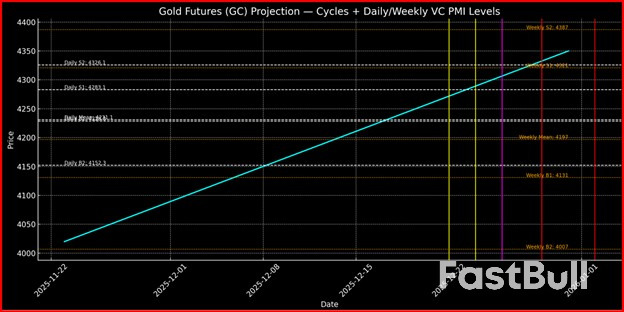

Gold futures continue to rise in a controlled but powerful mean-reversion advance, with the structure of the rally fully aligned with the VC PMI matrices and the 30-, 60-, and 90-day cyclical time signatures. The breakout from the 4018.1 low on November 21 defined the anchor for a new 30-day cycle, which is now in its expansion phase. The compression visible across the 15-minute and 60-minute time frames confirms that buyers continue to accumulate above the daily VC PMI mean at 4231.1, an essential equilibrium point that defines the bullish bias.

The current sequence shows prices operating above the Daily Mean and oscillating between the Daily B1 (4199) and S1 (4284). Once price maintains several bars above 4260, the model activates the Sell-2 target at 4387 as the next high-probability magnet. This level converges with the Weekly S1/S2 range at 4321–4387, forming a dominant resistance band into the final weeks of December.

Cycle analysis amplifies this bullish expectation. The 30-day cycle peaks between December 22–24, when the market typically conducts a fast push into the highest probability zone. The 60-day cycle, initiated in late October, reaches its acceleration and exhaustion window between December 26–29—historically the point at which trend extensions overshoot equilibrium levels. The 90-day macro cycle terminates between December 29 and January 2, precisely synchronizing with the upper VC PMI bands.

This rare triple-cycle alignment typically produces one of two outcomes: (1) a vertical blowoff extension, or (2) a final exhaustion high followed by a high-probability mean-reversion event. Given that the Weekly VC PMI Sell Zone at 4387 corresponds to the 78.6% Fibonacci retracement and the upper volatility bands, a test of 4320–4387 during the December 22–Jan 2 window would represent the statistically dominant scenario.

If price closes below Daily B1 (4231), a shallow reversion toward 4143 is expected. A deeper failure below 4090 would signal the 30-day cycle has truncated. Only a decisive close under 4016 invalidates the multi-cycle bullish structure.

As long as price holds above the 4230 equilibrium, the path of least resistance is upward toward the VC PMI Sell Zones and the apex of the December cycles.

Source: investing

Copyright © 2025 FastBull Ltd

News, historical chart data, and fundamental company data are provided by FastBull Ltd.

Risk Warnings and Disclaimers

You understand and acknowledge that there is a high degree of risk involved in trading. Following any strategies or investment methods may lead to potential losses. The content on the site is provided by our contributors and analysts for information purposes only. You are solely responsible for determining whether any trading assets, securities, strategy, or any other product is suitable for investing based on your own investment objectives and financial situation.