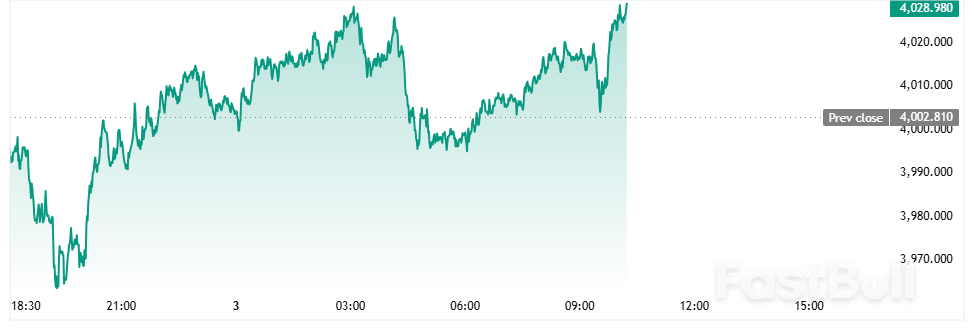

Gold is trading near the $4,030 per ounce session high after the latest data showed the U.S. manufacturing sector weakening last month.

The Institute for Supply Management (ISM) announced on Monday that its Manufacturing Purchasing Managers Index fell to 48.7 in October after posting a 49.1 reading in September. The headline number was worse than expected, as consensus forecasts looked for a reading of 49.5.

“In October, U.S. manufacturing activity contracted at a faster rate, with contractions in production and inventories leading to the 0.4-percentage point decrease of the Manufacturing PMI,” said Susan Spence, Chair of the ISM Manufacturing Business Survey Committee. “A chain reaction of one-month index improvements started with New Orders in August and flowed to Production in September. In October, it manifested in a 1.7-percentage point increase in the Backlog of Orders Index. These short gains have not appeared to translate into sustained growth for the sector, a reflection of continuing economic uncertainty.”

Spot gold continued to trade near the upper edge of its range on the session in the minutes after the 10 am EDT release. Spot gold last traded at $4,028.64 per ounce for a gain of 0.65% on the day.

The report’s components were mixed. The ISM noted cooling in inflation pressures, with the Price Index falling to 58, down from 61.3 in September. At the same time, the Production Index fell to 48.2, down from the 51 posted the previous month.

The New Orders Index rose to 49.4, down from the 48.9 reported in September. The ISM also noted improvement in the labor market, with the Employment Index rising to 46 from 45.3 the previous month.

““The Supplier Deliveries Index indicated slower delivery performance for the third consecutive month after one month in ‘faster’ territory, which was preceded by seven consecutive months in ‘slower’ territory,” Spence said. “The reading of 54.2 percent is up 1.6 percentage points from the 52.6 percent recorded in September. The Inventories Index registered 45.8 percent, down 1.9 percentage points compared to September’s reading of 47.7 percent.”

“All of the four demand indicators (New Orders, New Export Orders, Backlog of Orders, and Customers’ Inventories indexes) improved, although they are still in contraction territory,” she added. “The Customers’ Inventories Index contracted at a slower rate. A ‘too low’ status for the Customers’ Inventories Index is usually considered positive for future production.”

“Regarding output, production deteriorated and employment contracted at a slower pace, as 67 percent of panelists indicated that managing head count is still the norm at their companies, as opposed to hiring,” Spence said. “Finally, inputs (defined as supplier deliveries, inventories, prices and imports), are mixed, with the Supplier Deliveries Index indicating slower deliveries, the Inventories Index contracting at a faster rate, and the Prices Index continuing to indicate pricing increases, but at a slower rate. The Imports Index contracted at a slower pace.”

Source: kitco

Copyright © 2025 FastBull Ltd

News, historical chart data, and fundamental company data are provided by FastBull Ltd.

Risk Warnings and Disclaimers

You understand and acknowledge that there is a high degree of risk involved in trading. Following any strategies or investment methods may lead to potential losses. The content on the site is provided by our contributors and analysts for information purposes only. You are solely responsible for determining whether any trading assets, securities, strategy, or any other product is suitable for investing based on your own investment objectives and financial situation.