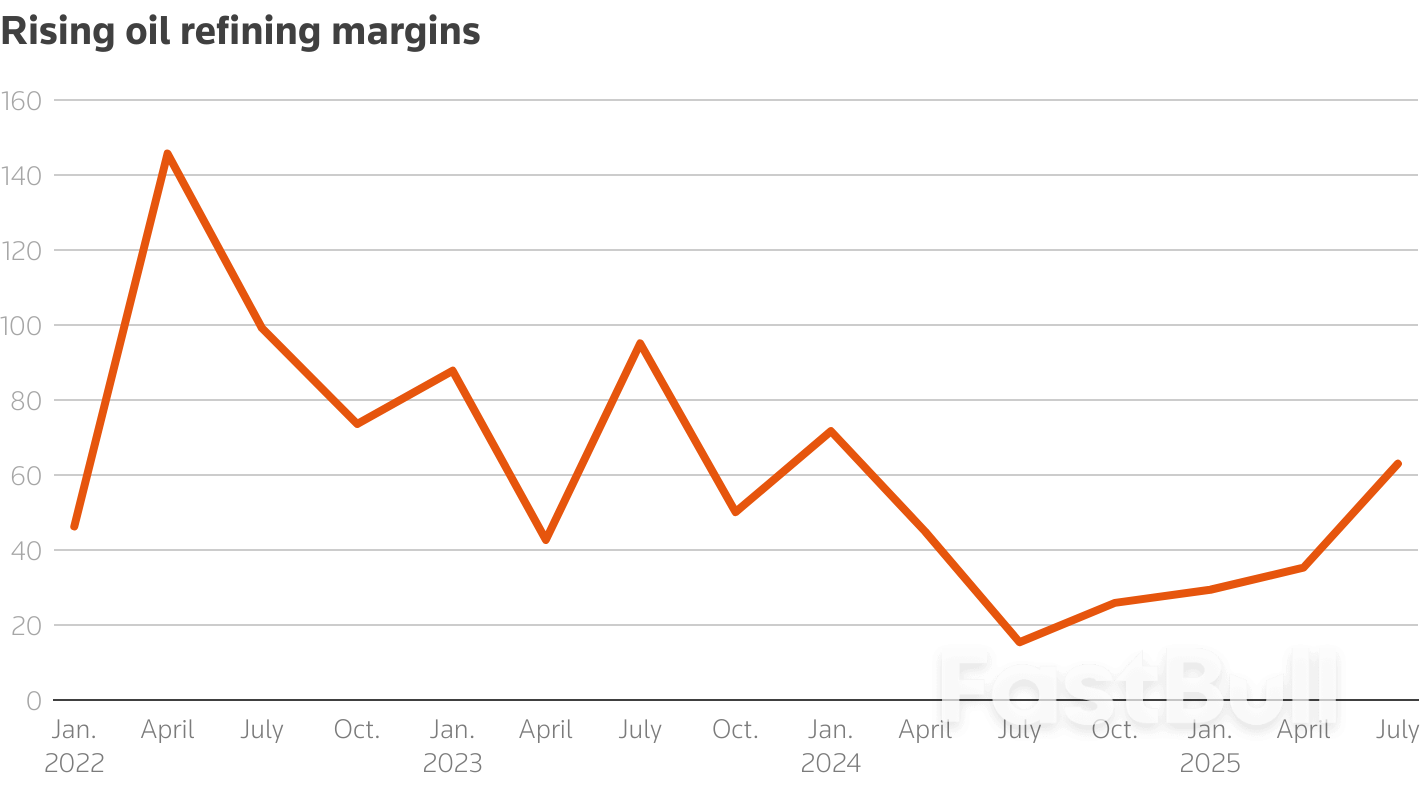

Top Western oil companies are enjoying a windfall from the expanding attacks on Russia's oil industry – both literal and economic – that have boosted global refining profit margins and mitigated concerns over a looming supply glut.

Waves of Ukrainian drone strikes on Russia's vast network of refineries and export terminals since July have hammered the country's exports of refined fuel, such as diesel and fuel oil. Russia's seaborne refined product exports in September dropped by 500,000 barrels per day from their 2025 highs to around 2 million bpd, the lowest level in over five years, according to Kpler data.

Curtailed Russian exports have boosted global refining margins, benefiting energy giants like Shell (SHEL.L), Exxon Mobil (XOM.N), Chevron (CVX.N), and France's TotalEnergies (TTEF.PA), which jointly operate nearly 11 million bpd, over 10% of global refining capacity.

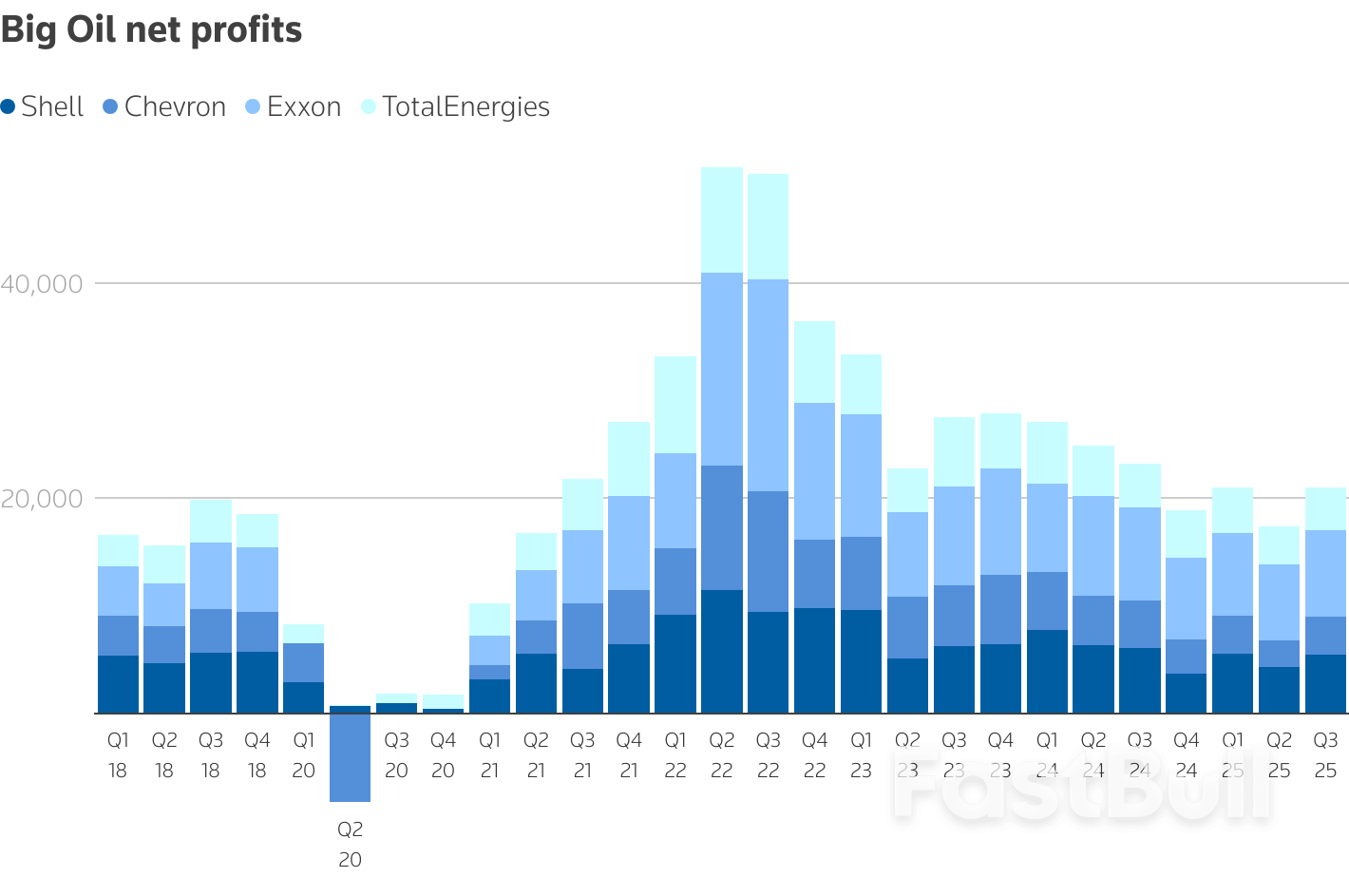

The four companies posted a combined 61% rise in profits from refining operations in the third quarter compared with the previous quarter, which contributed in large part to their 20% rise in overall profits.

Exxon, the largest U.S. oil company, saw earnings in its energy product division rise more than 30% on a quarterly basis to $1.84 billion, driven by strong refining margins "due to supply disruptions," the company said on Friday.

BP (BP.L)will report results on Tuesday, and it also looks set to benefit from these positive global refining trends. The British firm’s refining indicator margin, a gauge for its global operations, rose to $15.8 per barrel in the three months through September, a 33% quarter-on-quarter increase, and this figure is running at $15.1 per barrel in the fourth quarter thus far.

Stronger refining earnings will help offset declines in oil prices as the market appears to enter a period of significant oversupply.

The volatility in energy markets created by Western sanctions and other geopolitical conflicts has also benefitted the trading divisions of the oil majors, in particular Shell, BP and TotalEnergies. These trading desks can generate huge profits by rapidly responding to small changes in supply and demand dynamics.

Shell, the world's largest oil trader, does not disclose the division’s profits. However, it reported that stronger trading and refining margins boosted adjusted earnings in its chemicals and products division by $706 million in the third quarter compared with the previous three months.

Big Oil downstream earnings

Big Oil net profits

BENEFICIAL BANS

Refining margins are apt to stay elevated in the near term in response to the recent escalation in Western governments’ efforts to pressure Moscow to end the war in Ukraine.

The European Union stepped up its economic warfare against Russia in July when it announced plans to ban imports of fuels produced from Russian crude oil as of January 2026. The EU is seeking to close a loophole in previous sanctions packages that allowed refiners in India, Turkey and elsewhere to use discounted Russian feedstock to produce diesel and jet fuel that was then often sold to Europe.

The ban, which the EU formally approved earlier this month, again puts the Western oil majors in an advantageous position as non-Russian crude – including refined products made with non-sanctioned crude – will now be in higher demand.

Western energy giants then got another positive surprise last month when U.S. President Donald Trump on October 22 sanctioned Russia's two top oil companies, Rosneft and Lukoil, which together account for 5% of global crude supply and 3.3 million bpd of crude and refined product exports, roughly half of Russia's total.

The sanctions boosted oil prices and refining margins as buyers of Russian crude and products, particularly in India and Turkey, scrambled to find alternative supplies.

Does the combination of escalating Western sanctions and Ukrainian drone strikes mean the oil market should expect to see a repeat of the huge price rally that shook the market in the immediate aftermath of Russia's invasion in 2022, leading to record profits for the oil majors?

Probably not. The oil market today is well supplied and far better equipped to adapt to the impact of sanctions, especially given the expansion of the so-called “shadow fleet” of tankers that has been able to circumvent Western sanctions to sell Russian oil.

But the targeting of Russia’s oil and gas industry should, nevertheless, continue to be a boon to Western oil majors, which benefit from large upstream oil production as well as sprawling refining and trading operations.

Rising oil refining margins

Enjoying this column? Check out Reuters Open Interest (ROI),your essential new source for global financial commentary. ROI delivers thought-provoking, data-driven analysis. Markets are moving faster than ever. ROI can help you keep up. Follow ROI on LinkedIn and X.

Source: reuters