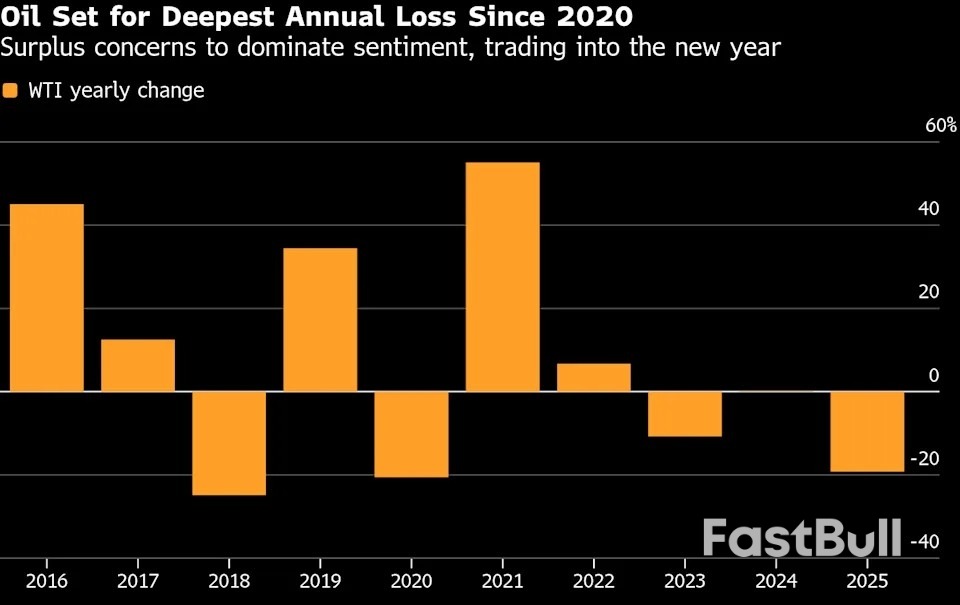

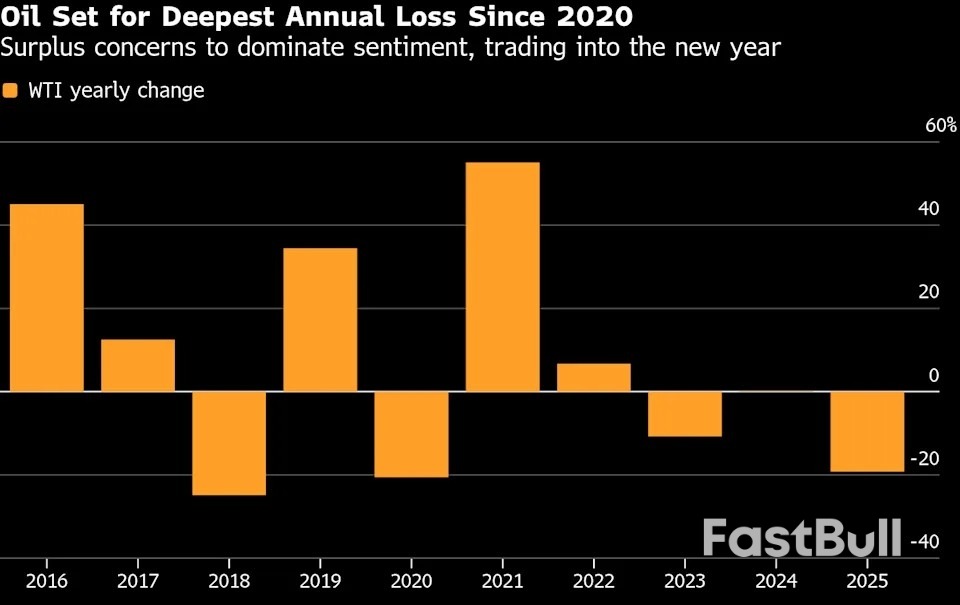

Oil closed out the year with its steepest annual loss since 2020 as the market confronts wide-ranging geopolitical risks and steadily rising supplies across the globe. A punishing surplus is expected to weigh on prices in 2026.

West Texas Intermediate fell 0.9% to settle at $57.42, completing a 20% decline for the year. In the short-term, traders are focused on an upcoming OPEC+ meeting and President Donald Trump’s policies toward major producers Russia, Iran and Venezuela.

But the long-term narrative has remained consistent: Oil markets are oversupplied. Both the International Energy Agency and the US government see production exceeding consumption by just over 2 million barrels a day in 2025 and that surplus worsening in the coming year.

OPEC+ roiled markets earlier this year when it raised output, reversing its longstanding policy of defending prices in an apparent effort to reclaim market share. This came as countries including Brazil and Guyana were boosting supply and the US pumped at record levels. The producer group is expected to hold off on output hikes during talks this weekend.

The drop in crude has helped to reduce inflationary pressures, helping central bankers as they seek to contain price gains. The US Federal Reserve cut rates three times in 2025, and minutes from policymakers’ last meeting showed most officials saw more reductions as appropriate. Still, it also threatens to reshape the budgets of major oil-producing nations and companies.

“The oil market is set to remain oversupplied into 2026, with strong non-OPEC production from the US, Brazil, Guyana and Argentina outpacing uneven global demand,” said Kaynat Chainwala, an analyst at Kotak Securities Ltd. Prices should stay range-bound between $50 and $70, with risks over Venezuelan or Russian supply remaining supportive, she added.

In the US, a weekly government report on Thursday showed that overall petroleum stocks were at their highest since October, with a strong build in refined products outpacing the draw in crude oil.

China Storage

Despite the drop for prices this year, a clutch of factors have ensured that crude futures haven’t fallen further. Prices held within a range above $65 for much of the summer in spite of the swelling production, as much of the oversupply ended up in storage tanks in China, far away from the pricing hubs for crude futures. In contrast, western facilities remained relatively empty, with the tank farms at Cushing, Oklahoma, — the pricing point for West Texas Intermediate futures — heading for its lowest annual average storage level since 2008.

Output of gassy types of oil like propane has also soared as US shale fields produce lighter types of fuel. Those volumes also have limited impacts on crude pricing.

Geopolitics will also help to shape the market outlook into next year. The US is driving efforts to end the war in Ukraine, an outcome that could ease the volume of Russian oil building up at sea. The US is also seizing tankers carrying Venezuelan cargoes, and the South American nation has had to reduce output in recent days as a result.

Trump also said this week that he would strike Iran again if it rebuilds its nuclear program. Brent futures surged above $80 after he authorized attacks on Iran earlier this year but slid rapidly when it became clear the conflict was ending.

Source: Bloomberg

Copyright © 2026 FastBull Ltd

News, historical chart data, and fundamental company data are provided by FastBull Ltd.

Risk Warnings and Disclaimers

You understand and acknowledge that there is a high degree of risk involved in trading. Following any strategies or investment methods may lead to potential losses. The content on the site is provided by our contributors and analysts for information purposes only. You are solely responsible for determining whether any trading assets, securities, strategy, or any other product is suitable for investing based on your own investment objectives and financial situation.