Asia Market Wrap - Asian Stocks Steady

Global stocks dipped slightly on the last trading day of 2025, giving back a small portion of the gains from a very strong year.

Despite this quiet finish, the global market index has risen 21% overall, marking its third straight year of growth.

In Asia, Chinese stocks rose slightly to finish the year up 18%, while Hong Kong fell today but still secured a 28% annual gain, largely ignoring concerns about trade wars. South Korea was the world's best performer, surging 76% this year thanks to strong results from tech giants like Samsung.

With Japanese markets already closed and most of the world taking a break for New Year's Day tomorrow, trading activity is expected to remain low.

China Manufacturing PMI Exceeds Expectations

China's manufacturing sector surprisingly returned to growth in December, with the RatingDog index rising to 50.1, which was better than experts predicted.

This improvement was driven entirely by stronger demand within China, aided by government efforts to boost local spending, even as sales to other countries declined. Despite receiving more orders, factories did not buy new supplies because they already had enough stock, and they continued to cut jobs for the second month in a row to lower costs.

Manufacturers are also facing a financial squeeze; while the cost of raw materials rose to a three-month high, they were forced to lower their own selling prices to keep customers buying. As a result, overall business confidence remains weak as companies worry about the future of the economy.

European Session - Fresh All-Time Highs Printed

European stocks hit all-time highs on the final day of 2025, wrapping up their best year since 2021.

The region's main index, the STOXX 50 rose by 0.5% today, securing annual gains of between 17% and 19%. This strong performance was led by the banking sector, which surged a remarkable 67% this year, while mining companies also rallied due to high metal prices.

Utility companies contributed to the gains as well, driven by increasing electricity demand from data centers. Trading was limited due to the holidays; markets in Germany, Switzerland, and Italy were closed, while exchanges in London and Paris opened for only half the day.

Meanwhile, notes from the US Federal Reserve revealed that officials debated economic risks before agreeing to cut interest rates earlier this month.

On the FX front, the British pound fell slightly against the US dollar on Wednesday, but it is still finishing the year with a strong 7.5% gain, its best result since 2017.

However, compared to its neighbors, the pound struggled; it dropped more than 5% against the Euro, making it the worst-performing major currency in Europe this year.

Other European currencies, such as the Swiss franc and Swedish crown, performed much better, rising between 13% and 19%.

Meanwhile, the US dollar held steady today but is set to record a 9.5% loss for 2025, its biggest drop in eight years. This weakness in the dollar paved the way for the Euro and the pound to post their strongest annual gains since 2017.

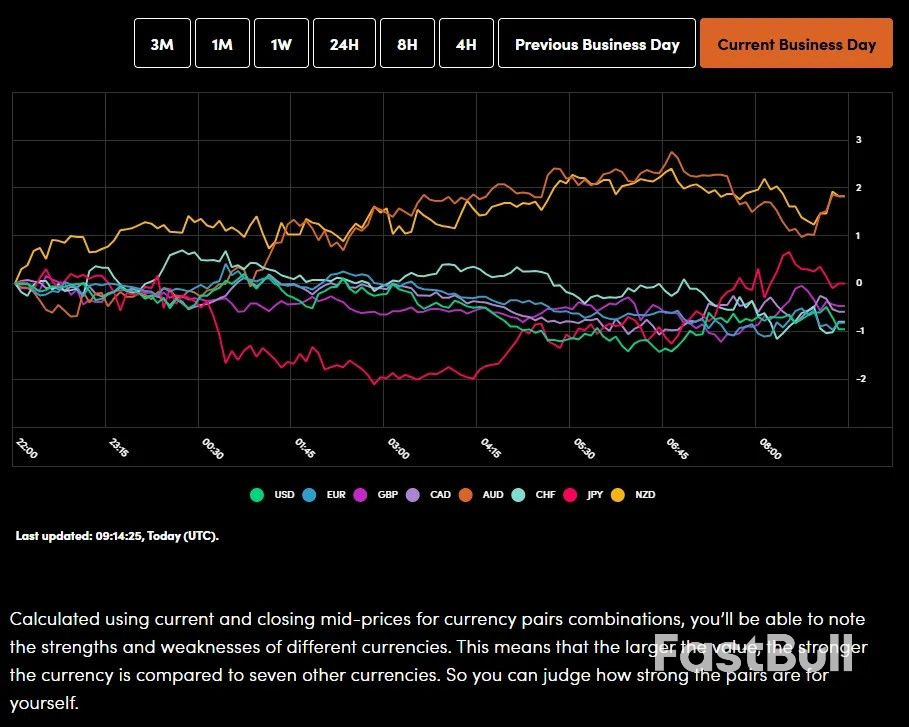

Currency Power Balance

On Wednesday, prices for precious metals like gold, silver, and platinum resumed their recent selloff as investors decided to collect the huge profits they had made earlier in the year.

Gold breached the $4300/oz level for the first time since December 16 before recovering to trade back above the $4300/oz handle at the time of writing. However, Gold is still down around 0.7% on the day and around 5% for the week.

Oil prices barely moved on Wednesday, but they are finishing 2025 with a sharp decline of over 15%. This drop comes despite ongoing wars and sanctions on major producers like Russia and Iran, as the market is primarily worried about having too much supply.

Brent crude is down nearly 18%, marking its biggest annual loss since 2020 and its third straight year of falling prices, the longest losing streak in its history.

Similarly, US crude oil is set to finish the year nearly 19% lower.

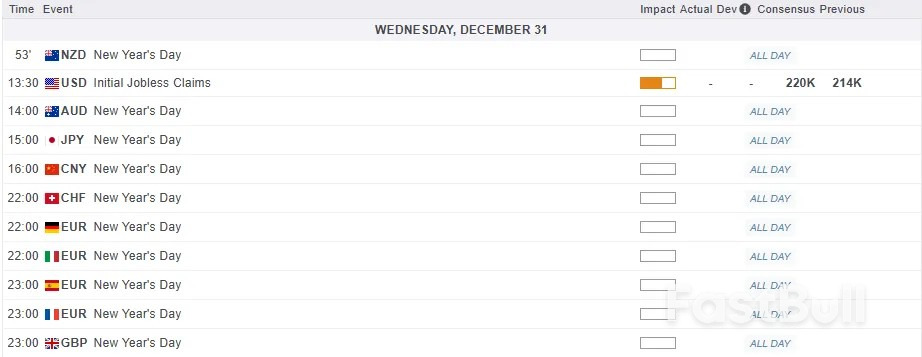

Economic Calendar and Final Thoughts

The European session remains quiet and the US session will likely follow suit in what is the last day of 2025.

There could be some volatility due to repositioning and profit taking as some market participants may look to start the year with a clean slate. Geopolitical tensions remain an area where market participants may continue to focus.

Chart of the Day - FTSE 100

From a technical perspective, the FTSE 100 index continues to hold near the all-time highs having printed fresh highs yesterday..

The period-14 RSI has seen a bounce of the 50 level which hints at bullish momentum still being in play.

The possibility of a pullback remains in play, with support resting at 9860 before the 9800 and 100-day MA at 9762 handle comes into focus.

FTSE 100 Index Daily Chart, December 31, 2025

Source: marketpulse