What a strange day. Overnight futures were sharply lower, with the Nasdaq down more than 1.5% at one point and clear signs of nervousness in global markets. Yet all of that anxiety disappeared almost immediately once the cash session opened. The S&P 500 erased an overnight decline of roughly 1% and finished the day higher by about 20 basis points.

Those cheap 6,900-strike call options may have been too tempting for the 0DTE crowd to ignore. Still, it remains a frustrating environment. It is becoming increasingly clear—at least to me—that the options market is exerting a growing influence on the S&P 500’s day-to-day price action. In many ways, it seems as though the index is being constrained and held in place, and it is difficult to know how much longer that dynamic can persist, perhaps through quad witching next week.

What stands out most is that the heaviest S&P 500 option activity was concentrated at the 6,900 strike for expiration on Thursday, and the index ultimately closed at 6,901. That coincidence strongly suggests that options-related flows drove a significant portion of the intraday price action.

Unfortunately, intraday transparency in the options market is limited. It is difficult to determine in real time whether traders are buying or selling calls, since changes in open interest are not available until the following day. With 0DTE options, that information is effectively unavailable altogether—at least with the data I can access. This makes it challenging to develop a precise mechanical understanding of what is occurring beneath the surface.

A trade printing at the ask does not necessarily imply a buyer, just as a trade at the bid does not automatically indicate a seller. Execution mechanics and hedging flows complicate the picture. As a result, interpreting intraday options activity with certainty is extremely difficult.

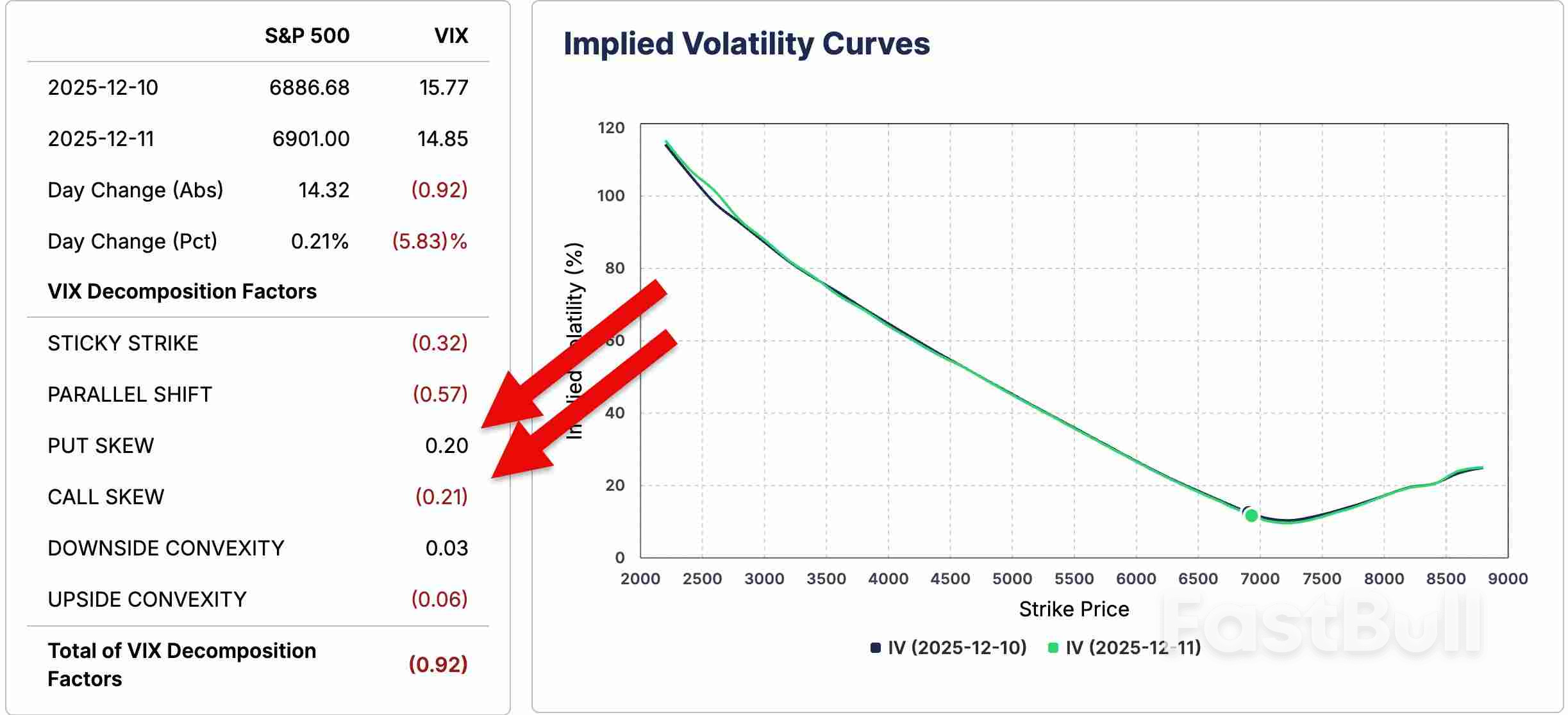

That said, Thursday followed a fairly classic pattern. The VIX traded overnight around 17, opened the cash session around 16, and then declined steadily to close near 15. A move like that typically reflects one of two dynamics: traders closing out put positions or traders selling calls.

What is perhaps most interesting is that the VIX decomposition shows call skew falling while put skew rose. That combination suggests that ATM put implied volatility fell faster than OTM put implied volatility within the VIX index, which is not what you would normally expect to see on a day.

Under more typical circumstances, volatility would be crushed across puts as hedges are closed. Instead, the action suggests that near-money puts were closed out—likely during the morning selloff—while OTM and longer-dated downside protection remained elevated.

It is almost as if the options market didn’t believe in the snap-back rally, and perhaps there is a viable and good reason for that.

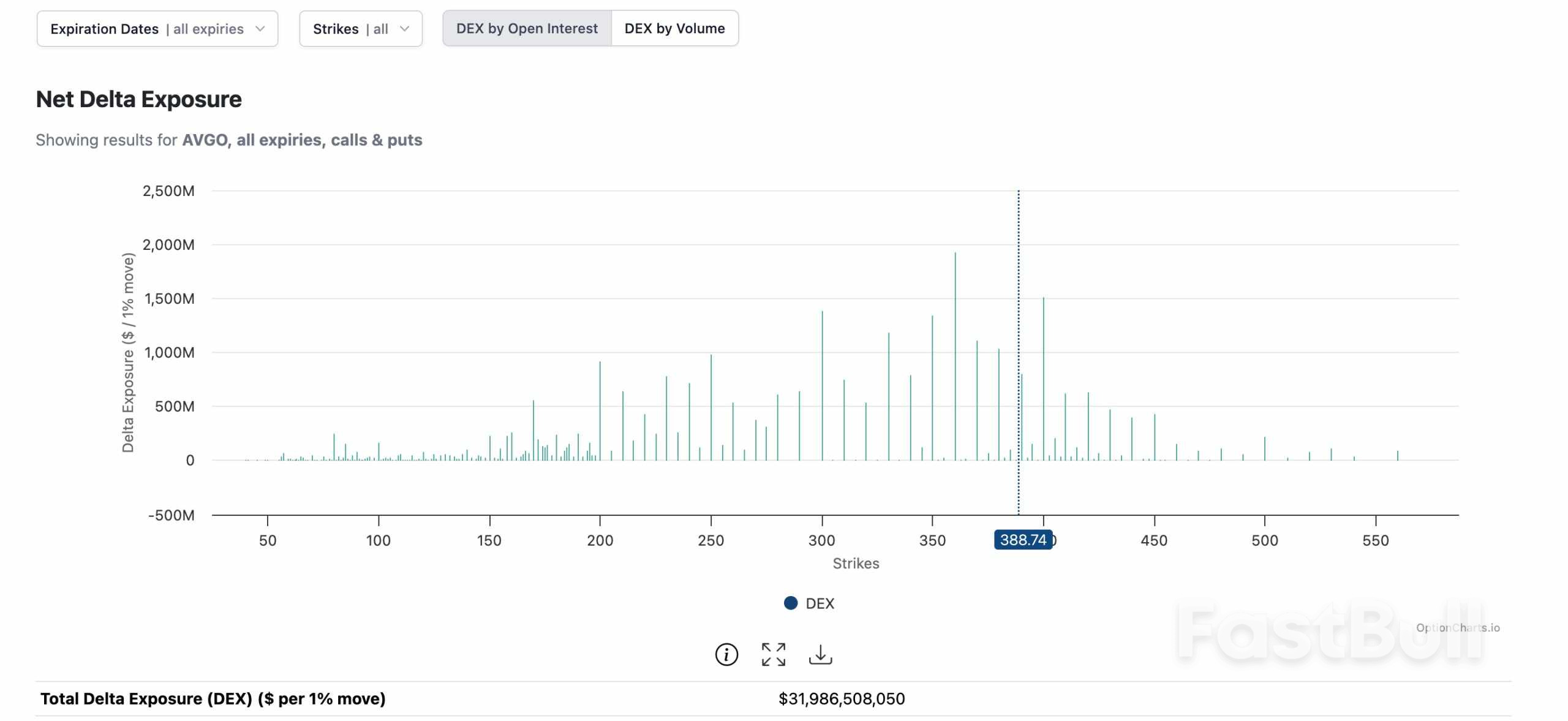

How the market will respond to the second AI company failing to rally following its earnings results is a good question. Oracle (NYSE:ORCL) declined, and Broadcom (NASDAQ:AVGO) fell approximately 5% after its report tonight. Seems that selling AI “chips” doesn’t deliver a good gross margin in comparison to the other “chips” they sell.

At least that is what I thought I heard them say. The stock is likely to have a hard time rising today, given there are many calls to sell if the stock can’t get over $400.

Source:investing

Copyright © 2025 FastBull Ltd

News, historical chart data, and fundamental company data are provided by FastBull Ltd.

Risk Warnings and Disclaimers

You understand and acknowledge that there is a high degree of risk involved in trading. Following any strategies or investment methods may lead to potential losses. The content on the site is provided by our contributors and analysts for information purposes only. You are solely responsible for determining whether any trading assets, securities, strategy, or any other product is suitable for investing based on your own investment objectives and financial situation.