Gold and the U.S. Treasury market are both signaling the world’s growing unease with the trump administration’s economic policies, and a full-blown financial crisis will likely occur before a policy pivot, according to Desmond Lachman, Senior Fellow at the American Enterprise Institute.

“In the same way as canaries are used to give an early warning sign that something is fundamentally wrong in a coal mine, so too the meteoric rise in the gold price since the start of the Trump administration could be signaling that real trouble lies ahead in the dollar and bond markets,” wrote Lachman, who previously served as a managing director at Salomon Smith Barney and deputy director of the International Monetary Fund’s (IMF) Policy Development and Review Department.

“The Trump administration would do well to heed those warnings and make an early policy course correction to regain market confidence," he added. "If not, we should brace ourselves for real financial market turbulence in the run-up to next year’s mid-term election.”

Lachman characterized gold’s price rally in 2025 as “nothing short of spectacular,” noting that the yellow metal has outperformed all other major financial assets. “[S]o much for Keynes dismissing gold as a barbarous relic,” he said. “Indeed, since the US abandoned buying gold at $35 an ounce in 1971, gold has increased more than a hundred-fold or at an annualized rate of around 9.5 percent.”

“A primary reason for the gold price spike is fear that the United States will try to inflate its way from under its public debt mountain,” Lachman wrote. “It would seem that this fear is well-based. Trump’s recently enacted Big Beautiful Bill of tax cuts has put the country’s public finances on a clearly unsustainable path. According to the Congressional Budget Office, that bill will keep the budget deficit at over 6.5 percent for as far as the eye can see. In turn, that will cause the public debt to rise to a Greek-like 128 percent of GDP by 2034.”

Another reason many now believe the current administration will attempt to “inflate away the public debt” is Trump’s ongoing attacks on the independence of the Federal Reserve. “At a time when inflation remains above the Fed’s two percent inflation target and when Trump’s import tariffs are expected to add to inflation, Trump is exerting considerable pressure on Fed Chair Jerome Powell to cut interest rates by two to three percentage points,” he noted. “Trump is also making every effort to stack the Fed Board with monetary policy doves and to appoint a replacement for Powell who will do his bidding to aggressively lower interest rates.”

The ongoing trend of central banks moving away from the U.S. dollar and toward gold in their reserves is another significant factor behind gold’s recent gains.

“They seem to be doing so because of their growing mistrust of the United States as a reliable financial partner,” Lachman said. “Over the past few years, the US has weaponized the dollar in its conflict with countries like Iran and Russia, raising fears that this practice might be used against other countries. Similarly, central banks appear to be unsettled by Trump’s arbitrary imposition of punitive tariffs on friends and foes alike, as well as by his seeming disregard for the rule of law.”

He also pointed out that gold is not the only financial asset sounding the alarm that the United States’ economic policy may be “out of kilter.”

“Since the start of the year, the dollar has lost around 10 percent in value at a time when one would have thought that it would be boosted by the highest import tariffs in one hundred years and by the widening of the short-term interest rate differential in favor of the United States,” Lachman said. “Equally troubling is the bond market seeming to have lost its safe-haven status. No longer do investors seem to be flocking to the US Treasury market at times of market turbulence.”

“Rudi Dornbusch, the late MIT economist, observed that financial crises take a lot longer to occur than you would have thought possible,” he said. “However, when they do occur, they do so at a very much faster speed than you would have anticipated.”

“With clear early warning signs that investors are losing confidence in the US economy coming from the gold and dollar markets, the Trump administration would be well advised to reconsider its economic approach,” Lachman concluded. “However, I do not suggest betting the farm on that before a real financial market crisis occurs.”

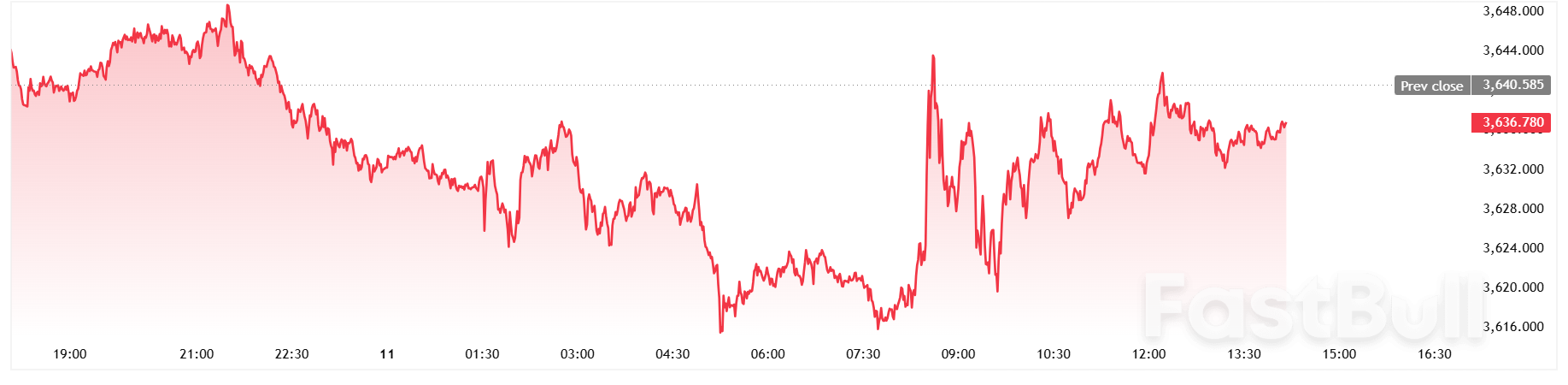

After seeing extreme volatility following this morning’s hotter-than-expected CPI report, spot gold has since stabilized into a steady upward climb back toward even on the session.

Spot gold last traded at $3,636.79 per ounce for a loss of 0.10% on the daily chart.

Source: kitco