Asia Market Wrap - China Stocks Continue to Rally, Goldman Increases CSI300 forecast to 4900

Asian stocks went up a little on Friday, following a good day for tech companies on Wall Street. Markets in Asia also had a good day, with the main Asia-Pacific stock index (excluding Japan) going up by 0.26%. In China, the tech-focused STAR 50 Index dropped by 3% after a big jump of more than 7% the day before.

Shares of the Chinese chip company Cambricon Technologies fell by more than 7% because the company had warned investors on Thursday that its stock price had risen too quickly since late July. Despite this, China's CSI300 index for top companies went up by 0.5%, and Hong Kong's Hang Seng Index rose by 0.8%. However, Japan's Nikkei index went down by 0.33%.

China's stock market is expected to have a record amount of trading this month, which shows how strong the current stock market surge is. This "bull run" is attracting many new investors every day. Even with concerns about the economy from US tariffs and a major property issue, and despite banks and regulators suggesting they might try to slow things down, there is a lot of excitement in the Chinese market.

In light of this positive trend, experts at Goldman Sachs raised their prediction for where the CSI 300 Index will be in 12 months, changing their forecast from 4,500 to 4,900.

European Open - Inflation Data in Focus

European stocks dropped slightly on Friday as investors waited for new economic information from Europe and a major US inflation report. These reports could give hints about when interest rates might be lowered in both regions.

The STOXX 600 index was down 0.2% and was on track for its first weekly loss in a month. This week, worries about a possible collapse of the French government and questions about the independence of the US Federal Reserve have put pressure on the stock market.

Recent data showed that consumer prices in France went up a bit less than expected in August. Later today, investors will be focused on new figures from Germany and the U.S. personal consumption expenditures report. In other news, shares of the French spirits company,

Remy Cointreau, went up by 1% after the company said a new trade agreement between the US and the EU would reduce the negative effect of US tariffs on its products.

On the data front, Inflation in France, Spain, and Italy came in slightly below forecasts, at 0.8%, 2.7%, and 1.7% respectively.

On the FX front, the euro's value stayed the same at $1.1677, while the British pound dropped slightly to $1.3474. Despite these small changes today, both currencies are set to have a good month, gaining more than 2% against the dollar. The dollar's value against the Japanese yen remained stable at 146.975 yen.

Elsewhere, the New Zealand dollar became a little stronger after the chairman of New Zealand's central bank, Neil Quigley, resigned. His resignation was due to controversy over how the central bank's governor had suddenly quit earlier in the year.

Meanwhile, China's currency, the yuan, reached its highest value against the dollar in 10 months. This is happening because China's central bank has kept its currency fixings stable and because of a booming stock market in China.

On the other hand, the Indian rupee fell to its lowest value ever, due to concerns about how new, high tariffs from the U.S. will affect India's economy.

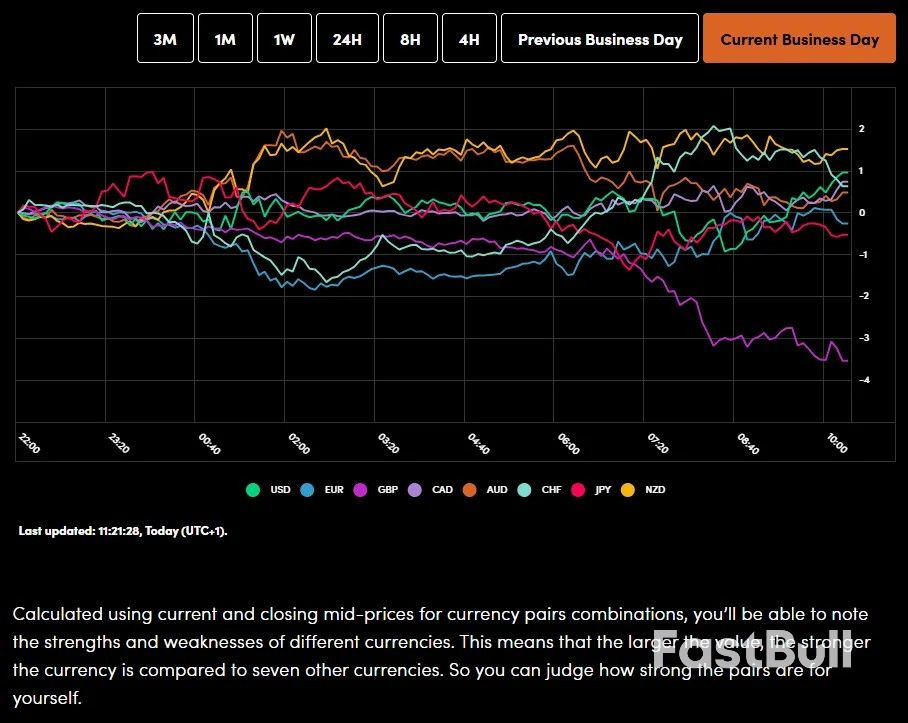

Currency Power Balance

Oil prices dropped on Friday, but they are still on track to end the week higher. The market is being pulled in two different directions: there's uncertainty about how much oil Russia will supply, but there are also expectations of lower demand as the summer driving season in the U.S., which uses the most fuel, is ending soon.

For the day, the price of Brent crude oil for October delivery went down by 36 cents to $68.26, and the more popular November contract slid 29 cents to $67.69. The price of West Texas Intermediate crude oil also fell by 28 cents to $64.32.

Even with today's drop, Brent crude is expected to finish the week with a 0.8% gain, and WTI is set to rise by 1%.

Gold prices went down a little bit on Friday, but they're still on track to increase for the month. This is happening as people wait for new U.S. inflation data, which will give more hints about when the Federal Reserve might cut interest rates.

The price of gold was down 0.1% at $3,414.07 per ounce. In August, gold went up by 3.6% and reached $3,423.16 on Thursday, which was its highest price since July 23rd.

German Unemployment at Highest Level in 10 Years

For the first time since 2015, the number of unemployed people in Germany has gone above three million, showing how a long period of economic struggles is finally hurting the job market. This three-million figure is seen as a key point that separates a strong job market from a weak one.

The new data shows that the number of unemployed people in Germany increased by 45,700, bringing the total to 3.025 million. Although the number of unemployed people adjusted for seasonal changes actually went down slightly, the overall increase is part of a longer trend. Since hitting a low in May 2022, unemployment has been steadily rising because the economy has been struggling for over five years. This is a classic example of how a weak economy eventually leads to a weaker job market.

Economic Data Releases and Final Thoughts

Looking at the economic calendar, the European session has been busy with a bevy of inflation data. We still wait on German inflation data which will be released a bit later in the day.

The US session is key today as markets brace for the Feds preferred inflation gauge, the US PCE data release. I do anticipate a 0.3% increase for the month, which is what most experts are predicting. If the increase is slightly higher, it could cause the dollar to go up a little, but it's unlikely to change the strong expectation that the Fed will cut interest rates in September. This is because of the recent reassuring comments made by Fed Chair Powell at Jackson Hole.

For now, the dollar's value (measured by the DXY index) will likely stay around its 50-day average of 98.0, even though there's still a chance it could drop further.

Chart of the Day - FTSE 100

From a technical standpoint, the FTSE 100 has finally broken below the neckline of the head and shoulder pattern which has been developing this week.

The index has fallen about 50 points already since the neckline break and is trading below the 100-day MA. A brief bounce has taken place but the possibility of another 50-60 point drop toward the 200-day MA could materialize.

Support is immediately provided by the 9180 handle before the 200-day MA at 9136 becomes the area of focus.

FTSE Four-Hour Chart, August 29. 2025

Source: marketpulse