Escalating fears about government finances everywhere from Britain to Japan have so far been contained mostly within bond markets, but big investors are preparing for stress to spread across assets from big tech to housing and currencies.

Budget-driven tumult in France, Britain and Japan, and ballooning U.S. debt have sapped demand for lending long-term to governments.

Here are some potential scenarios for how money managers see rising bond yields impacting corporate financing costs, currencies and equity valuations:

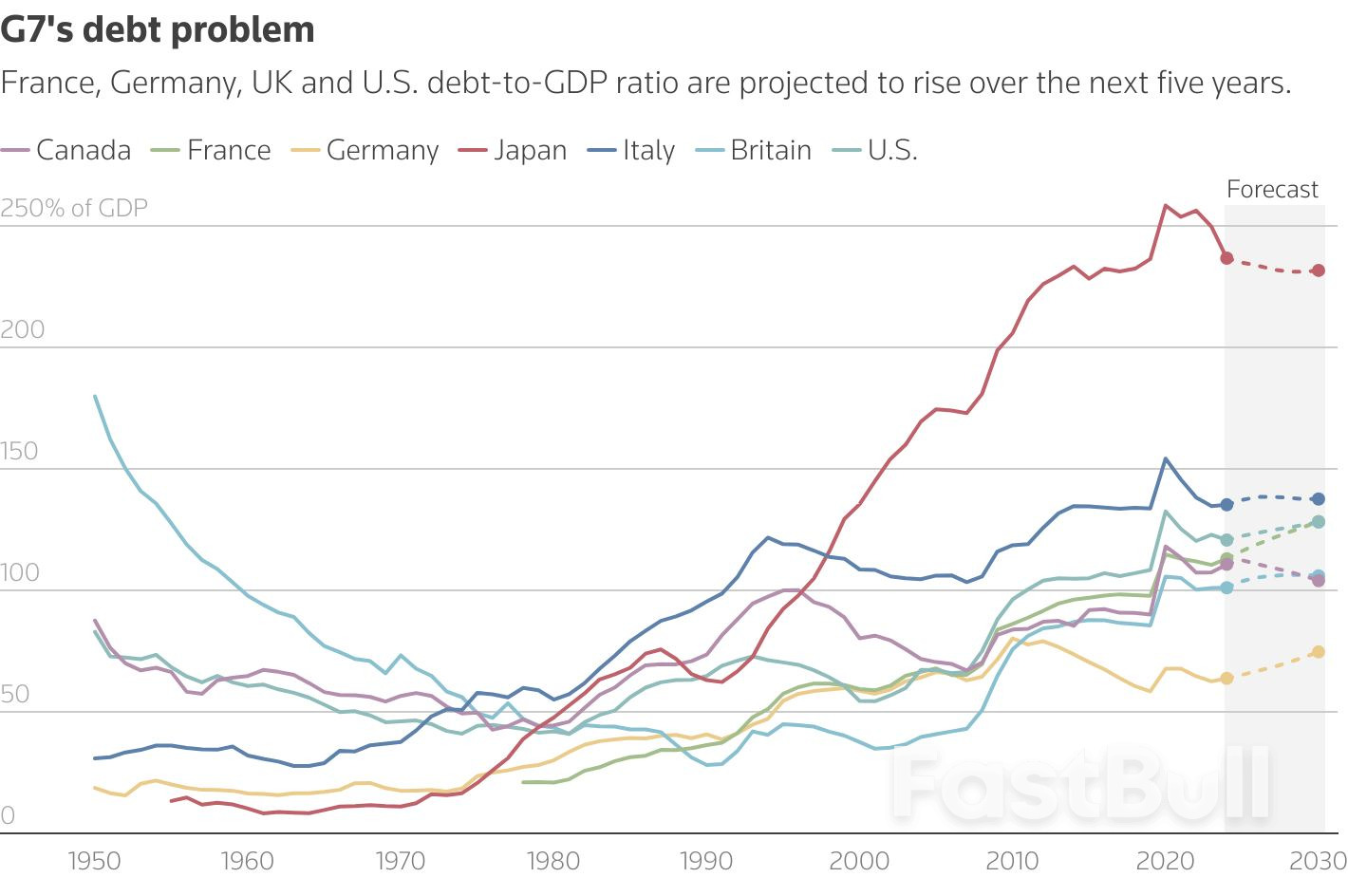

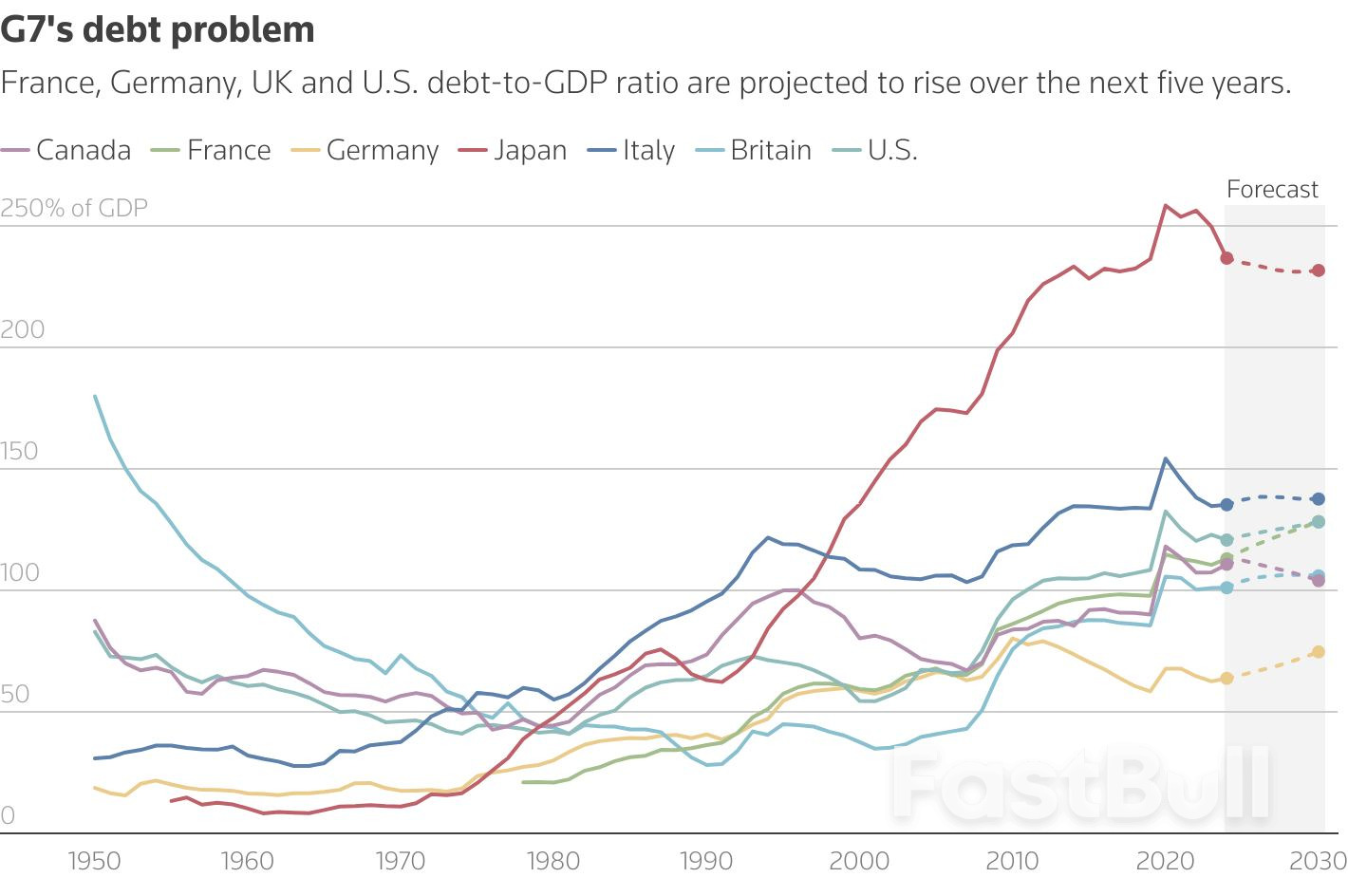

The line chart shows the debt-to-GDP ratios for G7 countries with forecasts from 2025 highlighted using dashed lines. The ratio for Germany, U.S., Britain, France and Italy is projected to rise.

1/PAIN BROADENS

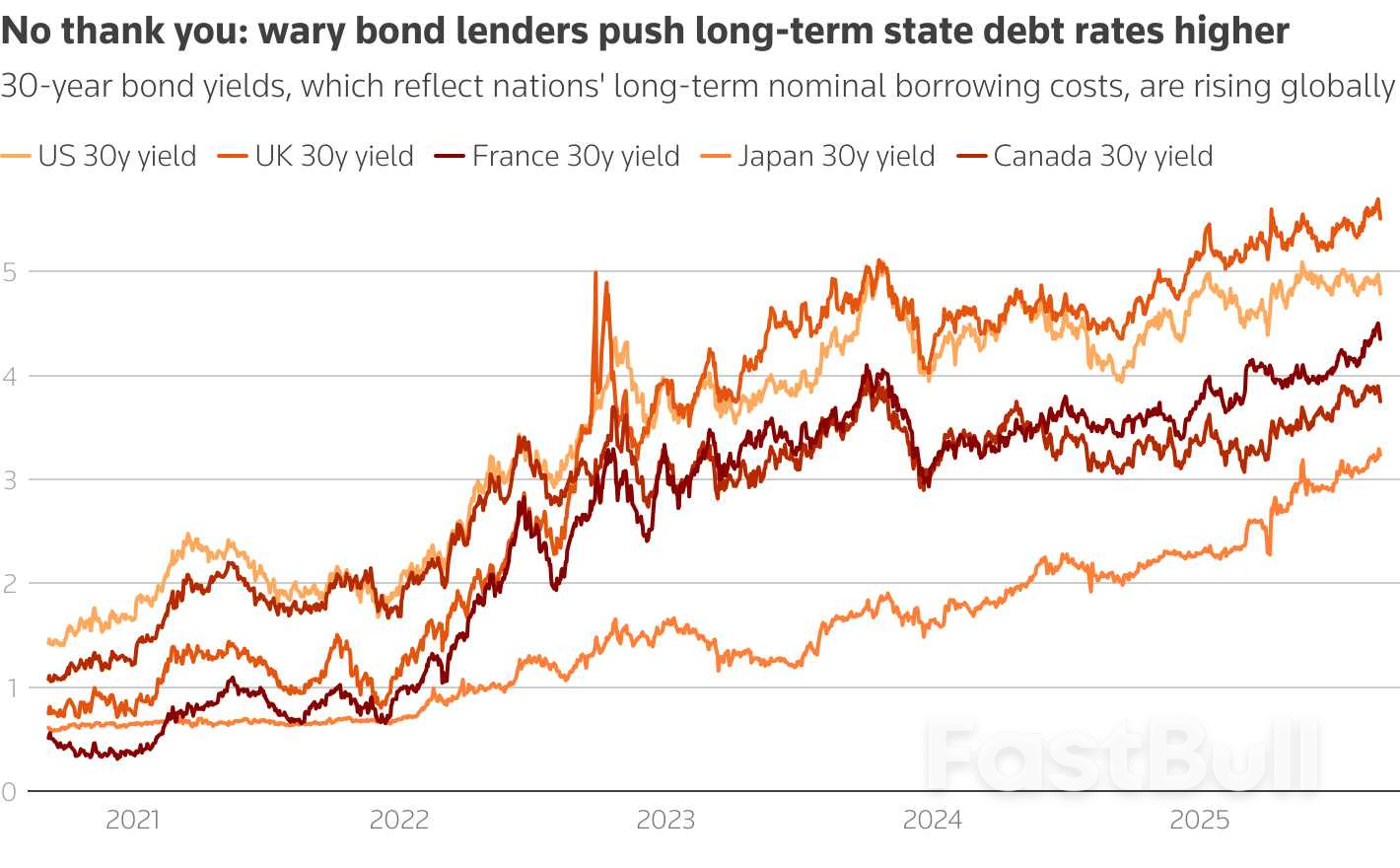

Governments' 30-year bond yields, which rise as debt prices fall, are near multi-year highs in Germany and the United States where they are around 5%. .

Such borrowing costs have hit 16-year highs in France and record peaks in Japan . Britain's 30-year yields are around 5.5% and recently hit 27-year highs, heightening fears about the sustainability of public finances.

Long-dated borrowing costs traditionally influence equity and housing markets and corporate financing rates.

RBC Bluebay Asset Management fixed income CIO Mark Dowding said fiscally troubled nations' currencies were vulnerable and was betting against Britain's pound .

"Every move up in yields leads people to lose a bit more confidence, that pushes yields up further and you end up in a bit of a doom loop," Dowding said.

In Canada, where economic weakness is pressuring public finances, 30-year yields are near 14-year highs and speculative bets against the nation's currency at a five-month peak.

30-year bond yields, which reflect nations' long-term nominal borrowing costs, are high and rising everywhere from Canada to Japan

2/ EUROPE WOBBLES

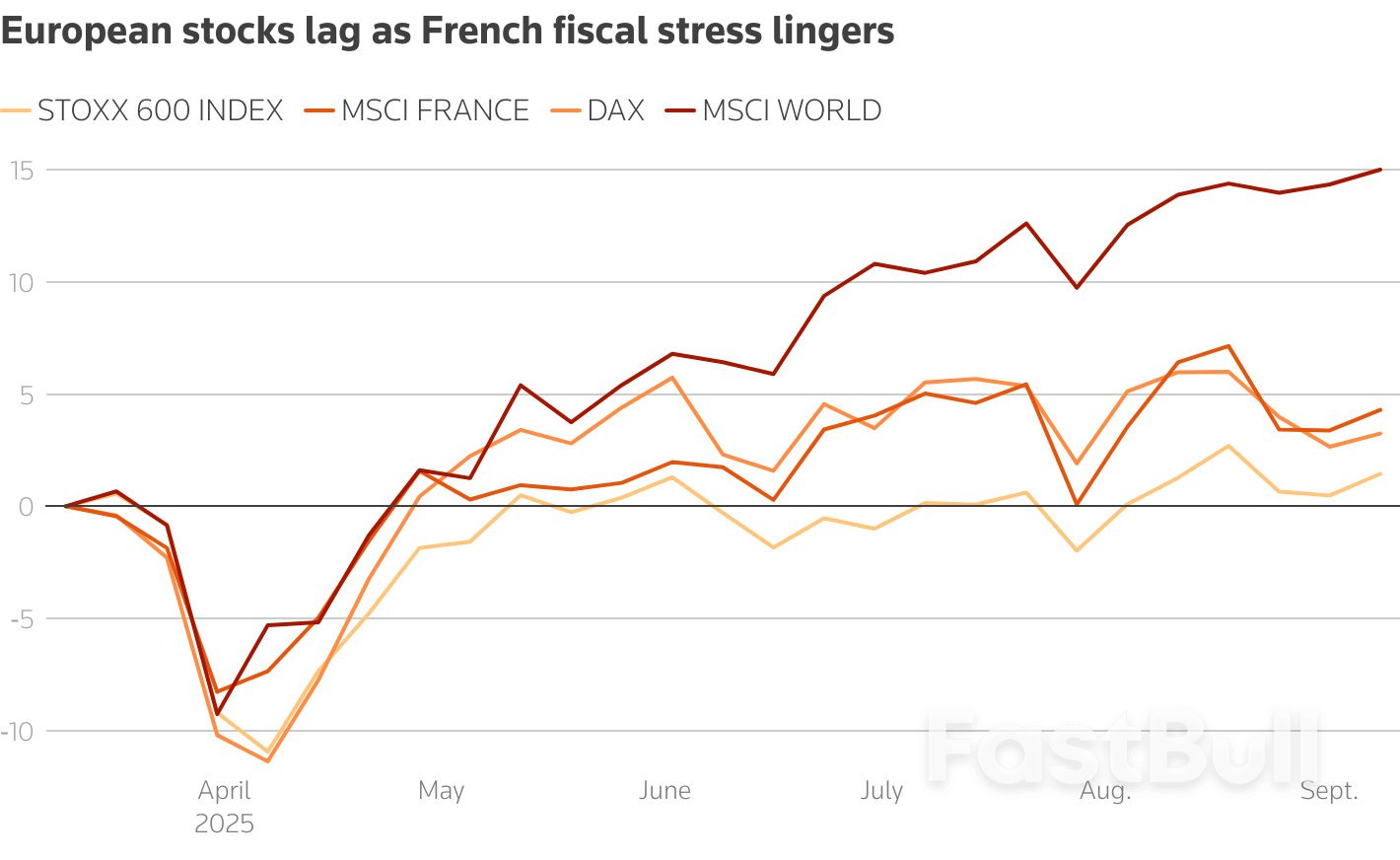

A rush into European assets to diversify away from the United States has stalled as French budget tumult weighs on European stocks, (.STOXX) which have lagged MSCI's world index (.MIWO00000PUS) since June.

"French-driven negative sentiment is not only affecting France but the rest of Europe," Fidelity multi-asset manager George Efstathopoulos said.

Carmignac investment committee member Kevin Thozet expected the euro, up around 13% so far this year to $1.17, to now trade sideways .

Thozet was also cautious on European banks (.SX7P) after a heady 45% year-to-date gain for the sector and considering the risk of French loan losses.

European stock markets in Germany, France and region wide have lagged world equities since the start of the summer

3/ TECH'S CROWN SLIPS

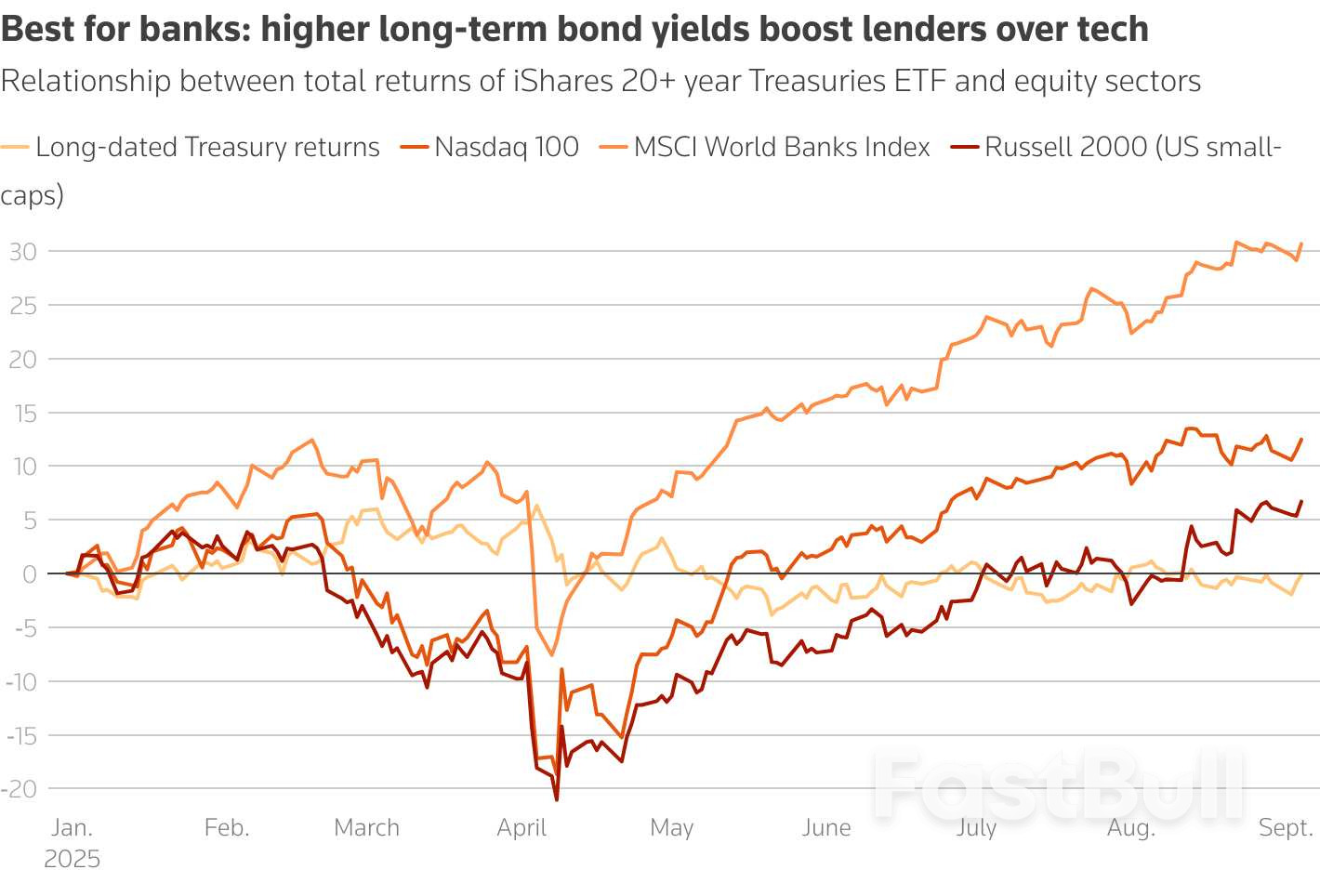

With big tech companies shoveling cash into multi-decade AI investments, their shares should be sensitive to changes in the cost of long-term capital, investors said.

Global tech stocks (.dMIWO0IT00PUS) have underperformed MSCI's global index in the last month and been outpaced by banks, whose profits are boosted by higher debt rates, over 12 months.

"We're watching for which segments of the market are getting impacted," by long term rates, Pictet multi-asset co-head Shaniel Ramjee said, including big tech, real estate and UK stocks.

Relationship between total returns of iShares 20+ year Treasuries ETF and equity sectors. higher long-term bond yields boost lenders over tech.

4/ WATCH JAPAN

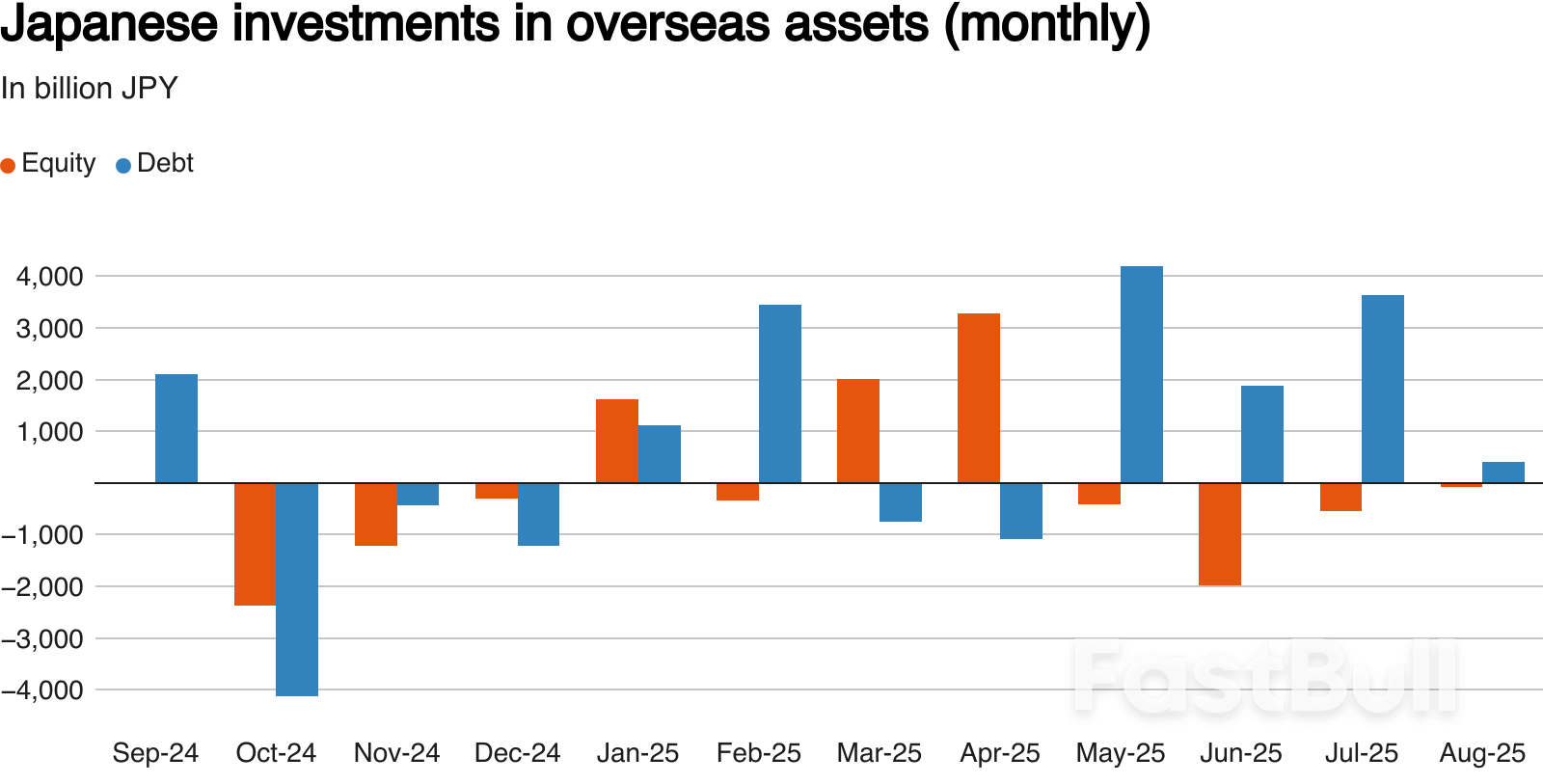

Japanese investors own over $3 trillion of overseas assets thanks to a multi-decade carry trade involving recycling the weak yen into dollar assets and banking easy exchange rate profits.

"They made roughly 10% a year, basically incredibly low-risk and low-volatility, and it's been an amazing and wonderful trade," Zennor Asset Management CIO David Mitchinson said.

Japanese investments in overseas assets in billion JPY

But now, Japan's inflation is surging, and mounting speculation that the Bank of Japan could soon deliver a further rate hike has helped lift the yen about 7% against a broadly soft dollar year-to-date .

Japan's investors are still buying overseas bonds but they are ditching foreign stocks.

"I expect the domestic (Japanese) money goes into domestic stocks," Artemis head of investments Toby Gibb said, adding he was topping up on Japanese equities (.TOPIX) too.

Source: reuters