Two weeks ago, Jerome Powell stated,

“We may be approaching the end of our balance sheet contraction in the coming months.”

In simple terms, as we wrote HERE, he is prepping the market for a quicker end to QT than was previously expected.

While Powell was cryptic about why, the answer is obvious: liquidity concerns. As we have noted in the past few weeks, tightness in the overnight funding markets is becoming more prevalent. Powell likely didn’t want to spook the markets by raising concerns about potential liquidity problems.

At yesterday’s FOMC meeting, the Fed cut rates by 25 basis points to a range of 3.75% to 4.00%, as was widely expected. As Powell warned a couple of weeks ago, liquidity concerns pushed the Fed to end QT on December 1. Per the FOMC statement:

The Committee decided to conclude the reduction of its aggregate securities holdings on December 1.

Beyond QT and liquidity concerns, the Fed doesn’t seem overly worried about a slowdown of economic growth. They note that economic activity has been expanding at a moderate pace. Furthermore, the unemployment rate “has edged up” but “remained low.” They state that inflation has risen and remains “somewhat elevated.” There were two dissenting votes. Stephan Miran wanted a 50-bps rate cut, while Jeff Schmid wanted to hold rates steady.

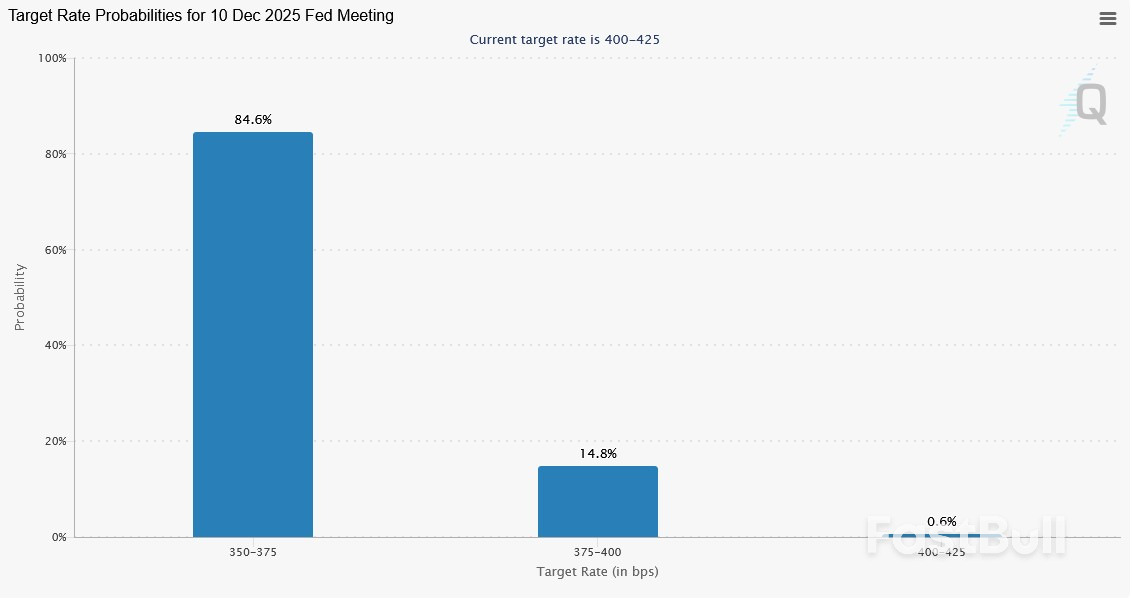

Our initial takeaway is that, barring worsening employment data or lower-than-expected inflation, the Fed may talk the markets down from its 85% probability of a December rate cut. To wit, Powell ended his press conference speech as follows:

An interest rate cut in December is not a foregone conclusion, far from it.

NLY: Deciphering REIT Earnings

Last week’s Commentary summarized how REIT investors view earnings reports differently from most other investors. With that knowledge, we review Wednesday’s earnings report from Annaly Capital Management (NYSE:NLY).

Disclaimer: We hold NLY and NLY preferred shares in some of the portfolios we manage.

NLY reported strong performance driven by mortgage-backed securities (MBS) spread tightening (yields fell more for MBS than UST) and reduced market volatility. Highlights include: GAAP net income of $1.21 per share, earnings available for distribution (EAD) of $0.73 per share (beating consensus of $0.72), and net revenue of $885.6 million. The investment portfolio grew to $122.1 billion, with leverage remaining at 7.1x.

REIT investors rely on various data to evaluate their investments. We share three of those below for NLY:

Economic Return – NLY had an 8.1% economic return, bringing its year-to-date total to 11.5%. This is due to favorable interest rate spreads.

Price to Book Value– Book value per common share rose to $19.25. As of October 28, the stock is trading around $21.06, with a price-to-book ratio of 1.09, a slight premium to its net asset value. MBS yields have fallen since then, so the book value is likely slightly higher than $19.25 today.

Dividend Sustainability– The quarterly $0.70 dividend is well-covered, with earnings available for distribution of $0.73 per share, providing a payout ratio of about 96%. The annualized dividend yield is 13.3%. Per CFO Serena Wolfe:

We are confident in maintaining earnings and dividend coverage, supported by stable swap portfolios and disciplined asset deployment.

Given our outlook for lower yields and a steepening yield curve, we like NLY’s prospects. However, the premium to BV introduces dilution risk to shareholders. Additionally, MBS spreads could widen if QT ends. NLY shares have been stable over the last two years. Given the double-digit dividend yield, investors are not banking on stock gains to supplement total return.

Source: investing