Fed Review: Hawkish Cut

Ahead of the meeting, we expected Powell to avoid pre-committing to a December rate cut, but his clear pushback against the market pricing was more hawkish than even we anticipated.

Ahead of the meeting, we expected Powell to avoid pre-committing to a December rate cut, but his clear pushback against the market pricing was more hawkish than even we anticipated. Powell emphasized that 'another cut in December is far from assured' amid the committee's 'strongly differing views' about the future, and that 'there is a growing chorus of feeling we should maybe wait a cycle'. He highlighted that despite the shutdown, available data does not signal significant further cooling in labour markets.

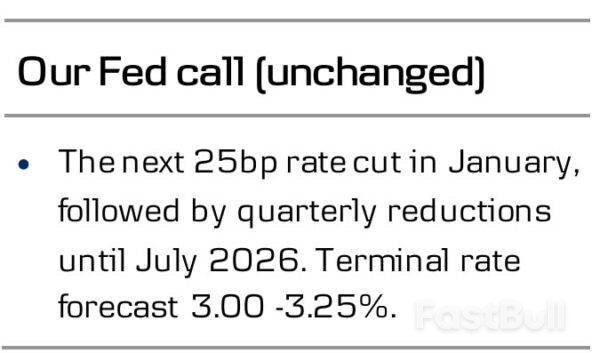

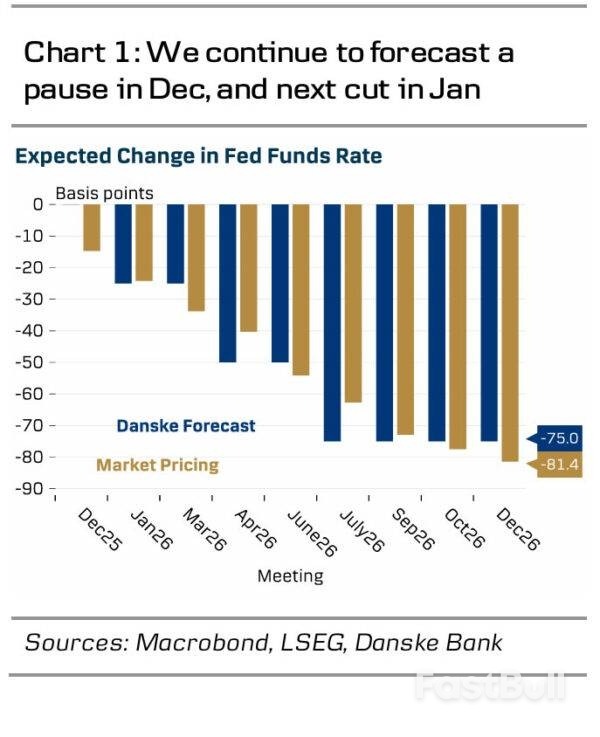

After the September meeting, we pointed out that the 'dots' signalled an almost even split between participants expecting cuts in both Oct & Dec, and those expecting only 0-1 cuts. We argued that markets underappreciated FOMC's willingness to pause, as ahead of this meeting, markets were pricing more than 90% likelihood for another cut in December. We stick to our call and expect a pause in December followed by the next cut in January. We still think the Fed is the best served by a more gradual approach towards further easing.

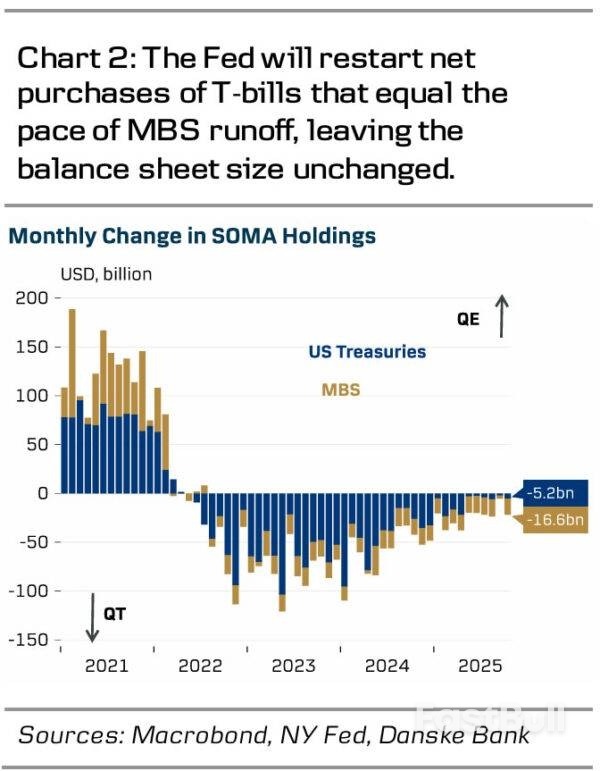

Markets were well prepared for the announcement to end QT. In our preview (see RtM USD, 28 Oct), we anticipated that the Fed would choose a less aggressive option of only ending the balance sheet runoff for US Treasuries. Instead, it opted to also 'neutralize' the runoff of mortgage-backed securities (MBS) by reinvesting the maturing principal payments to T-bills from December 1. Over the past few months, the pace of QT has been around USD5bn per month for Treasury securities and around USD16-17bn per month for MBS. Despite the seemingly 'dovish' balance sheet decision, UST yields moved higher already before the hawkish remarks in the press conference. This likely reflected Jeffrey Schmid's surprising dissent in favour of holding rates steady at this meeting. Less surprisingly, Stephen Miran also dissented, but in favour of a 50bp cut.

Powell flagged that eventually the Fed will look to start adding to reserve balances by increasing the size of its balance sheet again but did not yet speculate on the timing. The Fed did not perform an additional cut to the IORB rate, as speculated by some ahead of the meeting. This would have been an even more aggressive measure to ease the upward pressure seen in repo rates over past weeks and remains a possibility for future meetings.