Oil prices are unlikely to gain much traction from current levels this year as rising output from top producers adds to the risk of a surplus and U.S. tariff threats curb demand growth, a Reuters poll showed on Friday.

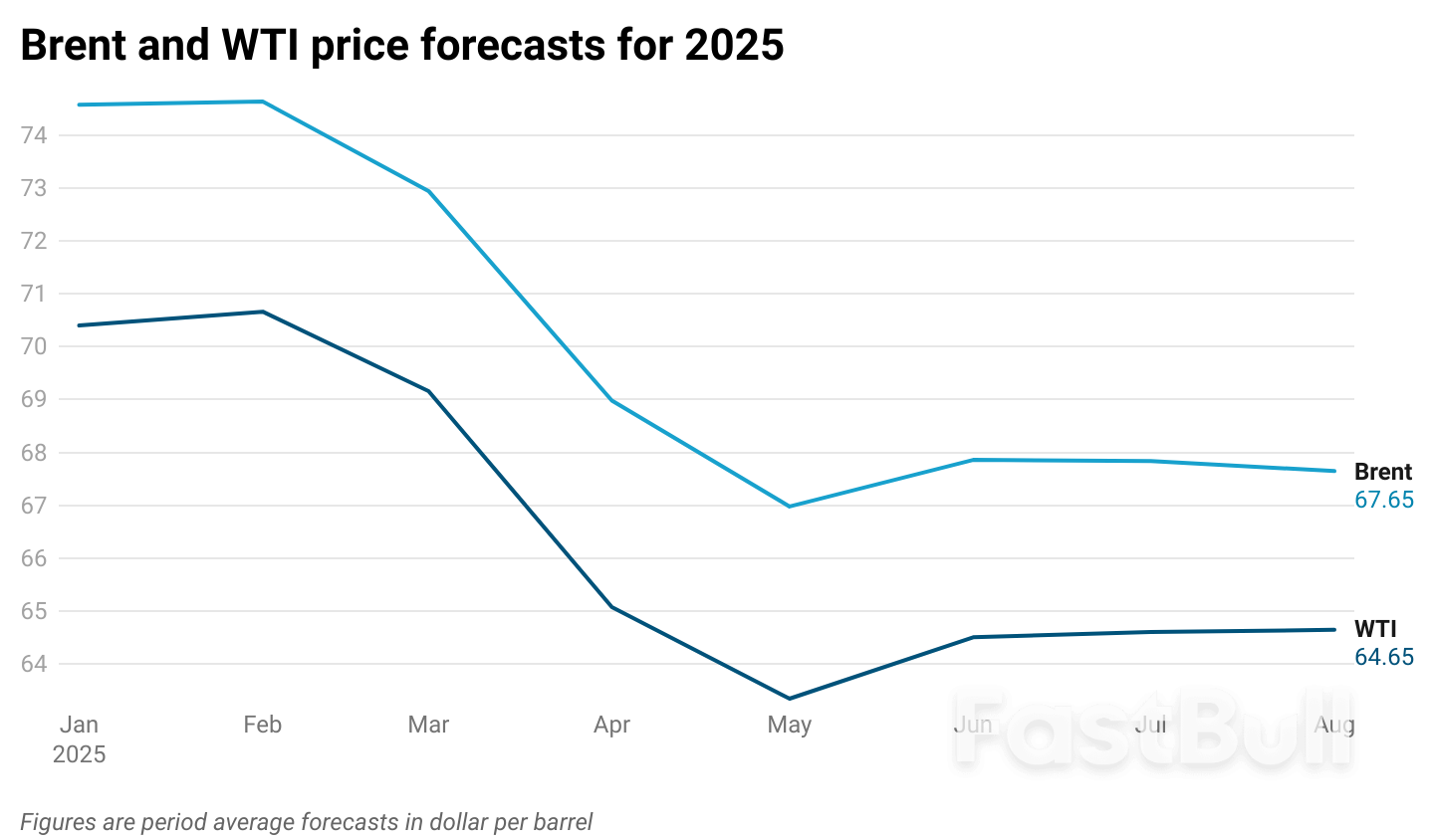

A survey of 31 economists and analysts conducted in August forecasts Brent crude will average $67.65 per barrel in 2025, little changed from July's $67.84 forecast. The global benchmark has averaged around $70 so far this year.

U.S. crude is seen at $64.65, compared with last month's $64.61 estimate.

"(With) the latest OPEC+ supply increases and the expected lackluster global demand, the prospect is for an even larger market surplus in 2025," said Moutaz Altaghlibi, senior energy economist at ABN AMRO.

He said the outlook remains clouded by "deep uncertainty" concerning any additional U.S. tariffs, especially those associated with geopolitical outcomes such as an Iranian nuclear deal or Russia agreeing to a ceasefire.

Earlier this month, the Organization of the Petroleum Exporting Countries and its allies, together known as OPEC+, agreed to raise oil production by 547,000 barrels per day for September.

"OPEC+ probably still has not reached the end of their output hikes. At the moment, market share seems to be more important than a higher level of oil prices," said Frank Schallenberger, head of commodity research at LBBW.

"This will lead to a big supply surplus on oil markets in 2025 and 2026 and will keep prices down."

Washington's attempts to broker peace in Ukraine with Moscow have so far proven unsuccessful. Meanwhile, U.S. President Donald Trump has imposed additional tariffs on India, pressuring New Delhi to stop buying Russian oil.

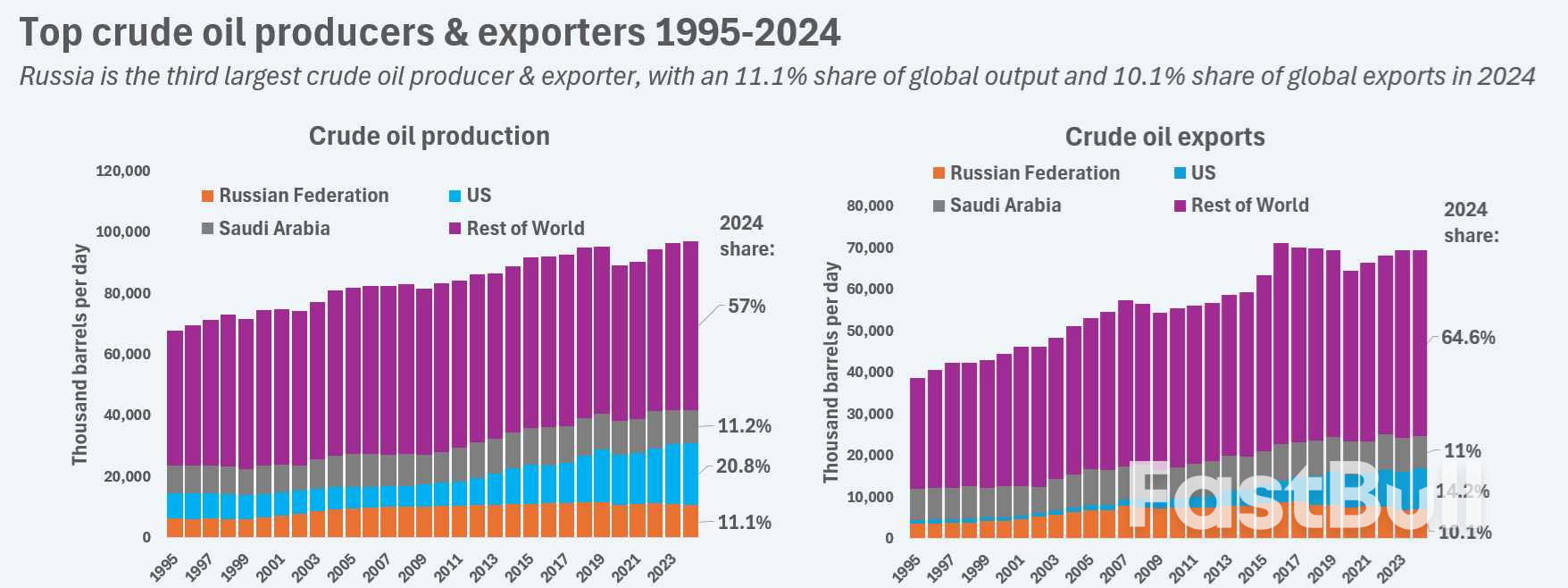

Top crude oil producers & exporters 1995-2024

Most of the poll respondents see limited impact on the oil market from Trump's threats on Russian crude buyers, as they expect OPEC+ and alternative suppliers could mitigate supply gaps.

However, the geopolitical risk premium is expected to underpin oil prices as a quick Russia-Ukraine ceasefire deal seems highly unlikely, analysts said.

Global oil demand is seen growing by between 500,000 and 1.1 million bpd in 2025, the poll showed, compared to the International Energy Agency forecast of 680,000 bpd.

Meanwhile, OPEC raised its global oil demand forecast for next year and trimmed its estimate for growth in supply from the U.S. and other producers outside the wider OPEC+ group.

"U.S. production is an interesting one as President Trump would like to push for more production, but OPEC+ may be right in their projections. The reason around this is price," said Zain Vawda, analyst at MarketPulse by OANDA.

Source: reuters

Copyright © 2025 FastBull Ltd

News, historical chart data, and fundamental company data are provided by FastBull Ltd.

Risk Warnings and Disclaimers

You understand and acknowledge that there is a high degree of risk involved in trading. Following any strategies or investment methods may lead to potential losses. The content on the site is provided by our contributors and analysts for information purposes only. You are solely responsible for determining whether any trading assets, securities, strategy, or any other product is suitable for investing based on your own investment objectives and financial situation.