Asia Market Wrap - Markets Show Signs of Risk Aversion

Markets showed caution around the world on Monday, as investors prepare for a busy week of new economic data. US stock futures and cryptocurrencies both declined, suggesting investors were avoiding risk, even though most still expect the US Federal Reserve to cut interest rates in December.

In Japan, the Nikkei stock index fell sharply, dropping 1.68% after four straight days of gains. This decline was triggered by two factors: rising Japanese government bond yields and a strengthening yen. Both of these changes were fueled by comments from Bank of Japan Governor Kazuo Ueda, which increased speculation that the central bank might raise interest rates as soon as this month. Because of this speculation, banks saw their shares rise significantly, including Sumitomo Mitsui Financial Group (+2.75%) and Mitsubishi UFJ Financial Group (+2.33%).

Conversely, most other sectors declined. The technology sector was hit hard, with chip-testing equipment maker Advantest and Uniqlo owner Fast Retailing both losing ground. Optic fibre cable maker Fujikura was the biggest loser on the Nikkei, plummeting 8.58%. The energy sector was the worst-performing overall.

China Manufacturing PMI at 4-Month Lows

The latest survey of China's factory sector showed a minor slowdown in November 2025. The RatingDog China General Manufacturing PMI dropped to 49.9, down from 50.6 the month before, and was slightly weaker than analysts had predicted.

Because the figure fell just below the 50-point mark, it signals a slight contraction (or drop) in factory activity. Overall production and the level of new orders remained mostly flat. Factories also reduced their workforce again (renewed job cuts) and purchased fewer materials. However, there was a bright spot: new orders from foreign customers grew at the fastest pace in eight months thanks to business efforts to expand. Suppliers also delivered materials quicker due to lower factory purchases and better communication.

Regarding prices, the cost of raw materials continued to increase, mostly driven by higher metal prices, though the rate of this inflation slowed down. Meanwhile, the prices that factories charge for their finished goods actually fell due to strong competition. Looking ahead, companies were more optimistic about the future, encouraged by new government policies, expansion plans, and the launch of new products.

European Session - European Stocks Slide

European stocks fell on Monday, losing ground after a strong month in November. Investors became more cautious, leading to a wave of "risk aversion" across the markets.

The main European index, the STOXX 600, dropped 0.4%. Key national markets in Germany and France saw similar declines of 0.5%. Following a solid run in November, which had calmed fears about a potential bubble in Artificial Intelligence (AI) stocks, traders are now looking for new reasons to buy. The main focus this week will be on new economic reports and early signs of how much people spent over the Black Friday and Cyber Monday holiday shopping period.

The biggest reason for the overall market slump was the industrial sector, which dropped by 1.3%. This slide was mainly due to two areas: Airbus and defence stocks. Planemaker Airbus saw its shares fall 2.1% after it had to recall and order immediate software repairs for 6,000 jets globally, more than half of its worldwide fleet.

Meanwhile, shares in major defence companies, including Hensoldt, Rheinmetall, and Leonardo, also dropped by more than 3% each.

Finally, London-listed Impax Asset Management also saw its stock fall by 3.6% after releasing its yearly financial results. On the geopolitical front, officials from the U.S. and Ukraine held encouraging talks on Sunday about a possible peace deal with Russia, though US officials remained cautiously optimistic given the obstacles to ending the three-year conflict.

On the FX front, the yen grew stronger on Monday. This was largely because the Governor of the Bank of Japan, Kazuo Ueda, gave a very strong hint that the central bank might consider raising interest rates at its policy meeting in December. This unexpected possibility caused the yen to rally, pushing the US dollar down 0.4% against it to 155.51 yen.

Meanwhile, the dollar struggled overall because investors are increasingly betting that the US central bank will cut interest rates later this month.

This environment helped the euro climb to a two-week high of $1.16155. In contrast, the British pound (sterling) dipped 0.2% to $1.3211, taking a pause after its best weekly performance in over three months, which had followed the UK's recent budget announcement.

Finally, cryptocurrencies saw a sharp drop, with Bitcoin falling 5.7% to $85,949 and ether dropping 6.4% to $2,828.41.

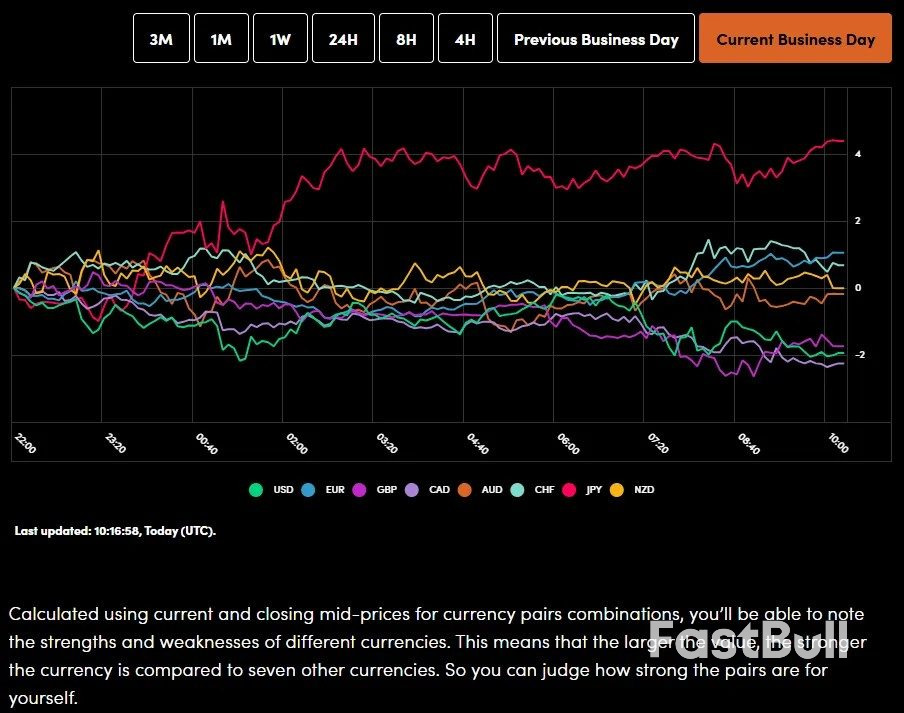

Currency Power Balance

Oil prices increased by 2% on Monday, reaching their highest point in over a week, due to several factors raising concerns about the future supply of oil.

First, the group of major oil-producing countries known as OPEC+ confirmed their current plan to keep oil production levels unchanged, meaning they will not increase the amount of oil being pumped into the market. Second, the Caspian Pipeline Consortium completely stopped exporting oil after a significant drone attack occurred in the area. Third, growing tensions between the U.S. and Venezuela also added to supply worries.

Because of these concerns, the price of Brent crude oil futures rose by 1.96% to $63.60/barrel, and U.S. West Texas Intermediate (WTI) crude futures jumped by 2.08% to $59.77 per barrel.

Gold prices rose significantly on Monday, reaching their highest value in a month and a half. This climb was mainly driven by investors expecting that the US Federal Reserve might cut interest rates later this month, combined with changes in the Fed's leadership.

Specifically, the price of spot gold increased by 0.3% to $4,249.21/oz.

Furthermore, silver also experienced a major jump, surging to a record high price. The futures contracts for US gold for December delivery saw an even bigger gain, rising 0.5% to $4,275.40.

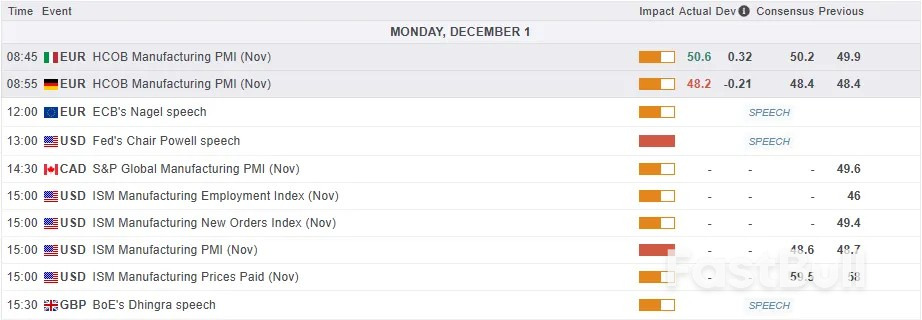

Economic Calendar and Final Thoughts

The European session will be quiet today with attention largely focused on Geopolitics before the US session begins.

The US session will bring PMI and ISM data which could impact the US Dollar as markets get back to normal following the US Thanksgiving break at the back end of last week. This will be a busy week for the US in terms of data as well as how rate cut expectations continue to evolve ahead of next week's FOMC meeting.

Chart of the Day - FTSE 100 Index

From a technical standpoint, the FTSE 100 has held above the 100-day MA since Thursday afternoon.

This could be seen as a sign of bullish momentum with a potential breakout coming soon.

However, the longer price remains rangebound, this will increase investor angst and a potential pullback may materialize.

For now though, a bullish move appears more favorable as markets enter the final month of 2025.

Immediate support rests at 9686, 9661 and 9638 respectively.

A move higher may encounter some resistance at 9750, 9800 and 9850.

FTSE 100 Index Daily Chart, December 1. 2025

Source: marketpulse