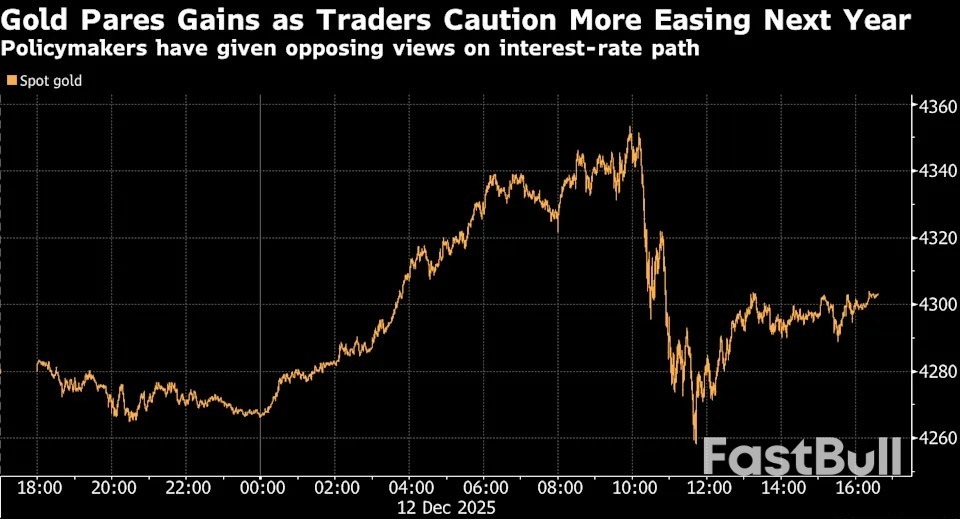

Gold Pares Gains as Fedspeak Raises Doubts on Further Rate Cuts

After the policymakers’ remarks, yields on Treasury 30-year bonds rose, sending bullion lower by as much as 0.5% before paring some of the losses.

English

Español

العربية

Bahasa Indonesia

Bahasa Melayu

Tiếng Việt

ภาษาไทย

Русский язык

Français

Italiano

Turkish

Português

日本語

한국어

简中

繁中

Manuel

ManuelAfter the policymakers’ remarks, yields on Treasury 30-year bonds rose, sending bullion lower by as much as 0.5% before paring some of the losses.

BEE SOUTH AFRICA (PTY) LTD is a broker registered in South Africa with registration number 2025 / 325303 / 07. Its registered address is:21 Villa Charlise, Edgar Road, Boksburg, Boksburg, Boksburg, Gauteng, 1459.BEE SOUTH AFRICA (PTY) LTD is an affiliated entity of Bee (COMOROS) Ltd, and the two operate independently.

BEEMARKETS SECURITIES & FINANCIAL PRODUCTS PROMOTION L.L.C is a broker registered in the United Arab Emirates with registration number 1471759. Its registered address is:Office No. 101, Property of Sheikh Ahmed Bin Rashid Bin Saeed Al Maktoum, Deira, Hor Al Anz.BEEMARKETS SECURITIES & FINANCIAL PRODUCTS PROMOTION L.L.C is an affiliated entity of Bee (COMOROS) Ltd, and the two operate independently.

Risk Disclosure:OTC derivative contracts, such as Contracts for Difference (CFDs) and leveraged foreign exchange (FX), are complex financial instruments carrying significant risks. Leverage can lead to rapid losses, potentially exceeding your initial investment, making these products unsuitable for all investors. Before trading, carefully evaluate your financial position, investment goals, and risk tolerance. We strongly recommend consulting independent financial advice if you have any doubts about the risks involved.

BeeMarkets does not guarantee the accuracy, timeliness, or completeness of the information provided here, and it should not be relied upon as such. The content—whether from third parties or otherwise—is not a recommendation, offer, or solicitation to buy or sell any financial product, security, or instrument, or to engage in any trading strategy. Readers are advised to seek their own professional advice.

Jurisdictional Restrictions:BeeMarkets does not offer services to residents of certain jurisdictions, including the United States, Mainland China, Australia, Iran, and North Korea, or any region where such services would violate local laws or regulations. Users must be 18 years old or of legal age in their jurisdiction and are responsible for ensuring compliance with applicable local laws. Participation is at your own discretion and not solicited by BeeMarkets. BeeMarkets does not guarantee the suitability of this website’s information for all jurisdictions.