Gold Investment Demand Spikes 84% Amid Global Uncertainty

Gold prices hit new highs in 2025, driven by an 84% surge in investor demand amid geopolitical risks.

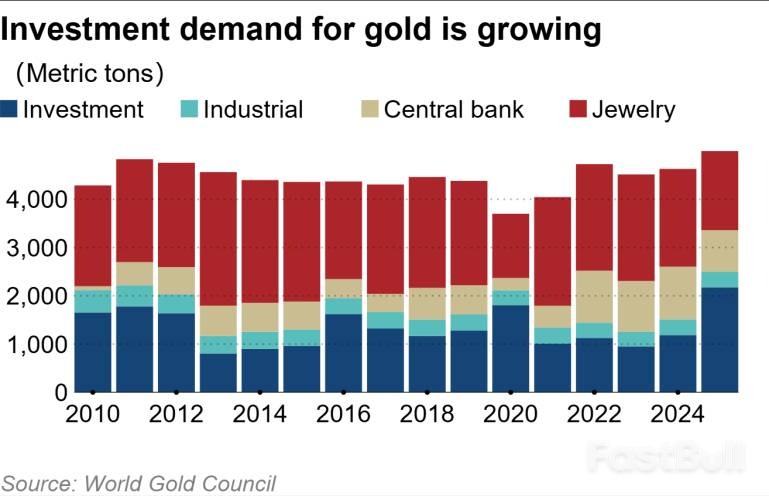

Investor demand for gold skyrocketed by 84% last year as mounting geopolitical risks and economic turbulence sent investors scrambling for safe-haven assets. According to statistics from the World Gold Council, this surge pushed the average London spot price to a new high of $3,431.5 per troy ounce, a 44% increase from 2024.

While overall gold demand edged up by just 1% to 5,002.3 metric tons, its value soared 45% to a record $555 billion, underscoring the impact of higher prices.

Investment Demand Drives the Market

The primary engine behind gold's record-breaking year was investment demand, which climbed to 2,175.3 tons. This figure represents 60% of the 3,671.6 tons mined in 2025, a sharp increase from the roughly 30% share seen between 2021 and 2024.

Several factors fueled this rush into gold:

• Geopolitical Instability: Worsening global tensions prompted a flight to the tangible security of gold.

• Economic Concerns: Uncertainty stemming from U.S. tariff policies drove investors to hedge their portfolios.

• Diversification: Concerns about a weakening U.S. dollar and elevated stock prices made gold an attractive alternative for diversification.

This influx of capital created a self-reinforcing cycle, where daily price highs attracted even more money from investors seeking to capitalize on the upward momentum.

Figure 1: This chart of global gold demand from 2010 to 2024 shows a clear, growing trend in the investment category, which set the stage for the dramatic surge in 2025.

ETFs See Massive Reversal in Fund Flows

The most dramatic shift occurred in exchange-traded funds (ETFs) backed by physical gold. After seeing a net outflow of 2.9 tons in 2024, these funds experienced a massive net inflow of 801.2 tons last year.

The regional breakdown of ETF inflows was led by North America:

• North America: Funds based in the region accounted for 446 tons, over half of the global total.

• Asia: The region saw the second-largest inflow at 215 tons.

• Europe: Net inflows reached 131 tons, a figure tempered by significant profit-taking in October.

Physical Bars Surge as Jewelry Demand Falters

Demand for physical gold bars and coins also saw strong growth, rising 16% to 1,374.1 tons.

This trend was particularly evident in China, a major gold market. While Chinese demand for gold jewelry fell by 25%, demand for bars and coins climbed 28%. This shift reflects a broader global pattern, as worldwide jewelry demand dropped 18% to 1,542.3 tons, largely due to slowing consumption in both India and China.

Central Banks Temper Buying but Remain Key Players

Central banks, which had been buying over 1,000 tons of gold annually for the previous three years, slowed their pace in 2025. Purchases fell by 20% to 863 tons, as record-high prices likely prompted a more cautious approach.

However, this level of buying is still significantly higher than the annual average of 473 tons recorded between 2010 and 2021. This indicates that the strategic appetite for gold among the world's central banks remains strong, even at elevated prices.