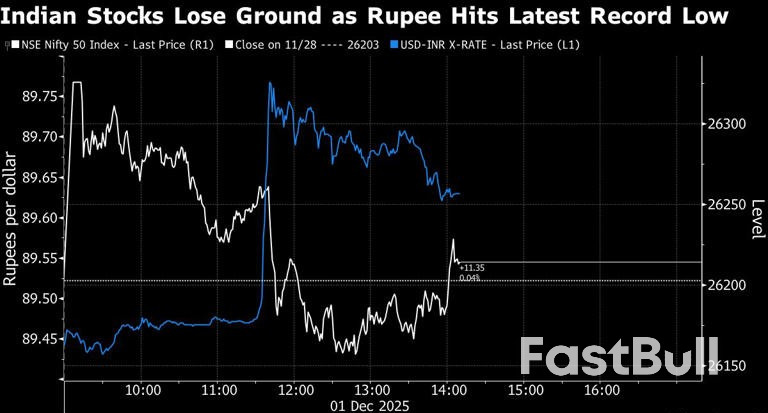

India’s Nifty 50 index and its currency appeared to move in lockstep on Monday, weighing down a stock gauge that touched an intra-day record during morning trading.

The benchmark was up as much as 0.5% after the open, putting it on course to close at an all-time high. But the Indian rupee had its own record to set, plunging to yet another low — and the stock market went down with it. The Nifty 50 was roughly flat in afternoon trading, and remains up around 11% so far this year.

The pair has witnessed similar movement in recent sessions, when the rupee’s fall against the dollar worsened. Market participants aren’t sure what’s driving the tight move, but they said a sense of uncertainty in the market is hitting both stocks and the currency.

“Equities are already trading close to all-time highs and sharp movement in the rupee is making some investors jittery,” said Abhishek Shah, a Mumbai-based proprietary trader. Shah also mentioned that lack of any communication on a tariff deal with the US is weighing on market sentiment.

There can be a feedback loop between a country’s currency and its stock market, although the correlation between the two is often unpredictable. For example, foreigners selling Indian stocks put pressure on the rupee, which could in turn encourage other foreigners to sell before the currency tumbles further.

Foreigners bought a net $430 million of Indian stocks in November, a big drop from the $1.2 billion they purchased in October, according to Bloomberg-compiled data. Data for foreigners’ net purchases on Monday isn’t yet available.

Source: Bloomberg

Copyright © 2025 FastBull Ltd

News, historical chart data, and fundamental company data are provided by FastBull Ltd.

Risk Warnings and Disclaimers

You understand and acknowledge that there is a high degree of risk involved in trading. Following any strategies or investment methods may lead to potential losses. The content on the site is provided by our contributors and analysts for information purposes only. You are solely responsible for determining whether any trading assets, securities, strategy, or any other product is suitable for investing based on your own investment objectives and financial situation.