Global Trade's Quiet Pivot From the US Market

US allies, prompted by tariffs, are strategically "de-risking" trade, forging new global pacts.

While America's military and technological dominance remains unchallenged, a subtle but significant shift is reshaping the global trade landscape. Prompted by President Donald Trump's affinity for tariffs, U.S. allies are discovering they have more options than previously thought in the trade of goods, and they are adapting with surprising speed.

This isn't a dramatic decoupling. No one is seriously attempting to abandon the U.S., which is still the world's most lucrative market. Instead, a recent wave of bilateral pacts signals a more measured strategy: "de-risking." This term, once primarily used in discussions about China, now applies to hedging against unpredictability from Washington.

Pursuing this strategy comes with costs, from reconfiguring supply chains to forging alliances with nations that don't share identical values. However, early indicators suggest the economic price of this insurance policy is manageable.

The New "De-Risking" Playbook

"Trade is probably one of the areas where middle powers have some of the greatest agency in choices," notes Alexander George, senior director for geopolitics at the Tony Blair Institute for Global Change (TBI).

He points to the European Union as a prime example. The threat of U.S. trade actions appeared to galvanize the bloc, leading to the recent signing of the long-stalled EU-Mercosur trade deal with Latin American countries and a new agreement with India.

Of course, these deals face political and legal hurdles. The EU's ability to ratify the Mercosur pact will be a key test of its resolve. Similarly, recent efforts by British and Canadian leaders to mend ties with China are in their early stages, though some initial deals have already been made.

How Businesses Are Reshaping Supply Chains

Businesses aren't waiting for governments to draw a complete map of the new trade order. The Irish Whiskey Association, for example, celebrated the EU-India deal as a "critical" move to find new customers and offset the impact of a 15% U.S. tariff on its largest market.

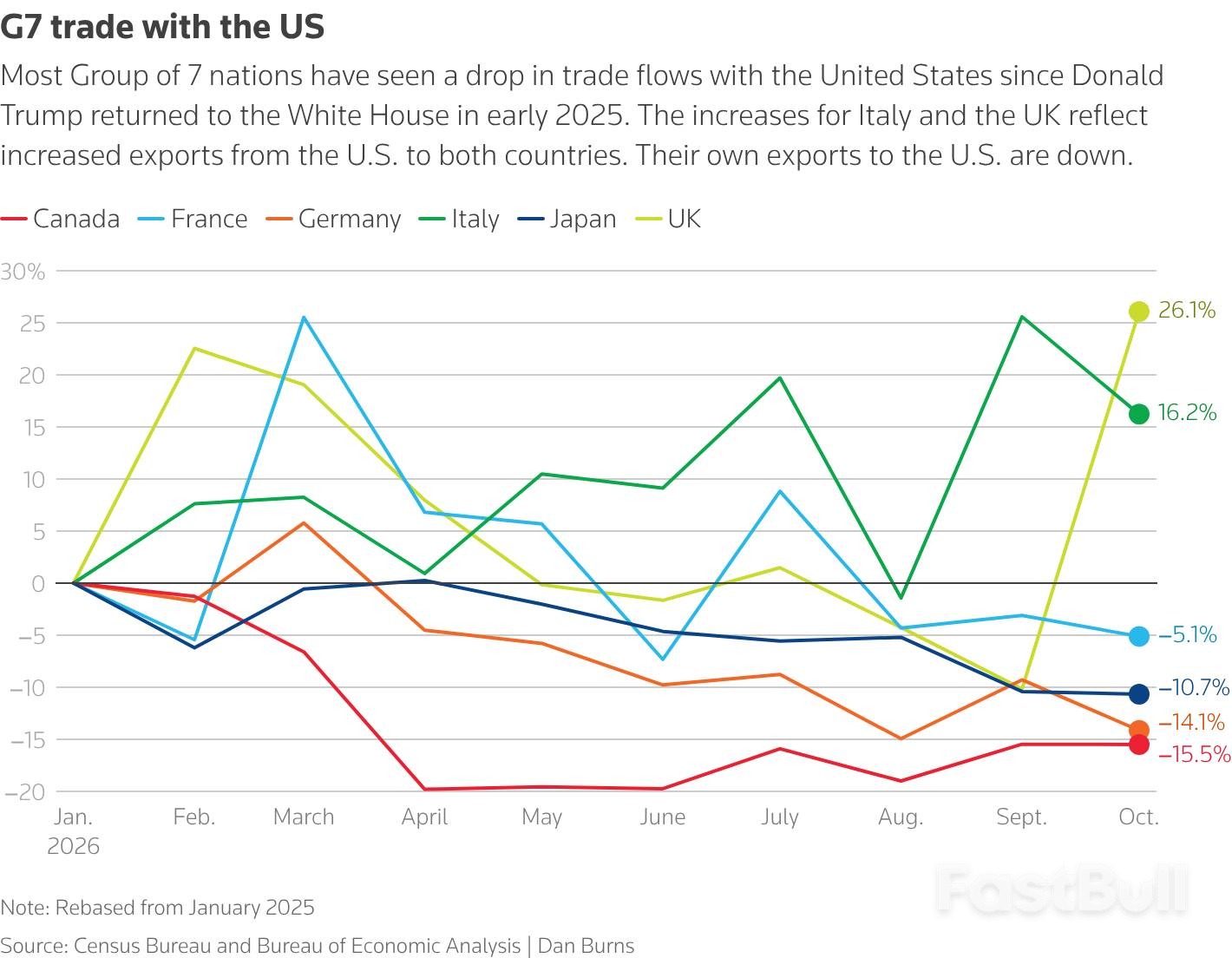

Figure 1: G7 trade flows with the United States show a clear divergence in 2026, with countries like Canada and Germany seeing significant declines while Italy and the UK increased their trade, illustrating the complex realignment of global commerce.

Meanwhile, German corporate investment in China reached a four-year high last year. According to the IW German Economic Institute, this was partly driven by a need to build local supply chains in response to a more challenging U.S. trade environment.

Despite the turbulence, the global economy has remained resilient. A quarterly Reuters poll of 220 economists showed that the forecast for global economic growth this year remains at 3%, unchanged from a year ago, even with supply chain adjustments underway.

Some experts see long-term benefits in this restructuring. World Trade Organization Director-General Ngozi Okonjo-Iweala told Reuters that diversifying investment and production builds global resilience and creates jobs. This aligns with Canadian Prime Minister Mark Carney's call for "middle powers" to build a network of alliances among themselves.

The Cost of Confrontation

For most nations, diversification is a safer bet than direct confrontation with the United States.

Modeling from the UK's Aston University found that if tensions over Greenland had escalated, a threatened 25% U.S. tariff would have cost European economies only 0.26% of per capita income if they chose not to retaliate. In contrast, a retaliatory 25% levy on U.S. goods would have more than doubled that cost.

Mujtaba Rahman, managing director for Europe at Eurasia Group, notes that forging new trade alliances abroad can be politically easier for governments than implementing difficult domestic economic reforms. "Diversification on the trade side is absolutely happening and continuing," he said of Europe.

Limits to the Global Trade Realignment

Two key factors could limit the pace and scope of this global adaptation.

First, China's reluctance to stimulate domestic consumer demand means it cannot easily absorb the slack from the U.S. market. The Tony Blair Institute observed that while China's exports have grown since the implementation of higher U.S. tariffs, its imports have stayed flat, forcing other nations to accept widening trade deficits with Beijing.

Second, the United States may actively discourage countries from pursuing diversification strategies that pull them out of its economic orbit. "The question is to what extent this becomes a geopolitical faultline," said TBI's George, highlighting the risk of trade shifts escalating into broader strategic tensions.