After years of watching technology stocks drive the U.S. bull market, investors are betting the rally will broaden to industrial, healthcare and small-cap companies, with a chance they can catch up and assert market leadership.

Stocks such as Nvidia (NVDA.O), opens new tab, Alphabet (GOOGL.O), opens new tab and Broadcom (AVGO.O), opens new tab have buoyed the market's enduring rally, in which the S&P 500 (.SPX), opens new tab has risen over 90% since the bull market began more than three years ago.

But investors have become wary of expensive tech valuations amid uncertainty over the AI theme that propelled market gains, concerns that helped other stocks make inroads.

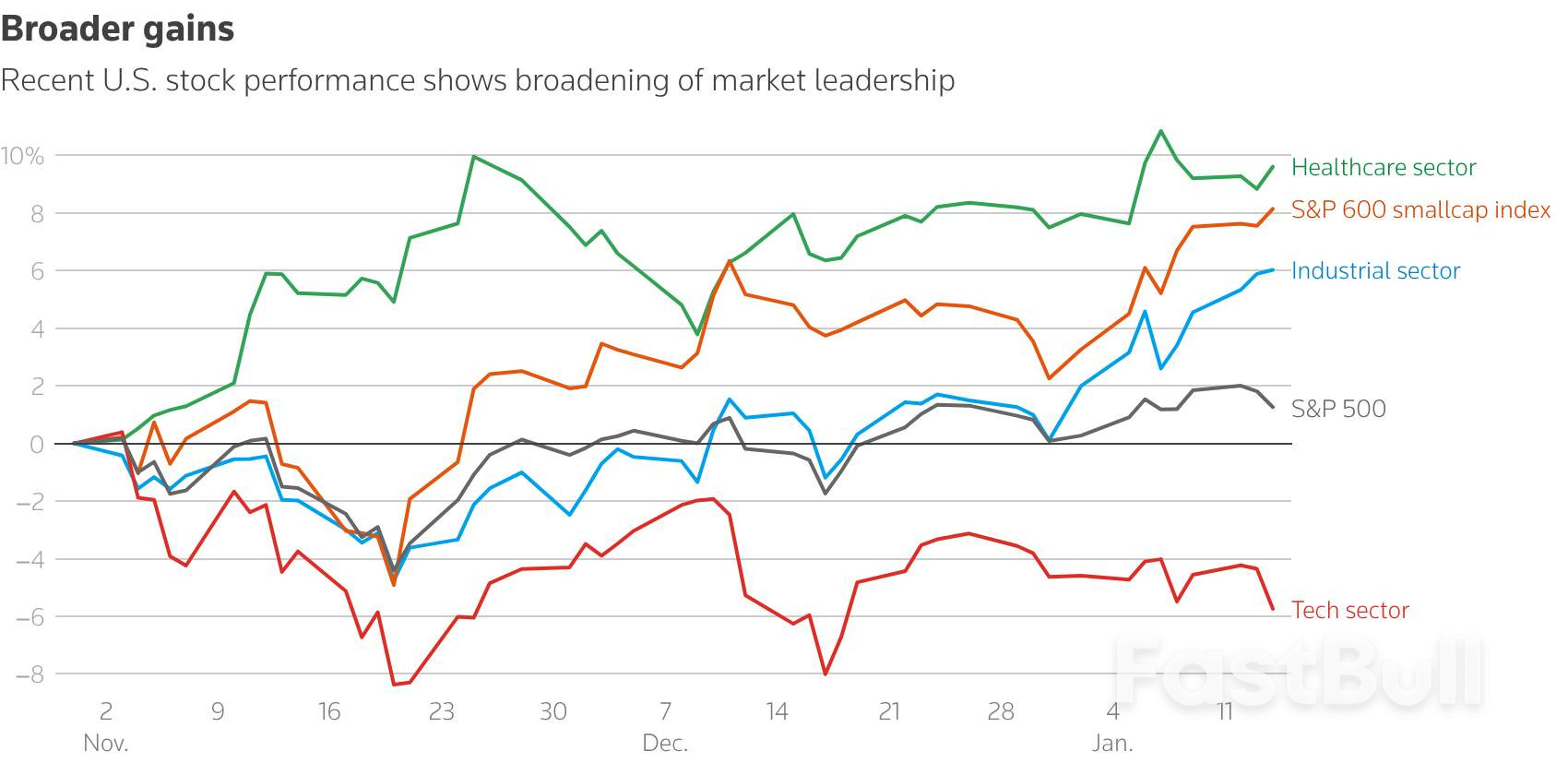

Shares of industrial, healthcare and small-cap companies have outperformed the S&P 500 since the end of October, while the tech sector has declined. That rotation was on display on Wednesday as the S&P 500 tech sector (.SPLRCT), opens new tab fell more steeply than broader market indexes.

"There is a lot of hope that this is going to be the year where we are going to see some true broadening of leadership," said Angelo Kourkafas, senior global investment strategist at Edward Jones. "The conditions are likely in place for that broadening to happen, especially when you sprinkle in and consider elevated valuations, there are some pockets of value that can be found looking beyond technology."

Fourth-quarter earnings reports in coming weeks will factor into the broadening trend's durability. A wide swath of sectors is expected to show solid profits in 2026.

"Strategists have been predicting better earnings for a long time, but I really think it has legs this year," said Nanette Abuhoff Jacobson, global investment strategist at Hartford Funds. "We're starting to see the AI benefits filtering through to such a broad collection of sectors."

S&P 500 vs key sectors, market groups over recent weeks, shows broadening leadership

'AVERAGE' S&P 500 STOCK NOT SO AVERAGE

Tech and tech-related stocks led much of the bull run that began in October 2022, just before the launch of chatbot ChatGPT that sparked enthusiasm for AI-linked shares.

Late last year, the trend began to turn. One factor has been concerns AI investments would not yield sufficient returns to justify elevated valuations, investors said.

"With some questions being raised on tech, investors are looking at, what are other areas that I could invest in," said Keith Lerner, chief investment officer at Truist Advisory Services.

In another sign of broadening, the equal-weight version of the S&P 500 (.SPXEW), opens new tab, which is a gauge for the average stock in the index, has gained over 5% since the end of October. That tops a 1% rise for the standard S&P 500, which is more heavily influenced by heavyweight stocks.

EARNINGS GROWTH FOR ALL SECTORS

More expansive profit growth stands to support wider stock gains. Each of the 11 S&P 500 sectors is expected to show earnings up at least 7% this year, according to LSEG IBES.

Megacaps have been responsible for a huge chunk of earnings growth, but their advantage over smaller companies is shrinking. The "Magnificent Seven," which includes Nvidia, Alphabet and Apple (AAPL.O), opens new tab, are expected to grow earnings by 23.5% in 2026, against a 13% rise for the rest of the S&P 500, according to Tajinder Dhillon, head of earnings research at LSEG.

"If, in fact, that gap in earnings growth narrows between the Mag 7 and everyone else, I think we'll get a broadening," said Michael Arone, chief investment strategist at State Street Investment Management. "If it doesn't, then it's likely the Mag 7 will continue to be leadership."

Expected S&P 500 sector earnings growth for 2026

In a report this week titled "The Broadening Is Underway," Morgan Stanley equity strategist Michael Wilson said the median S&P 500 stock trades at a price-to-earnings ratio of 19 times, against a P/E of 22 for the cap-weighted index.

Improving valuations on top of strong earnings for the median or average stock could be a "wildcard" for 2026, Wilson said in the report.

TECH'S DOMINANT MARKET PRESENCE

To be sure, tech's massive presence - the sector accounts for one-third of the S&P 500's weight - means it likely will remain a force in U.S. stocks, while the market may struggle if tech falters.

Over the past decade, the S&P 500 has never gained at least 10% on an annualized basis when the tech sector has lagged the aggregate performance of the other 10 S&P 500 sectors during those periods, according to Citi Wealth.

Meanwhile, tech is generating outsized profits. The sector is expected to increase earnings by over 30% in 2026, against 15.5% for the S&P 500 overall.

After last year recommending clients overweight in "growth" stocks, which include tech and other AI-exposed names, Jack Janasiewicz, portfolio manager at Natixis Investment Managers, said he has been suggesting to investors that they balance more with "value" stocks, which include financials and industrials.

"I still think tech works. You don't want to be chasing it, but you also don't want to be underweight," Janasiewicz said, adding: "There is certainly a wider range of outcomes that you could see."

Source: reuters