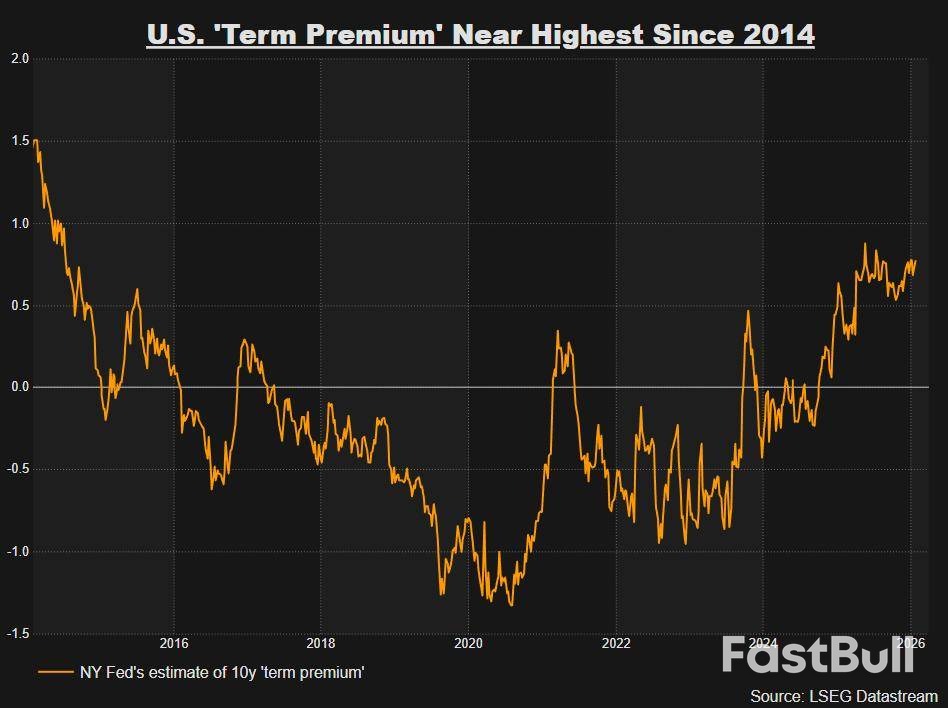

The stubbornness of long-term rates reflects a rising "term premium"—the extra compensation investors demand to hold long-term government bonds instead of rolling over short-term debt. This premium on 10-year Treasuries is now near its highest level in more than a decade.

Several factors are driving this increase:

• Sticky Inflation: Both current inflation and consumer expectations for future inflation remain elevated.

• Fiscal Worries: The long-term trajectory of U.S. public finances is a growing concern for investors.

• Central Bank Independence: Questions about the Fed's independence have not helped stabilize market sentiment.

Figure 2: The 10-year term premium, which represents the extra yield investors demand for long-term risk, is approaching its highest point since 2014, putting upward pressure on borrowing costs.

Interest rate futures markets predict a Warsh-led Fed would cut the funds rate by 50 basis points this year, but there is little confidence that long-term rates would follow. Investors seem to be signaling a potential policy mistake: that further rate cuts now could ignite higher inflation and, consequently, higher rates down the road.

The High-Stakes Bet on an AI Boom

Warsh and Bessent believe they have a solution: an artificial intelligence-driven productivity boom. They argue that AI could lower inflation expectations and, ultimately, bring down long-term borrowing costs. Even Powell has acknowledged that such a scenario could help the Fed achieve its inflation target.

If this plays out, falling mortgage rates could revive the housing market and create a powerful "wealth effect" for consumers. Thirty-year mortgage rates have remained above 6% since mid-2022, a fact that Trump, a former real estate developer, is keenly aware of.

However, banking on an AI-powered bailout is a significant gamble. The productivity-enhancing effects of AI are still unproven, and it’s a stretch to assume they can counteract the powerful forces currently pushing yields higher.

Economic Headwinds Keep Rates Elevated

Several key economic indicators suggest that long-term yields are unlikely to fall anytime soon.

• Strong Growth: The Atlanta Fed's GDPNow model estimates real economic growth is running at around 4%, implying nominal growth of nearly 7%.

• Loose Financial Conditions: According to Goldman Sachs, financial conditions are the loosest they have been in four years.

• Booming Markets: Wall Street continues to perform strongly.

None of these factors support the case for lower long-term yields or continued cuts to the Fed funds rate. Only a sharp economic downturn, a collapse in the labor market, or a major geopolitical shock would likely change this outlook—scenarios that aren't part of the Bessent-Warsh playbook.

Recognizing these limitations, Trump has started to target long-term rates more directly, threatening to cap credit card interest rates at 10% and directing the government to purchase more mortgage-backed securities. Yet he will almost certainly continue to pressure the next Fed Chair to lower rates. The fundamental problem remains: the Fed's power to control long-term borrowing costs is far more limited than the White House believes.