The S&P 500 Index is poised to end 2025 up more than 17% as the bull market continues for a third year driven by enthusiasm for artificial intelligence.

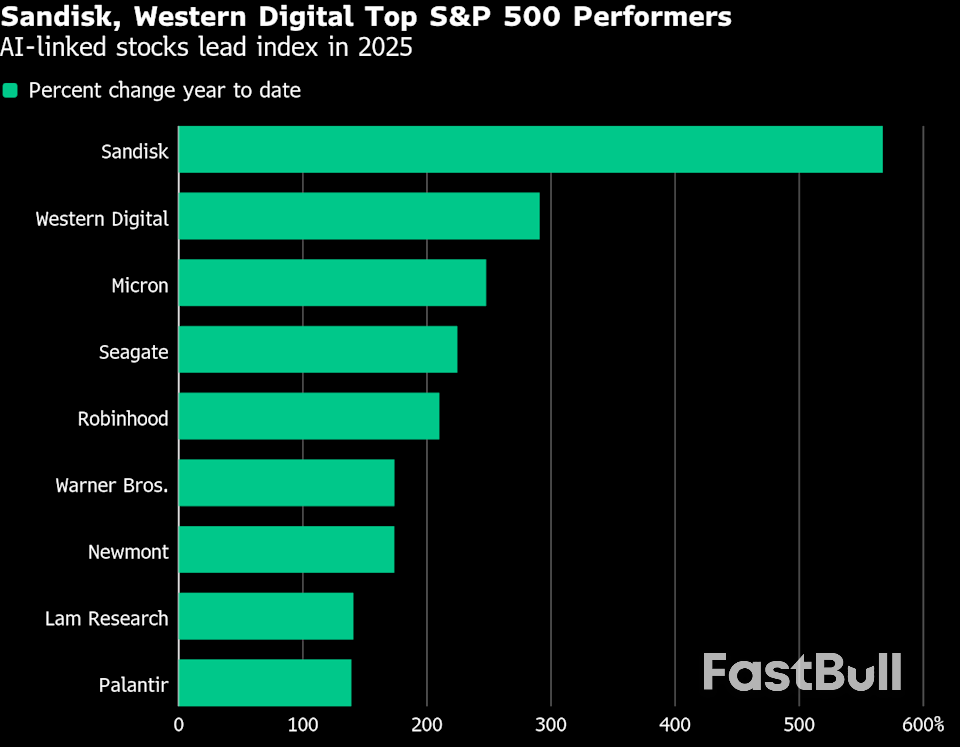

The AI trade broadened out this year, as chip stocks again led the S&P 500 but were joined by the shares of companies tied to building the data centers that will power the technology. Three of the index’s top 10 performers in 2025 were data storage companies, which are among the main beneficiaries of the hundreds of billions of dollars in pledged spending by the giant AI cloud service providers known as hyperscalers.

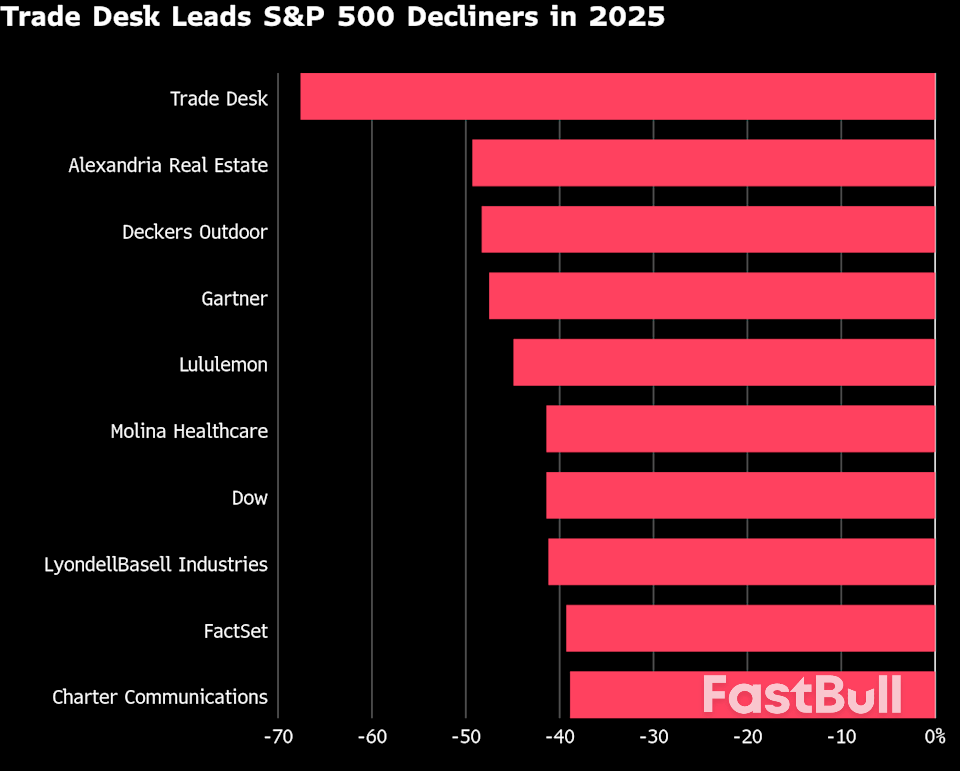

On the flip side, economic uncertainty from President Donald Trump’s sweeping tariffs weighed on the shares of consumer companies, while health-care stocks struggled with uncertainty surrounding the administration’s policies and pressure on drug prices.

Here are some of the biggest winners and losers in the US stock market this year.

Winner: New AI Leadership

Technology stocks, especially those tied to AI, again dominated the market. But leadership shifted to the shares of companies associated with data — from storage to the building, heating and cooling of data centers. Hyperscalers like Microsoft (MSFT) Corp., Amazon.com (AMZN) Inc., Alphabet (GOOG) Inc. and Meta Platforms (META) Inc. have pledged to spend more than $440 billion over the next 12 months to build out AI capabilities, benefiting firms such as Sandisk (SNDK) Corp., Western Digital (WDC) Corp. and Seagate Technology Holdings Plc (STX), which were three of the four best performing stocks in the S&P 500.

Winner: New S&P 500 Additions

A slew of companies were added to the S&P 500 in 2025, including Robinhood (HOOD) Markets Inc., Sandisk, AppLovin (APP) Corp. and Carvana (CVNA) Co., all of which posted triple-digit percentage gains and landed among the top 20 performers in the index.

Of course, not every stock that joined the S&P 500 got a boost. Trade Desk (TTD) Inc. shares were the worst performers in the index with a nearly 70% loss, while Block (XYZ) Inc. tumbled more than 20% and Coinbase (COIN) Global Inc. sank more than 6%.

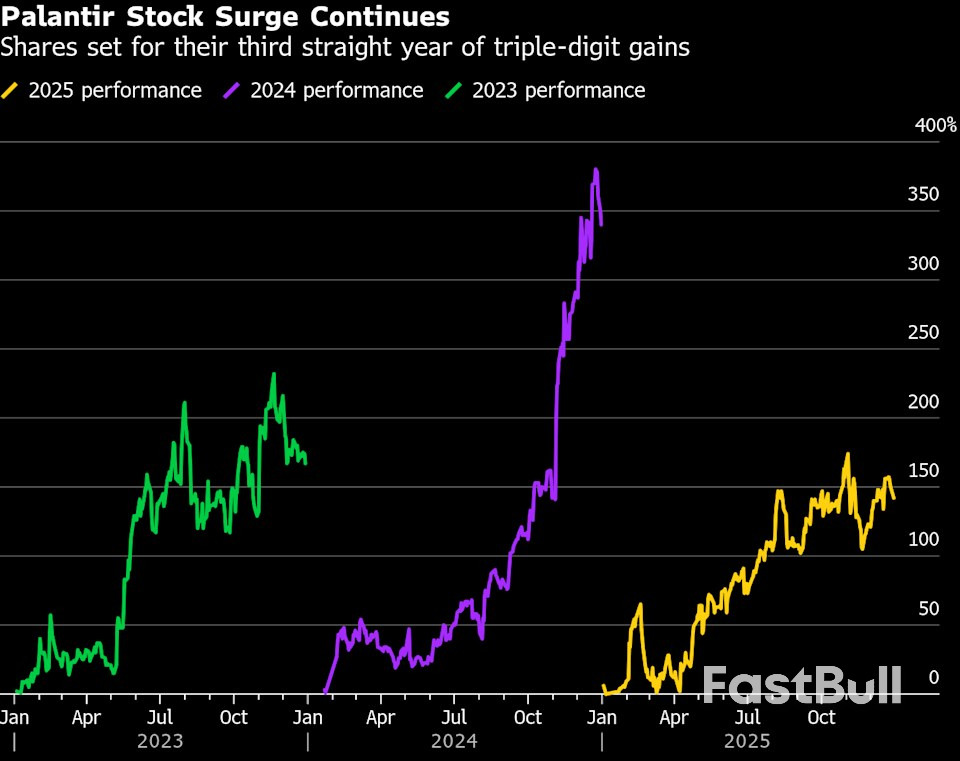

Winner: Palantir

Palantir (PLTR) Technologies Inc. shares are set to notch a triple-digit gain for the third year in a row. The software developer got a boost from AI enthusiasm and strong buy-in from retail traders who are drawn to the company’s outspoken Chief Executive Officer Alex Karp.

But the stock is now rather pricey. With a multiple of more than 180 times forward earnings, it’s the third most expensive member of the S&P 500 behind Tesla Inc. and Warner Bros. Discovery Inc.

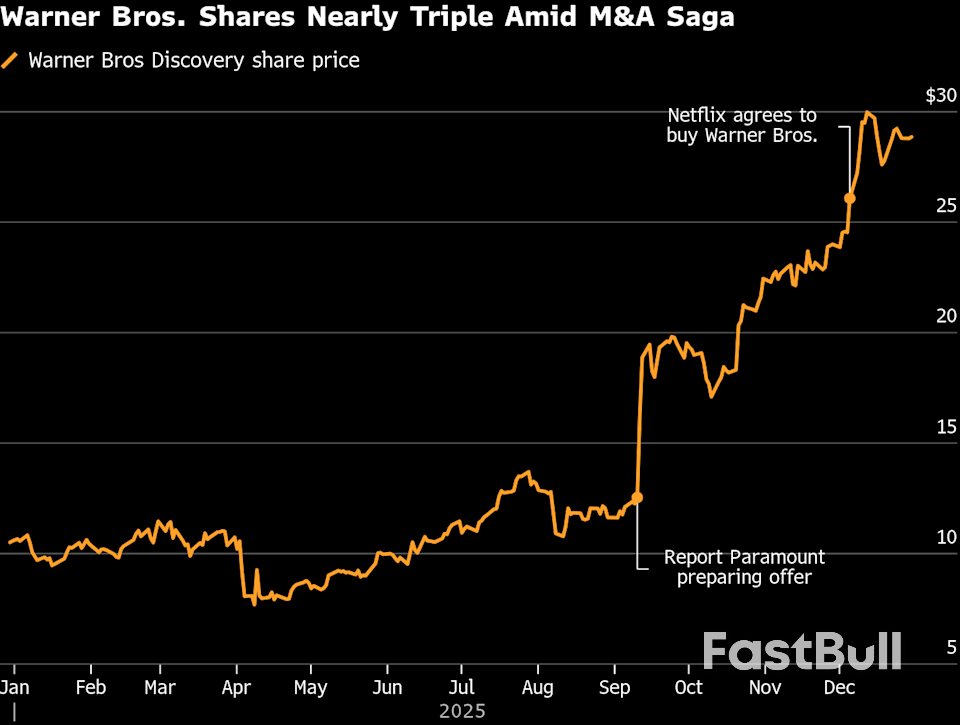

Winner: Warner Bros. Discovery

Warner Bros. Discovery (WBD) soared almost 175% in 2025 on the strength of takeover speculation. The company formally put itself up for sale in October, and there’s an ongoing battle between the top two bidders, Paramount Skydance (PSKY) Corp. and Netflix (NFLX) Inc., with both suitors jockeying to strengthen financial backing for their offers.

The Warner Bros. board prefers the Netflix bid and is reportedly planning to reject Paramount’s offer, but Larry Ellison, the billionaire chairman of Oracle Corp. and father of Paramount Chief Executive David Ellison, is personally guaranteeing the Paramount proposal.

Loser: Consumer Staples

Economic uncertainty, tariffs and concerns about the health of the US consumer as inflation creeps higher weighed on consumer stocks, especially some major staples names. Clorox (CLX) Co., frozen french fries maker Lamb Weston (LW) Holdings Inc., Campbell’s (CPB) Co. and beverage giant Constellation Brands (STZ) Inc. were among the 20 worst-performers in the S&P 500. Shares of fast-casual dining brand Chipotle (CMG) Mexican Grill Inc. sank nearly 40% after two years of double-digit gains.

Loser: Retail

The same economic uncertainty also hit shares of some retail companies. Deckers (DECK) Outdoor Corp., which owns brands such as Hoka and Ugg, was down almost 50% in 2025, snapping a nine-year streak of gains. The stock was hit hard by a few weak earnings forecasts and analyst downgrades.

Lululemon (LULU) Athletica Inc. shares are set to fall nearly 45% this year, their second consecutive double-digit annual decline, as the athletic apparel retailer struggles through an overhaul after a period of slow growth and the recent exit of its chief executive officer. Activist investor Elliott Investment Management has built a stake of more than $1 billion in the company.

Loser: Managed Care

Health insurance stocks underperformed in 2025 despite hopes that the group would benefit from a shift in policy by the Trump administration. Molina (MOH) Healthcare Inc. shares were down more than 40%, their second straight year of double-digit declines. UnitedHealth (UNH) Group Inc. and Centene (CNC) Corp. have both shed more than 30%, putting them among the 25 worst performers in the S&P 500.

Still, there are signs of hope for the group as some investors view the beaten-down valuations as attractive, making the stocks possibly due for a rebond. Money manager Michael Burry has said he’s long Molina shares and that he views the company as acquisition target in 2026 if it remains this cheap.

Source: Bloomberg