World shares were set for a seventh straight month of gains and the dollar was near a 3-month high on Friday after Amazon and Apple's earnings reinforced global tech optimism and the hope that massive AI spending will ultimately bolster growth.

European stocks started modestly lower ahead of euro zone inflation data later and after the European Central Bank on Thursday had further dampened talk of another euro zone interest rate cut any time soon.

Nasdaq futures jumped 1.1% and S&P 500 futures gained 0.6%, though, after forecast-busting Amazon earnings (AMZN.O), sent its shares up more than 11% in pre-market trading and a prediction of bumper iPhone sales sent Apple's (AAPL.O) up over 2%.

That offset overnight tumbles in Meta (META.O) and Microsoft (MSFT.O) amid worries about their surging AI spending. Six of the "Magnificent Seven" U.S. tech megacaps have now reported, with Nvidia - which has just become the world's first $5 trillion company - due to report in three weeks' time.

In Asia, Japan's Nikkei (.N225) had rallied over 2%, boosting its weekly and monthly gains to 6% and 16.4%, respectively. That was the largest monthly rise since 1990, turbocharged by hopes for aggressive fiscal stimulus under new Prime Minister Sanae Takaichi.

This week has also seen the Bank of Japan hold interest rates steady despite many economists predicting a hike.

Chinese blue chips (.CSI300) and Hong Kong's Hang Seng (.HSI) both skidded roughly 1.5% though after data showed China's factory activity contracted at the fastest pace in six months in October.

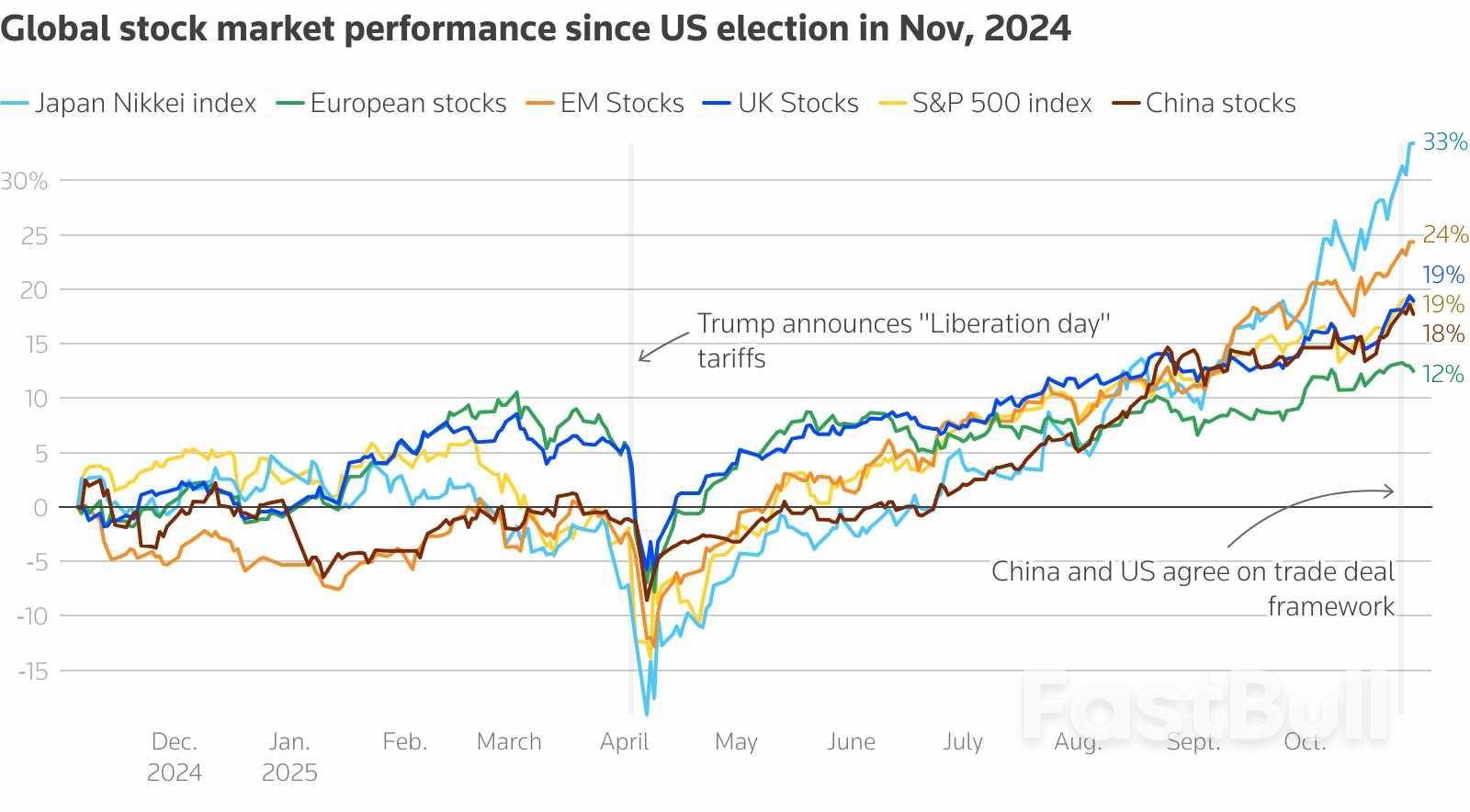

Investors also locked in gains after a trade truce reached by U.S. President Donald Trump and Chinese President Xi Jinping, which will lead to reduced U.S. tariffs on imports of Chinese goods and continued rare earth exports from China.

Global stock market performance since US election in Nov 2024

SUBTLE SHIFTS

This week, major central bank meetings have delivered decisions that have subtly shifted expectations. The biggest surprise came from Federal Reserve Chair Jerome Powell who pushed back against the market's sanguine view about a rate cut in December.

Both Treasuries and European government bonds were steady on Friday, but were set for weekly losses.

Two-year Treasury yields were flat at 3.6085%, having risen 12 basis points this week already, while the 10-year yield was steady at 4.0969% and up 10 bps for the week.

Germany's 10-year Bund yields , the euro area's benchmark, were up 1.5 basis points on the day at 2.65% and set for a weekly rise of 2.5 bps.

The rise in yields offered support to the U.S. dollar (.DXY) , which was holding near three-month highs at 99.5 against its major peers, although resistance seems heavy at 99.564 and 100.25.

The euro was flat at $1.1569 after the ECB kept its rates at 2% for the third meeting in a row and sounded moderately more positive on growth prospects.

The central bank also published a survey on Friday showing euro zone bloc firms are seeing a slight improvement in business conditions and that investment into sectors like artificial intelligence is booming.

"What the data this week suggests is that maybe we have got something fundamentally wrong about the impact of trade tariffs," Morgan Stanley's Chief Europe Economist Jens Eisenschmidt said, also highlighting the boost from AI.

"It doesn't make me revise anything dramatically, but it makes me think."

In the commodities markets, oil prices fell and were headed for a third straight monthly fall as a stronger dollar capped gains and rising supply from major producers offset new Western sanctions on Russian exports.

Brent crude futures slipped 0.9% to $64.55 a barrel, while U.S. West Texas Intermediate crude was at $60.10, down 0.8%.

Spot gold prices retraced some of the overnight gains and were down 0.3% to $4,008 per ounce. They were down 2.5% for the week and well below the record high of $4,381 hit just last week.

Source: reuters