Deutsche Bank AG, Goldman Sachs Group Inc. and other Wall Street banks are forecasting that the US dollar will resume its slide next year as the Federal Reserve keeps nudging down interest rates.

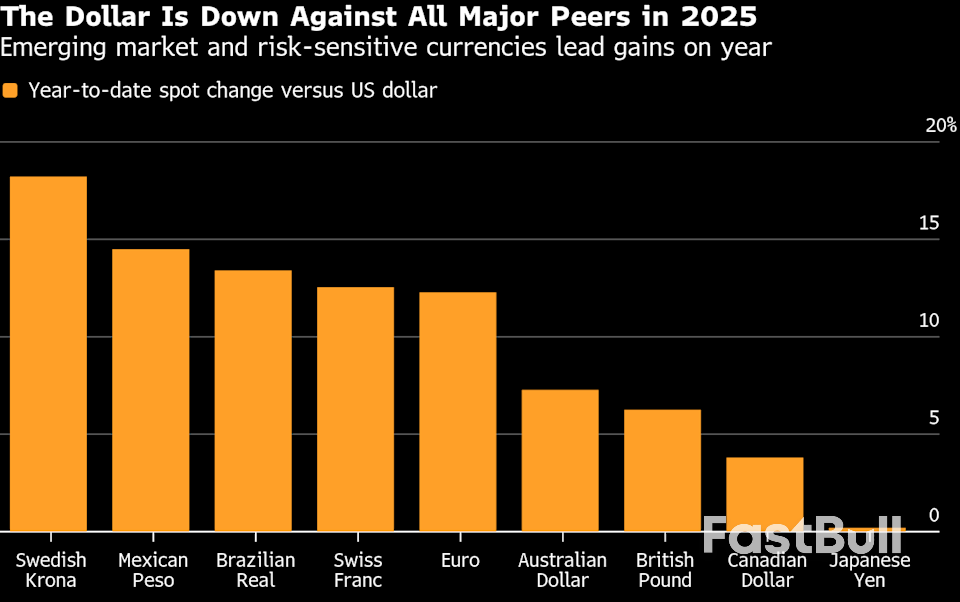

The currency has stabilized over the past six months after tumbling by the most since the early 1970s during the first half of the year when President Donald Trump’s trade war unleashed havoc in global markets.

But strategists expect the greenback to weaken again in 2026 as the US central bank continues to ease monetary policy just as others hold steady or move closer toward raising rates. That rift would give investors an incentive to sell US debt and shift the cash to countries where payouts are higher.

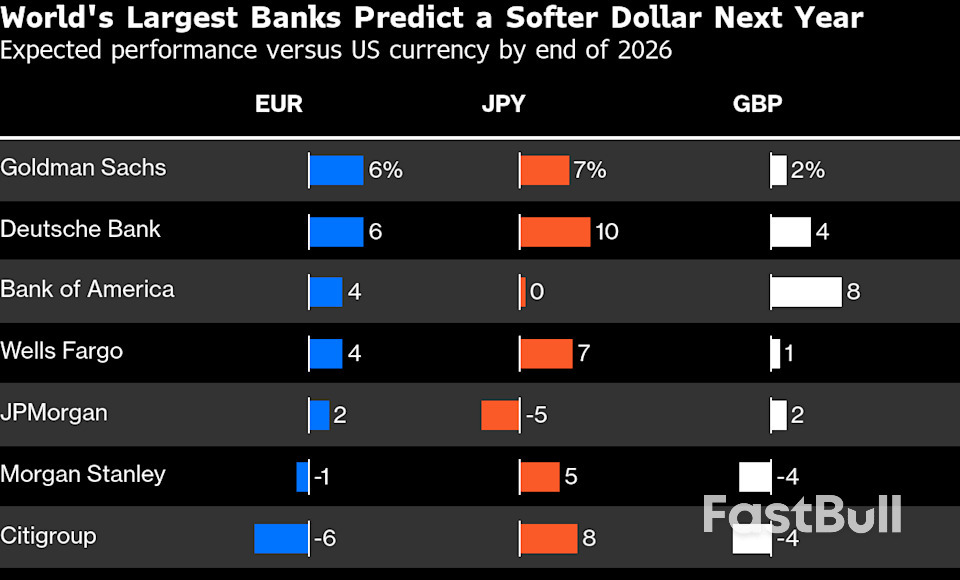

As a result, forecasters at more than half a dozen major investment banks are largely predicting that the dollar will slip against major counterparts like the yen, euro and pound. According to the consensus estimates compiled by Bloomberg, a widely tracked index of the dollar will weaken some 3% by the end of 2026.

“There is ample room for markets to price in a deeper cutting cycle,” said David Adams, head of G-10 foreign-exchange strategy at Morgan Stanley, which expects the dollar to drop 5% in the first half of the year. “That leaves plenty of capacity for further dollar weakness.”

The dollar’s decline is expected to be more muted and not as broad as it was this year, when it lost ground against all of the major currencies, leaving the the Bloomberg Dollar Spot Index down nearly 8% in its deepest annual drop since 2017. And the outlook hinges on anticipation that the US job market will continue to weaken — which remains uncertain, given the surprising resilience of the post-pandemic economy.

Currency forecasting is also particularly vexing. When the dollar was surging late last year as investors piled into the so-called Trump trade, betting his policies would spur growth, strategists expected the the rally would reverse by mid-2025, only to get caught off guard by the scale of the drop during the first half of the year.

But strategists see the broad contours heading into the new year as a recipe for a weaker dollar. Traders are pricing in two more quarter-point Fed rate cuts next year, and it’s possible that whoever Trump picks to replace Chair Jerome Powell may give in to White House pressure to lower rates even more. Meanwhile, the European Central Bank is expected to hold rates steady while the Bank of Japan nudges them upward.

“We see risks stacked more against the dollar than in favor of the dollar,” Luis Oganes, London-based head of global macro research at JPMorgan, said at a news conference on Tuesday.

A weaker dollar would have ripple effects in the broader economy by pushing up the cost of imports, increasing the value of corporate profits from overseas, and boosting exports — which would likely be welcomed by a Trump administration that’s complained about the US trade deficit. It could also extend rallies in emerging markets as investors shift cash there to seize on higher interest rates.

That movement propelled emerging-market carry trades — which entail borrowing in low-rate countries and investing where yields are higher — to the biggest returns since 2009. JPMorgan and Bank of America Corp. both see potential for additional gains, flagging the Brazilian real and a handful Asian currencies — like the South Korean won and Chinese yuan — respectively.

At Goldman Sachs, analysts led by Kamakshya Trivedi this month also noted that the market is starting to price a more optimistic economic outlook into other G-10 currencies — like Canada’s and Australia’s — following stronger-than-expected data. They noted the dollar’s “tendency to depreciate when the rest of the world is doing well.”

The contrarians who expect the dollar to gain against some other major currencies point primarily to the robust US economy. That growth, powered by the artificial-intelligence boom, will lure investment flows into the country that drive up the value of the dollar, analysts at Citigroup Inc. and Standard Chartered said.

“We see strong potential for a dollar cycle recovery in 2026,” the Citigroup team led by Daniel Tobon wrote in their annual outlook.

The prospect of stronger-than-expected growth was underscored Wednesday, when Fed policymakers marked up their projections for 2026. Yet they still cut interest rates by a quarter point and continued to pencil in one more such move next year. Powell also allayed any concern that the Fed could pivot to raising rates, saying the debate now is whether to continue cutting — or wait — as it’s tugged between a weakening job market and still above-target inflation.

His comments were met with relief in the markets, where some traders had worried that the Fed would deliver a more hawkish message. As Treasury yields dropped, the Bloomberg dollar index slid 0.7% on Wednesday and Thursday, its biggest two-day drop since mid-September, when traders were positioning for the Fed to resume its rate-cutting cycle.

In an annual outlook note to clients late last month, Deutsche Bank’s George Saravelos, the global head of foreign exchange research in London, and Tim Baker, his New York colleague, said the dollar has benefited from a “remarkably resilient” economy and the run-up in US stock prices. Yet they said the dollar is overvalued and predicted it will fall against its major counterparts next year as growth — and equity returns — pick up elsewhere.

“If these forecasts materialize, they will confirm that this decade’s unusually long dollar bull cycle is over,” they wrote.

Source: Bloomberg