Multifamily Delinquencies Rise Again, Hit New Post-Great Recession High

The phrase “renter friendly” is anything but friendly for owners of multifamily rentals.

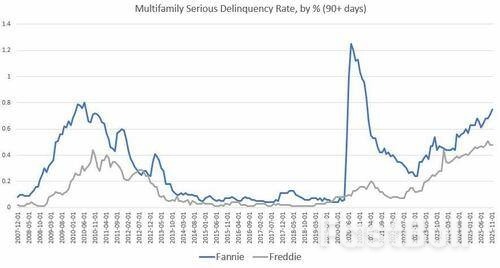

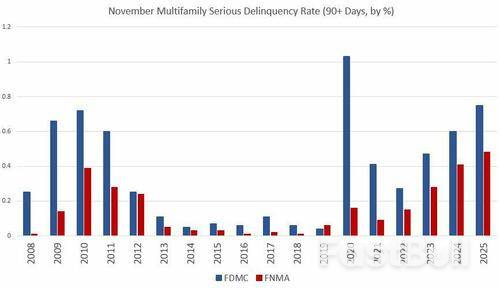

Fannie Mae and Freddie Mac (also known as "GSEs") have released their November reports on their mortgage portfolios and mortgage delinquencies. Both Fannie and Freddie report that serious delinquencies in multifamily are rising to multiyear highs.

For November, seriously delinquent multifamily mortgages (90+ days delinquent) at Fannie Mae rose to 0.75 percent. That's up from October's total of 0.71 percent, and it was up from November 2024's total of 0.60 percent. Fannie's delinquency rate has risen quickly since December 2022 when the rate was 0.24 percent. Excluding the covid panic, Fannie's delinquency rate is now the highest since 2010, but remains below the Great-Recession high of 0.80 percent.

Freddie Mac's delinquency report, on the other hand, shows delinquencies above the Great-Recession peak. During November, Freddie reported multifamily serious delinquency rate was 0.48 percent. That's unchanged from October 2025, but up from November 2024's level of 0.41 percent.

Comparing for November of each year, November 2025's delinquency rate at Fannie exceeds that of November 2011, the previous peak year for delinquencies (ex covid), when November delinquencies reached 0.72 percent. At Freddie, November 2025's delinquency rate of .48 percent is the highest in decades, and above the previous peak of 0.39 percent.

This trend likely reflects slowing rent growth and waning demand for rentals as employment stagnates and wage growth slows. CNBC reported on Dec 26:

After years of steep increases, renters are finally seeing sustained price relief, a trend that appears to be carrying into early 2026.

In November, the median asking rent across the 50 largest U.S. metro areas was $1,693, down about 1% from a year earlier and marking the 28th consecutive month of year-over-year declines, according to Realtor.com listings data. Nationally, the median rent fell to $1,367, down 1.1% from a year earlier, according to Apartment List's data.

November is typically the slowest month for rentals, but rents fell more from October to November this year than they did over the same period last year, according to Apartment List.

With new apartment supply still hitting the market, rents are expected to remain lower into 2026.

"Barring a major economic shock, 2026 is shaping up to be one of the more renter-friendly periods we've seen in a decade," says Michelle Griffith, a luxury real estate broker at Douglas Elliman.

The phrase "renter friendly" is anything but friendly for owners of multifamily rentals. Moreover, landlords must continue to contend with rising prices in services and materials necessary for regular maintenance of multifamily units. In other words, we must consider inflation, so real, inflation-adjusted rent growth is even worse than the nominal declines now reported in a number of metro areas. In Denver metro, for example, the median asking rent in November was down 4.8 percent, year over year.