YouTube has added PayPal’s PYUSD stablecoin as a payout option for U.S. creators. The choice routes through PayPal’s payout infrastructure rather than requiring YouTube to custody or transfer crypto directly.

According to Fortune, PayPal crypto chief May Zabaneh confirmed the arrangement. Google and YouTube also confirmed PYUSD was added as a payout option for eligible creators.

The change lands inside one of the largest recurring creator pay streams in media. YouTube has paid out more than $100 billion to creators over the past four years.

That implies roughly $25 billion per year flowing through the platform’s monetization stack. The immediate impact is not that creators must “go on-chain.” It is that a stablecoin is now presented as a selectable payout rail inside a familiar payouts workflow for some creators. It starts in the U.S. and is opt-in.

Stablecoins move into mainstream creator payouts

Primary product documentation already supports the plumbing for that workflow, even if the PYUSD toggle itself is only confirmed by Fortune. Google’s help pages state that AdSense and AdSense for YouTube can pay via PayPal Hyperwallet.

They also state that Hyperwallet is available as a payment method for publishers based in the U.S. In some Google help flows, additional countries are listed.

According to Google’s documentation, the AdSense for YouTube payment process describes earnings being issued and then made available in Hyperwallet as part of the payout flow.

That matters because it keeps crypto handling concentrated inside a payments provider’s custodial, compliance-scoped environment. It still offers a route to external settlement for creators who want it.

PayPal’s help center explains that customers can transfer supported crypto, including PYUSD, to external addresses. Network support details are handled within PayPal’s crypto transfer experience.

Outbound transfers are part of the standard crypto feature set. That creates a practical bridge from a platform payout to an on-chain address without requiring the platform to integrate wallets.

How PYUSD turns platform payouts into on-chain, user-controlled transfers

In practice, a “payout in PYUSD” can be understood as three steps: YouTube earnings issuance, availability through Hyperwallet, and a creator-selected cash-out method. Google documents the first two steps through its AdSense for YouTube and Hyperwallet payout guides.

Fortune reports the third step now includes PYUSD for U.S. creators. If a creator chooses PYUSD and later wants to move funds beyond PayPal’s custody, PayPal documents the transfer-to-address path in its crypto help pages.

That places the final on-chain exit decision with the user rather than the platform. The scale of that distribution channel helps explain why stablecoin issuers and payment firms keep targeting payroll-like flows.

Creator payouts behave like long-tail contractor payments: frequent, fragmented, and often international in effect even when the payer is U.S.-based. A stablecoin option inside a mainstream payout menu does not need majority adoption to become operationally meaningful.

It converts small percentages of a large base into recurring transaction volume and repeated user behavior around holding, transferring, or spending a token balance. PYUSD’s current footprint also makes the distribution angle more relevant than a one-off announcement.

PYUSD sits at around $3.91 billion in market cap and a similar circulating supply, consistent with its dollar peg design. The token’s supply depth suggests a new on-ramp from creator payouts is better framed as incremental flow and velocity rather than a near-term supply shock.

PYUSD distribution shifts from headline supply to incremental payment flow

PayPal has also been extending PYUSD’s network reach, expanding to Arbitrum in 2025.

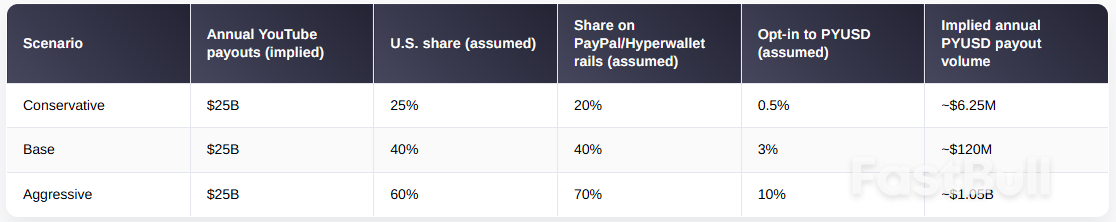

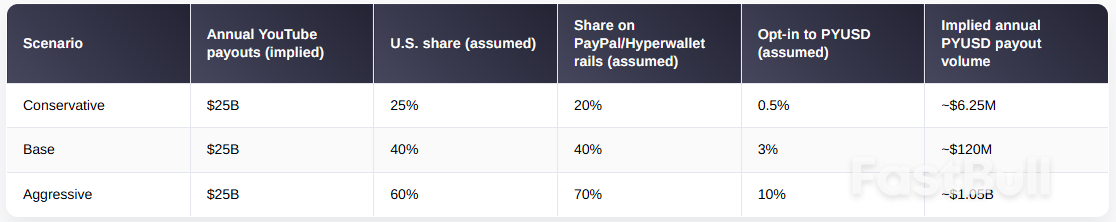

That adds another settlement environment intended to support commercial and cross-border uses alongside earlier support on other networks. Because YouTube has not published a breakdown for how much of its creator payouts are U.S.-based, any sizing exercise has to be explicit about assumptions.

YouTube also has not published how many creators use PayPal-linked rails. Using Reuters’ $100 billion over four years figure as a baseline, the range of potential annual PYUSD payout volume depends on opt-in behavior more than on YouTube’s aggregate payout totals.

Even under the aggressive case, the implied flow is better read as a habits-and-plumbing story than a direct market-cap catalyst for a stablecoin already measured in the billions. Where supply can change is in “stickiness,” meaning how long recipients hold balances before converting or spending.

If payouts arrive in PYUSD and creators treat that balance as a temporary staging point before cashing out, the incremental steady-state balance can remain modest even when monthly flow rises.

If PayPal expands the places where PYUSD can be used within its network, or if creators choose to keep balances in-token, the same payout volume can support higher outstanding balances.

This kind of integration is also landing as U.S. policymakers move toward clearer payment stablecoin frameworks that enterprise finance teams can map onto existing controls.

Citi’s September 2025 “Stablecoins 2030” research notes stablecoin issuance rising from about $200 billion at the start of 2025 to roughly $280 billion.

It also includes revised 2030 issuance forecasts of $1.9 trillion in its base case and $4.0 trillion in a higher-adoption case. According to Citi, the scale of potential usage is tied to settlement behavior and transaction turnover as much as raw issuance.

Stablecoins move from pilot phase to regulated financial infrastructure

A competing lens is that stablecoins function economically as deposit-like liabilities that raise classic oversight and run-risk debates. That point is discussed in the Financial Times.

In Washington, the direction of travel is toward codifying guardrails rather than leaving stablecoins in a patchwork of state money-transmitter rules and enforcement actions. Congress.gov’s summary for the GENIUS Act outlines a framework concept for who can issue payment stablecoins and the expectations around redemption and oversight.

The bill is structured around issuer permissions and standards. The U.S. Treasury has already opened an advance notice of proposed rulemaking on implementation.

The ANPRM signals that operational details are moving into rulemaking, including the compliance and reporting expectations that large payment networks and platforms tend to require before turning a new money rail on at scale.

The Richmond Fed has also summarized issuer disclosure concepts that can matter for enterprise adoption, including monthly attestations and executive certifications. Final requirements depend on completed rules.

Against that backdrop, the YouTube-to-PYUSD option is a case study in how stablecoins can enter mainstream distribution without a platform retooling itself into a crypto business.

The platform keeps its payouts relationship with an established provider, and the provider offers a stablecoin balance as one of several payout destinations.

Creators decide whether to stop at a custodial balance, convert to fiat, or transfer to an external address. According to Fortune, that choice is now available to U.S. creators as a PYUSD payout option inside YouTube’s payout settings via PayPal’s rails.

Source: Cryptoslate