Markets May Be Underpricing The Most Consequential Court Ruling Of The Year

We will soon find out if tariffs are unconstitutional.

We will soon find out if tariffs are unconstitutional.

Nov 5th will be a key date for markets: the Supreme Court will start hearing arguments on Trump's IEEPA tariffs.

And while markets don't seem particularly focused on this event, I believe it's crucial to be prepared for it.

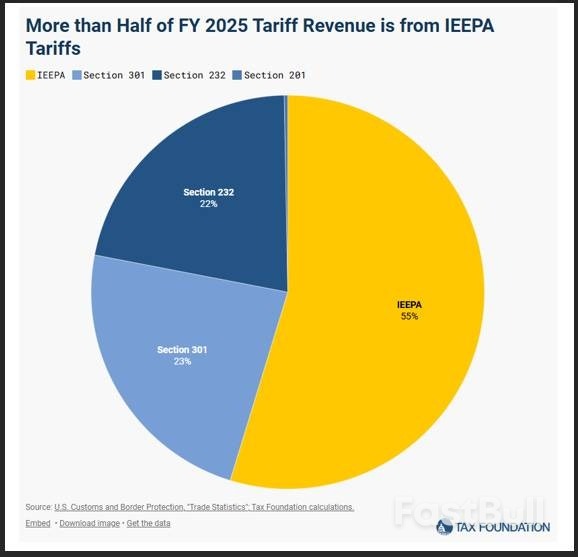

The pie chart above shows why the Supreme Court ruling will be crucial.

If the Supreme Court strikes down IEEPA tariffs as unconstitutional, around 55% of the US tariff income would be wiped out from the 2026 budget and US companies would be eligible for a refund for the 2025 tariffs paid under the IEEPA regime.

In numbers, we are talking about a $150-200bn annualized tariff income loss for the US.

Now, you all know that from a strict monetary perspective, the US tariffs act like a tax.

Data is uncontroversial there: tariffs are being paid by US consumers and corporates (mostly corporates), which is akin to an increase in corporate tax rate that reduces companies' margins.

If the Supreme Court undoes IEEPA tariffs, this would be the equivalent of a ~200bn fiscal stimulus:

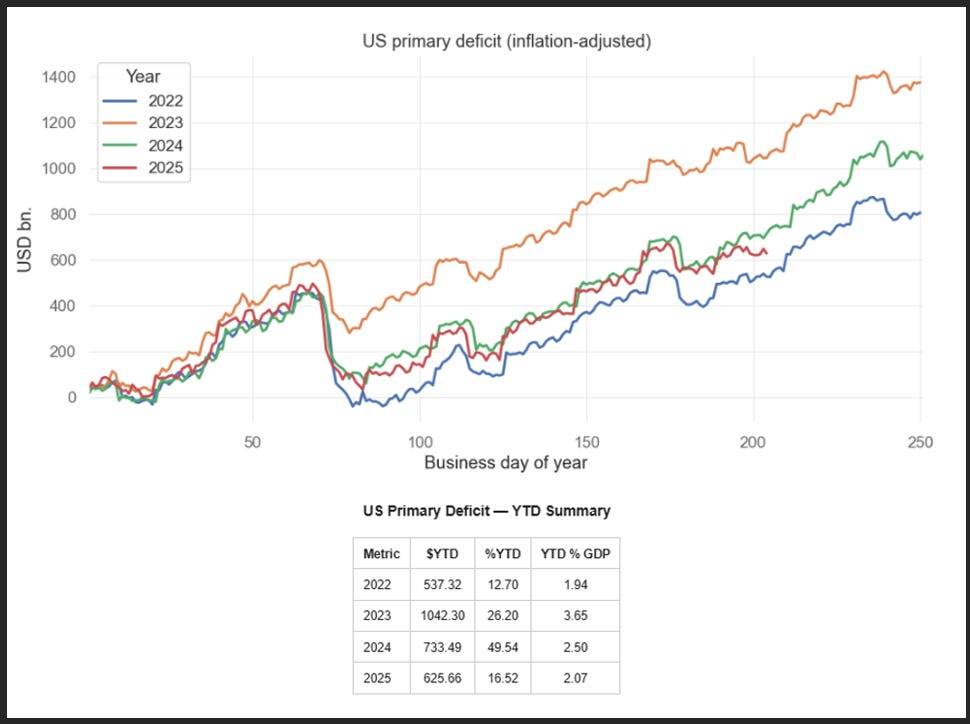

The chart above shows the inflation-adjusted primary deficit spending in the US (read: money printing).

In 2025, the US government has injected $626 billion in the US economy – this is a much lower pace than 2023-2024. The slowdown in US primary deficit spending is mostly due to tariffs.

Revert the IEEPA tariffs, and the US will be going back to the glorious money-printing days of 2024 at least.

So, what are the odds that the Supreme Court will strike down Trump's IEEPA tariffs?

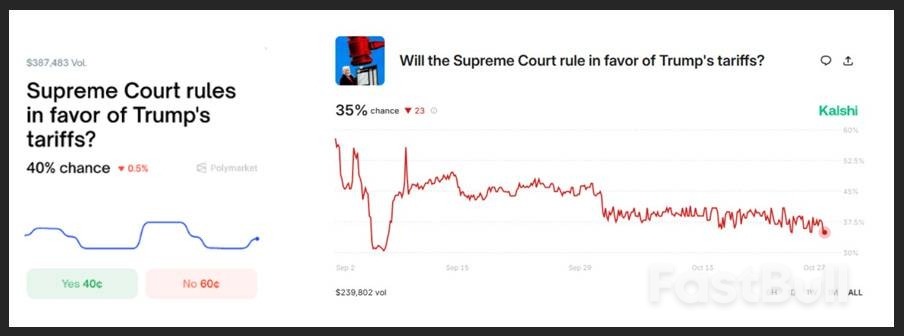

Prediction platforms suggest 60-65% odds, although volumes are quite small:

We can actually get an idea of the real market-implied odds by looking at another market: the newly set-up ''Tariff Refund Trade'' that certain banks are allowing hedge funds to invest in.

According to Bloomberg:

"Wall Street banks are arranging bets on President Donald Trump's tariffs being struck down by the Supreme Court — long-shot trades that could pay off handsomely for hedge funds betting against the legality of the administration's flagship policy.

Jefferies Financial Group Inc. and Oppenheimer & Co. are among firms brokering the deals, matching investors with companies that have paid tariffs to import goods into the US, according to people with knowledge of the matter and correspondence seen by Bloomberg News."

In the trades, the importing companies essentially sell to investors any future rights to claim refunds on their tariff bills, which could come if the nation's top court sides with an ongoing legal challenge to Trump's tariffs. The companies sell at a discount to their expected refunds, meaning investors would reap the upside in the event of a favorable ruling. The banks arranging the deals take a cut.

For example, a hedge fund might pay somewhere between 20 to 40 cents for each dollar of claims they could get back in refunds, giving them an upside of several times their bet, according to the correspondence and some of the people, who asked not to be identified discussing potential terms. Most of the trades range in size from $2 million to $20 million, with few over $100 million, one of the people said.''

It would seem that hedge funds are paying ~30% on average upfront for the trade, which implies roughly the same probability that tariffs are deemed unconstitutional.

But companies are cashing in months in advance the US government refund that would come if IEEPA tariffs are shut down, so we need to make an adjustment for that.

This cross-check says the real market-implied odds of tariffs deemed unconstitutional are closer to the 40-45% area, while prediction platform sit around 60-65%.

Call it 50-50: a coin toss.

Now, let's assume the Supreme Court strikes IEEPA tariffs down.

Can we say with 100% certainty that this will be akin to a ~200bn fiscal stimulus?

Not so fast.

Trump can also set tariffs under Section 232, 301 and 122.

Section 232 covers the sectorial tariffs under commerce authority, and Section 301 the ''fentanyl-like'' tariffs under USTR authority – both fall under the executive (President) powers, not the Congress.

Section 122 also falls under Presidential powers, and it would allow Trump to go for global 15% tariffs for 150 days before Congress would have to approve.

I am saying this because while the Supreme Court might strike down IEEPA tariffs, the Trump administration has seven Section 232 sectoral investigations ending by January 2026 and could come up with more Section 301 or blanket Section 122 tariffs to offset the Supreme Court decision.

Nevertheless, we are going into a coin-flip decision and markets might find reasons to celebrate a Supreme Court decision to strike down IEEPA tariffs – but Trump has weapons to counter such decisions.

In general, bear in mind the following:

- - The US will add $400bn in primary spending through the OBBB next year;

- - Germany will kickstart a large fiscal spending program;

- - The new Japanese PM Takaichi is working on an additional budget to increase fiscal spending;

- - Korea, Canada, Sweden and Australia are expanding primary fiscal spending by 1% of GDP;

- - Debt-funded AI capex might total $300bn next year

Regardless of the Supreme Court decision, the global money printing machine will accelerate.