Oil Demand Concerns Persist Despite Geopolitical Supply Disruption Fears

Crude oil edges higher on geopolitical tensions despite bearish supply outlook. WTI heads for worst annual decline since 2020 amid oversupply.

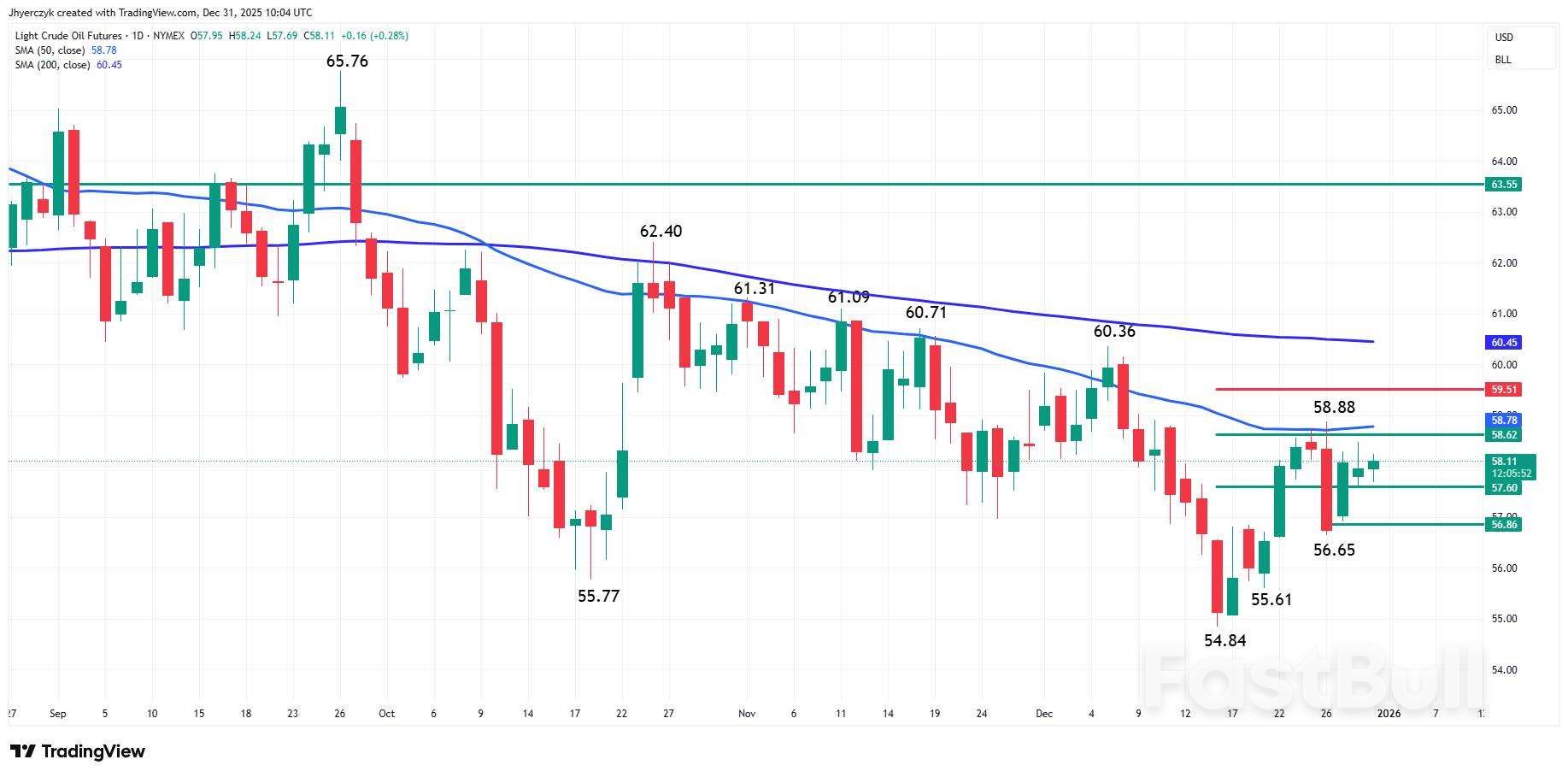

Crude Edges Higher in Thin Holiday Trade After 61.8% Rebound From December Low

Light crude oil futures are inching higher on Wednesday on below average volume. The price action suggests traders may have packed it in for the New Year's holiday.

The month began with a steep drop from $60.36 on December 5 to $54.84 by December 16. Since that low was reached, however, prices have rebounded more than 61.8% to $58.88 on December 26 before pulling back to $56.65 the same day.

At 11:25 GMT, light crude oil futures are trading at $58.11, up $0.16 or +0.28%.

Geopolitical Tensions Drive Short-Covering Rally Amid Bearish Supply Outlook

The sell-off was fueled by a bearish supply outlook, while the rebound represents short-covering tied to escalating tensions between Russia and Ukraine, and the United States and Venezuela. Shorts took protection out of fear of a supply disruption. Tensions between Saudi Arabia and Yemen also contributed to the bid in the market this holiday-shortened week.

Key Technical Levels: 50-Day MA at $58.78 Holds Cards for Direction

Today, traders will be looking for support at the first 50% level at $57.60. If that fails, they will likely lean on $56.86 to $56.65.

On the upside, the resistance zone is $58.62 to $59.51. Inside this area is the 50-day moving average at $58.78. It is both resistance and a potential trigger point for an acceleration to the upside. More importantly, it is my short-term trend indicator.

A breakout over the 50-day MA may not be enough to fuel a strong rally into the 200-day MA at $60.45. I think we are going to need to see a recovery and a support base built above the 50-day MA before we can be confident there are real buyers in there driving the price action.

But for a bullish technical outlook to align with a bullish fundamental outlook, the supply/demand fundamentals are going to have to change. At this time, they are bearish because of oversupply. A supply disruption could alleviate some of this pressure, but disruptions tend to be short-term in nature.

WTI Set for 19% Annual Decline as Oversupply Dominates Year-End Action

Early expectations for 2026 are bearish, but with lingering geopolitical tensions propping up prices. Oil prices may be close to unchanged today, but for the year, they are set to fall more than 15%. Oversupply was the major concern throughout the year, driving prices lower until the nearby futures contract hit its lowest level since 2021 in December.

Reuters is reporting that Light crude oil futures are down nearly 18% for the year, their most substantial annual percentage decline since 2020. Brent is also on track to finish a third year of losses, their longest-ever losing streak. West Texas Intermediate (WTI) crude, also known as Light Crude Oil, is headed for a 19% annual decline.

2026 Forecast: Bearish Q1 Followed by Recovery, OPEC Cuts Limit Downside

My outlook for 2026 calls for lower prices in the first quarter, with WTI hovering near $55.00 to $50.00 per barrel, then a recovery later in the year to $60.00 to $65.00.

Volatility is likely to be skewed to the upside because of the possibility of an escalation in the geopolitical issues and the possibility of a prolonged supply disruption.

What this means is that I don't see prices falling below $50.00 for a lingering period, but the odds are we could spend some time over $65.00 if supply is disrupted for a long time. I believe that if prices were to fall substantially, OPEC would step in and cut production.