Crypto Crushed By Triple-Whammy Overnight

BoJ hawks trump Fed doves; Strategy 'selling' fears; and renewed China ban anxiety tanked crypto markets worldwide...

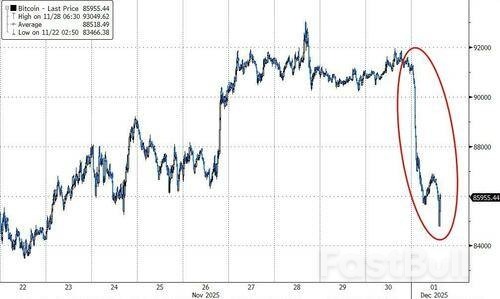

After an ugly November (the worst since 2018), December is continuing that trend with a big drop overnight that shook what had appeared to be a stabilizing market.

Hawkish BoJ

The overnight plunge appeared to be triggered by Japanese government bond (JGB) futures tumbling on expectations that the Bank of Japan would raise borrowing costs at its December meeting.

Japan's 2-year government bond yield briefly touched 1.01 percent, the highest since 2008, as traders bet the Bank of Japan's long era of near-zero rates is ending.

Some 90 minutes later, BOJ Governor Kazuo Ueda said in a speech that his board might increase interest rates soon.

Traders raised the odds of a BOJ rate hike in December to about 80% after Ueda told business leaders that the central bank "will consider the pros and cons of raising the policy interest rate and make decisions as appropriate."

Any hike would be an adjustment in the degree of easing, with the real interest rate still at a very low level, he said.

As Bloomberg reports, the reaction underscored how crypto investors must now reckon with macro forces far beyond the Fed which is widely expected to ease monetary policy at next week's meeting.

"In the early days, Bitcoin mostly moved to whatever the Fed was signaling, rate cuts, hikes, or balance sheet shifts," said Rachael Lucas, an analyst at BTC Markets.

"These days, Bitcoin reacts to the whole central-bank landscape, not just one player."

The reaction was swift and violent, tanking the largest cryptocurrency from around $92,000 to $84,000 before a small rebound back above $86,000.

"It's a risk off start to December," said Sean McNulty, APAC derivatives trading lead at FalconX.

"The biggest concern is the meagre inflows into Bitcoin exchange traded funds and absence of dip buyers. We expect the structural headwinds to continue this month. We are watching $80,000 on Bitcoin as the next key support level."

Ethereum also tanked, back below $3,000...

Strategy selling?

Things worsened this morning as Bloomberg reports that concerns are rising that Strategy Inc. soon may be forced to sell some of its roughly $56 billion cryptocurrency haul if token prices continue to fall, leading its shares to wobble in pre-market trading.

Strategy's mNAV — a key valuation metric comparing the firm's enterprise value to the value of its Bitcoin holdings — sat at about 1.2 on Monday, according to its website, spurring investor fears it may soon turn negative.

"We can sell Bitcoin and we would sell Bitcoin if we needed to fund our dividend payments below 1x mNAV," Phong Le, Strategy's chief executive officer, said on a podcast on Friday, noting that it would only be carried out as a last resort.

"There's the mathematical side of me that says that would be absolutely the right thing to do, and there's the emotional side of me, the market side of me, that says we don't really want to be the company that's selling Bitcoin," Le added.

"Generally speaking, for me, the mathematical side wins."

MSTR is trading down 5% in the pre-market

However, after a week of not adding to its Bitcoin hoard, Strategy Chairman Michael Saylor appeared to hint in a Sunday post on X that it might soon make further purchases.

China notices 'speculation', issues re-ban

Finally, we note that China's central bank has flagged stablecoins as a risk and has promised to refresh its crackdown on crypto trading, which it has banned since 2021.

The People's Bank of China said on Saturday, after a meeting with 12 other agencies, that "virtual currency speculation has resurfaced" due to various factors, posing new challenges for risk control.

"Virtual currencies do not have the same legal status as fiat currencies, lack legal tender status, and should not and cannot be used as currency in the market," the bank said, according to a translation of its statement.

"Virtual currency-related business activities constitute illegal financial activities."

China's central bank banned crypto trading and mining in 2021, citing a need to curb crime and claiming that crypto posed a risk to the financial system.

So a triple-whammy for an already sensitive crypto market overnight - is this the weak hand flush needed for the Santa Claus rally to start?