The fourth quarter earnings season momentum continues this week, as results from Alphabet (GOOG, GOOGL), Amazon (AMZN), AMD (AMD), Qualcomm (QCOM), and Palantir (PLTR) highlighted the calendar.

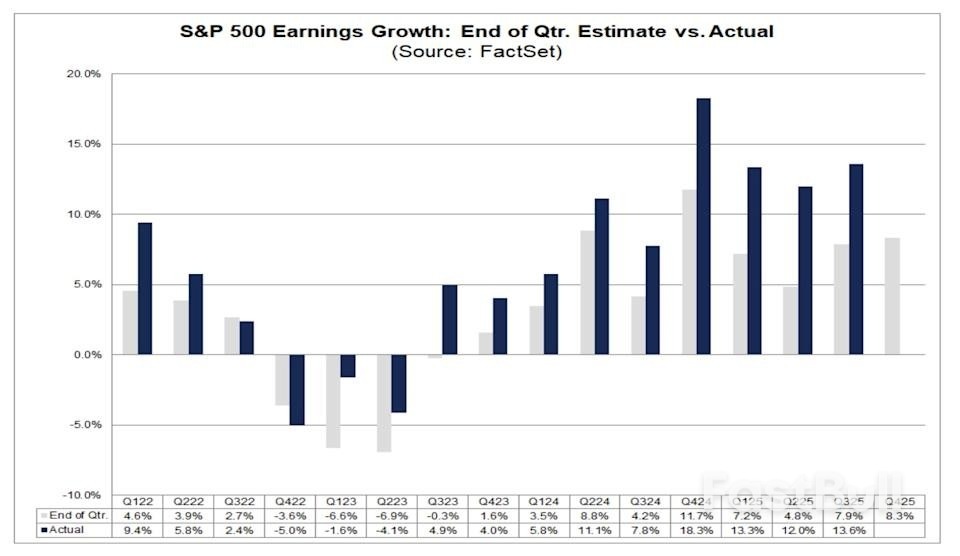

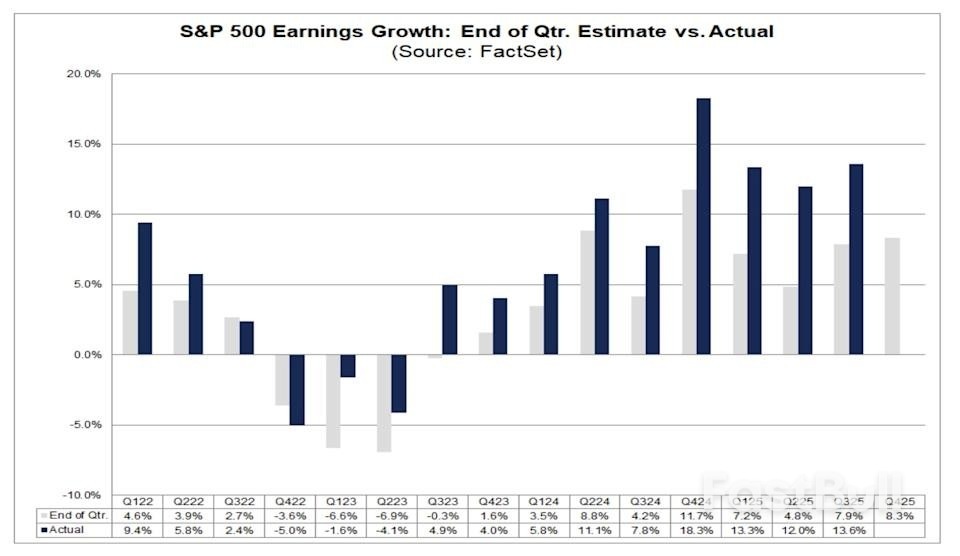

As of Jan. 30, 33% of S&P 500 (^GSPC) companies have reported fourth quarter results, according to FactSet data, and Wall Street analysts estimate an 11.9% increase in earnings per share for the fourth quarter. If that rate holds, it would represent the 10th consecutive quarter of annual earnings growth for the index and the fifth consecutive quarter of double-digit growth.

Heading into the reporting period, analysts were expecting an 8.3% jump in earnings per share, down from the third quarter's 13.6% earnings growth rate. Wall Street has raised its earnings expectations in recent months, especially for tech companies, which have driven earnings growth in recent quarters.

Massive Big Tech capital expenditures set the tone for the AI trade. Plus, the themes that drove the markets in 2025 — artificial intelligence, the Trump administration's tariff and economic policies, and a K-shaped consumer economy — continue to provide plenty for investors to parse.

This week, investors heard updates from companies including Disney (DIS), Chipotle (CMG), PepsiCo (PEP), Uber (UBER), and Snap (SNAP).

Source: Yahoo Finance

Copyright © 2026 FastBull Ltd

News, historical chart data, and fundamental company data are provided by FastBull Ltd.

Risk Warnings and Disclaimers

You understand and acknowledge that there is a high degree of risk involved in trading. Following any strategies or investment methods may lead to potential losses. The content on the site is provided by our contributors and analysts for information purposes only. You are solely responsible for determining whether any trading assets, securities, strategy, or any other product is suitable for investing based on your own investment objectives and financial situation.