With the era of COVID-19 federal relief programs over and tariffs continuing to raise prices, consumers are having a harder time keeping up with their debt.

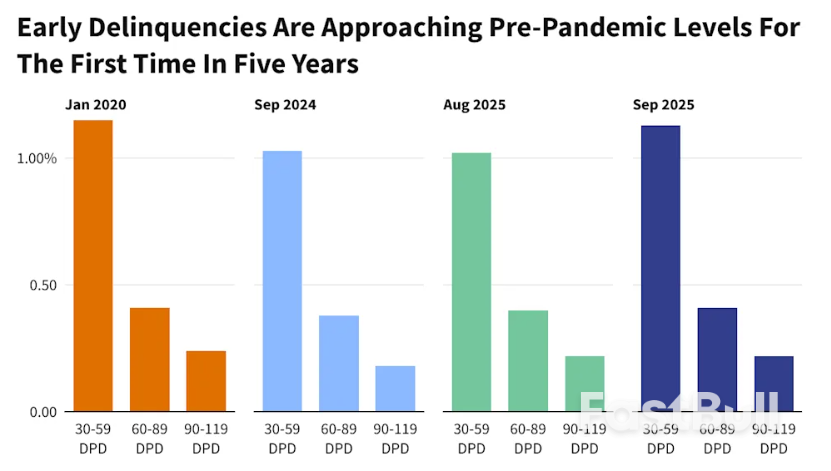

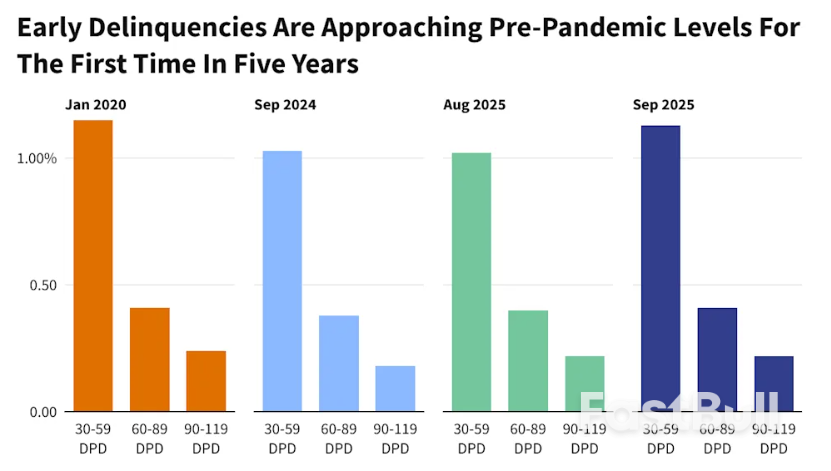

A recent report from credit scoring company VantageScore showed that delinquency rates for consumer loans grew in September. Specifically, early-stage delinquencies are approaching rates not seen in five years.

The percentage of loans in early delinquency, defined as a payment not made within 30 to 59 days, was 1.13% last month. This is up from 1.02% in August and approaching the 1.15% delinquency rate in January 2020, reported VantageScore.

Why This Matters

Delinquency rates are a strong indicator of Americans' financial health. More loans that are past due signal that inflation and other economic woes are stressing more consumers' budgets.

Consumer loan delinquency rates dropped during the pandemic, when economic growth slowed and consumers were spending less. In addition, many Americans received federal stimulus checks at the time, which helped them keep up with their debt. Some borrowers were also granted relief from their debt payments, such as when the Department of Education paused all student loan payments.

However, delinquency rates began accelerating again in 2022, as inflation started heating up and stimulus checks ran out. The Federal Reserve was able to tame inflation to some extent, but it began to flare up again after tariffs were announced earlier this year.

The Fed has been wary of cutting interest rates due to rising inflation. High interest rates keep borrowing costs high and make it harder to pay off debt. However, because the job market has been deteriorating rapidly at the same time, the Fed cut rates by a quarter point in September and again on Wednesday.

“Banks are reining in new lending, suggesting that they're taking a more cautious posture after a strong summer,” said Susan Fahy, executive vice president and chief digital officer at VantageScore, in a press release. “Early-stage delinquencies are near levels last seen before the COVID pandemic.”

Among all loan types, mortgages have had the fastest increase in delinquency rates. Last month, late-stage delinquency rates for mortgages (90 to 119 days past due) had the most significant year-over-year growth of any debt, and were at their highest since January 2020.

In addition, loan originations for all debt types fell in September. With high interest rates and home and car prices continuing to climb, fewer consumers have taken out auto loans and mortgages compared to early 2025.

Source: Investopedia

Copyright © 2025 FastBull Ltd

News, historical chart data, and fundamental company data are provided by FastBull Ltd.

Risk Warnings and Disclaimers

You understand and acknowledge that there is a high degree of risk involved in trading. Following any strategies or investment methods may lead to potential losses. The content on the site is provided by our contributors and analysts for information purposes only. You are solely responsible for determining whether any trading assets, securities, strategy, or any other product is suitable for investing based on your own investment objectives and financial situation.