Asia Market Wrap - Alibaba Surges

Asian stock markets are on the rise, following a positive trend in the U.S. market.

As a result, stock markets in Japan, South Korea, and Taiwan have reached new or near-record highs, with Japan's main index climbing 1% and South Korea's jumping 1.3%.

Meanwhile, Chinese stocks also hit their highest point in over three years, largely due to strong investor interest in companies related to artificial intelligence. Overall, a major index tracking Asian shares outside of Japan saw a significant 1.2% increase.

Major players like SK Hynix, Samsung, and TSMC saw their stock prices rise significantly. The e-commerce giant Alibaba also had a great day, with its stock soaring.

This strong performance has pushed the MSCI regional equity index that tracks Asian stocks up by more than 20% this year. In fact, it is now just a tiny fraction away from its highest point ever, which it reached in 2021.

UK Economy Stalls

The British economy didn't grow at all in July, which was exactly what experts had predicted. This came after a small increase in June.

While some parts of the economy did well, others performed poorly. The services sector (things like transportation and healthcare) grew slightly, as did the construction sector (helped by new home building). However, this was canceled out by a drop in the production of goods, especially in manufacturing. Factories that make things like electronics and medicine had a particularly bad month, though some other areas, like electrical equipment, did see an increase.

Looking at the past three months, the economy grew just a little bit. This was because the growth in services and construction was held back by the drop in production.

Compared to the same time last year, the economy has grown by 1.4%, which is the same as the month before but a bit less than what was expected.

The recent economic numbers don't really change what the Bank of England is expected to do.

The next week will be much more important because new reports on jobs and rising prices (inflation) are coming out. My view is that the Bank of England will be more likely to cut interest rates in November than most people think.

European Open - European Stocks Steady

On Friday, European stock markets were a little lower, after being slightly higher earlier in the day. The main reason for the drop was that healthcare company stocks went down.

For example, the stock for the drug company Novartis fell after an investment bank said it faced more competition from cheaper drugs.

Stocks for luxury brands like L.V.M.H. and Richemont also declined, as a different bank suggested they were not good investments right now.

The market is also waiting to hear whether a major ratings agency will lower France's credit rating, which is adding to the uncertainty.

On a positive note, companies in the aerospace and defense sector are having a very good week, with their stocks rising sharply. This is happening because of recent global tensions, which have boosted investor confidence in that industry. Despite the overall market drop today, French stocks are still on track to end the week with a gain.

On the FX front, the U.S. dollar is a little stronger today, but it is still on track to end the week weaker than it started.

The Euro didn't change much in value. It had risen the day before because traders now believe the European Central Bank is less likely to cut interest rates again, as the bank seems confident about the economy.

The British Pound is a bit weaker after new data showed the UK economy did not grow at all in July. Finally, the Chinese yuan and the Australian dollar also slipped slightly, although the Australian dollar remains near its highest value in almost a year.

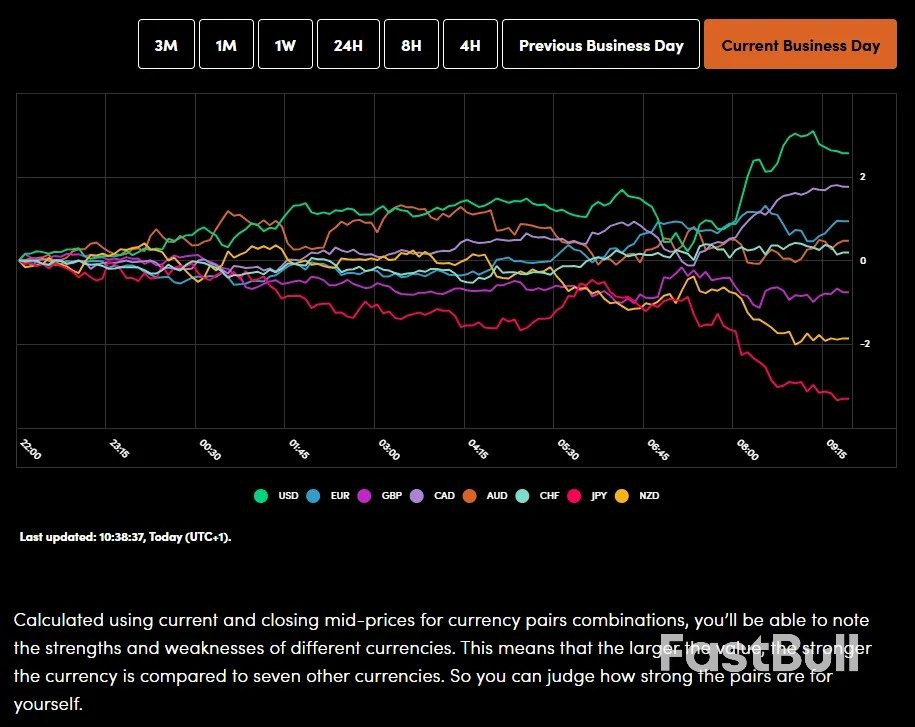

Currency Power Balance

Oil prices are holding steady today because two different things are happening at the same time.

On one hand, there are worries that there's too much oil available and that the U.S. isn't buying as much. This would normally cause prices to fall.

On the other hand, there are concerns that ongoing conflicts in the Middle East and Ukraine could disrupt the flow of oil, which would cause prices to rise.

Since these two worries are balancing each other out, oil prices are not moving much today, after Brent and WTI benchmarks fell by 1.7% and 2% respectively on Thursday.

Gold prices are still holding around the $3650/oz handle.

The main reason for this is growing concern about the weak job market in the United States. This has made people more confident that the U.S. will cut interest rates several times before the end of the year.

The price of gold has now been rising for four weeks in a row.

Economic Data Releases and Final Thoughts

Looking at the economic calendar, the European session will be quiet moving forward with ECB policymakers speaking the highlight.

The US session will bring more inflation insights with the University of Michigan Sentiment and inflation expectation numbers due. This could stoke volatility depending on the data and could also impact longer term interest rate projections.

Chart of the Day - FTSE 100

From a technical standpoint, the FTSE broke out of the range we discussed yesterday before rising toward resistance at 9357.

The index has taken a breath in the early part of the European session but a test of the 9357 handle remains possible.

The one concern is that the RSI period-14 is in oversold territory and could lead to a pullback before continuing higher.

The smart move would be to wait for a pullback for would be bulls to get involved.

Support rests at 9295 before the range top will come into focus at 9267.

Source: marketpulse