Powell's Silence on Fed Independence Fuels Market Anxiety

Powell's silence on political threats to Fed independence sparks market jitters as succession looms.

Federal Reserve Chair Jerome Powell’s press conference on Wednesday was remarkable for what he refused to say. While the central bank’s decision to hold interest rates steady was expected, Powell’s deliberate silence on the growing political threats to the Fed's independence has left investors on edge.

After fielding standard questions on inflation, jobs, and the economy, Powell repeatedly deflected inquiries about the institution's autonomy. When asked about his plans after his term ends in May or the administration's political pressures, his responses were a masterclass in evasion: "I have nothing for you on that today," and "it's not something I'm going to be getting into today."

The polite laughter in the room couldn't mask the gravity of the situation. At stake is the very principle that the Federal Reserve operates free from partisan influence—a cornerstone of faith for global markets.

Market Jitters and the Independence Premium

This is far from an academic debate. The uncertainty surrounding the Fed's future is already rippling through financial markets. Analysts are connecting the ambiguity to several key trends:

• The U.S. dollar's recent slump

• A resurgence of "Sell America" sentiment among traders

• A steady rise in long-term bond yields

• An expanding "term premium" on Treasuries, pushing it toward multi-year highs

While Powell was never likely to elaborate on the Trump administration’s threat of indictment or the legal challenge to fire Governor Lisa Cook, his "no comment" stance creates a communication vacuum. Even his reassurance that he doesn't believe the Fed will lose its independence—"We haven't lost it, and I don't believe we will"—falls short of calming a market that thrives on clarity.

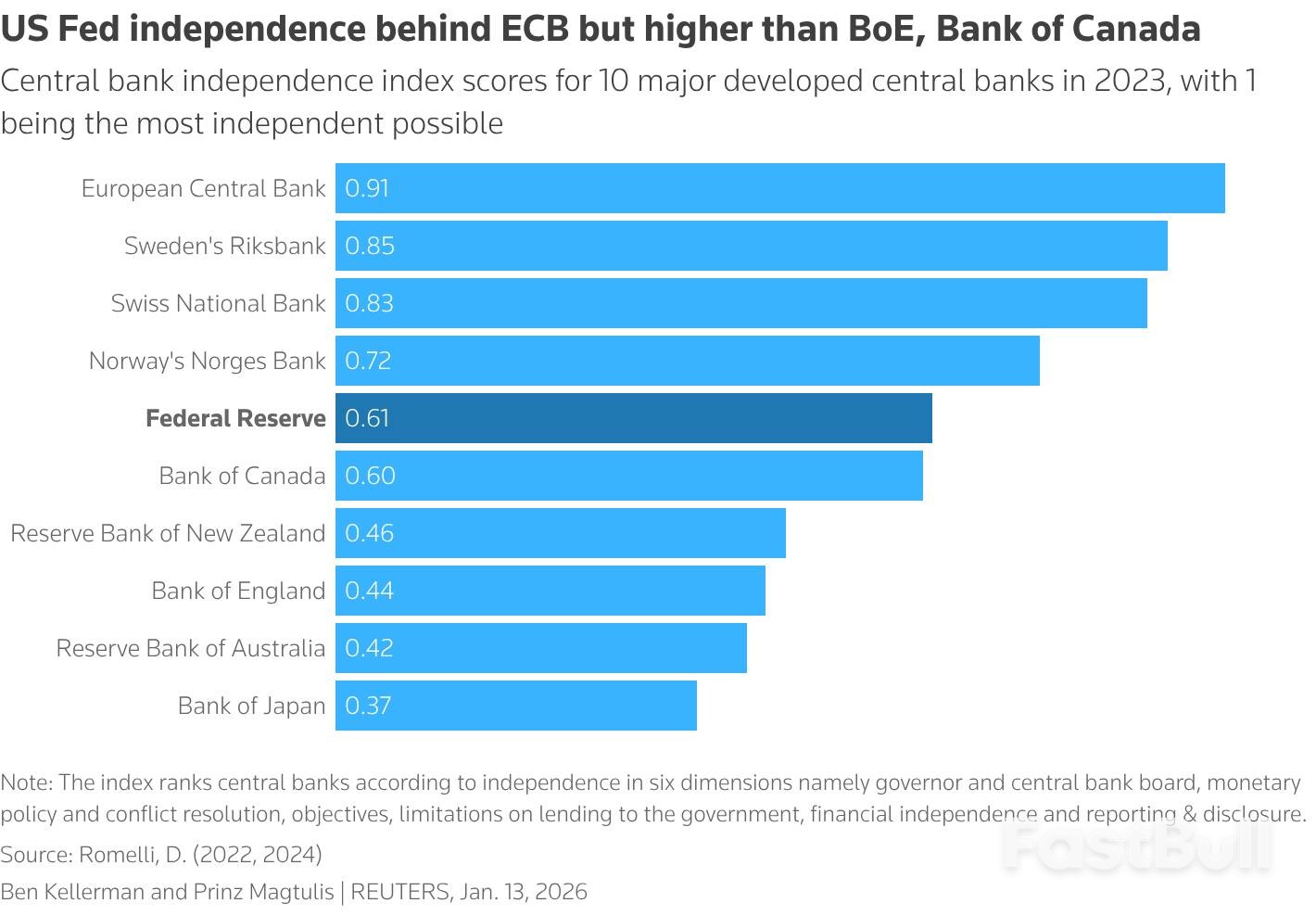

Figure 1: A 2023 ranking of central bank independence places the U.S. Federal Reserve behind the ECB but ahead of the Bank of England, highlighting its historically strong but not top-tier autonomy.

A System Under Pressure

The challenges facing the Fed reflect a broader shift. Canadian Prime Minister Mark Carney recently spoke of a "rupture" in the 80-year-old global order, driven largely by new policies from Washington. A similar disruption now appears to be targeting the 113-year-old Federal Reserve.

President Donald Trump is expected to announce his nominee for the next Fed Chair soon. Despite official denials, many investors fear the new leader will be a surrogate tasked with prioritizing the president's call for lower interest rates over the central bank's dual mandate.

When asked what advice he would give his successor, Powell was direct: "Stay out of elected politics. Don't get pulled into elected politics. Don't do it." He stressed that the Fed's legitimacy comes from its accountability to Congress, not the executive branch.

The Race to Replace Powell

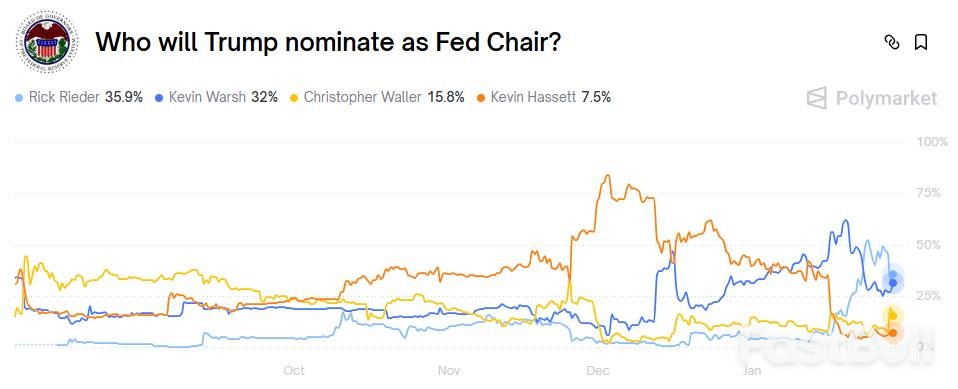

With White House economic adviser Kevin Hassett remaining in his current role, the shortlist for the next Fed Chair has reportedly narrowed to three candidates:

• Christopher Waller, a current Fed Governor

• Kevin Warsh, a former Fed Governor

• Rick Rieder, a bond fund chief at BlackRock

All three are seen as favoring lower interest rates. According to the betting site Polymarket, Rieder emerged as a frontrunner a week ago, but his lead is shrinking. This uncertainty over who will lead the Fed perfectly mirrors the market's deeper anxiety about whether the institution's independence can survive intact.