As Brussels pushes ahead with a new wave of enlargement, the numbers behind Europe’s trade with its candidate countries reveal a story of dependence, asymmetry, but also a large, untapped potential.

The official EU candidates are Albania, Bosnia and Herzegovina, Moldova, Montenegro, North Macedonia, Serbia, Turkey, and Ukraine. Kosovo is treated as a potential candidate.

Together, they cover a diverse sweep of geography from long Adriatic coastlines to lush forests and some of Europe’s most productive farmland — also including some of Europe's youngest populations.

But while trade flows between the bloc and future members are booming, the relationship remains unequal, with more EU-produced goods finding a market than those stemming from potential member states.

A relationship measured in billions

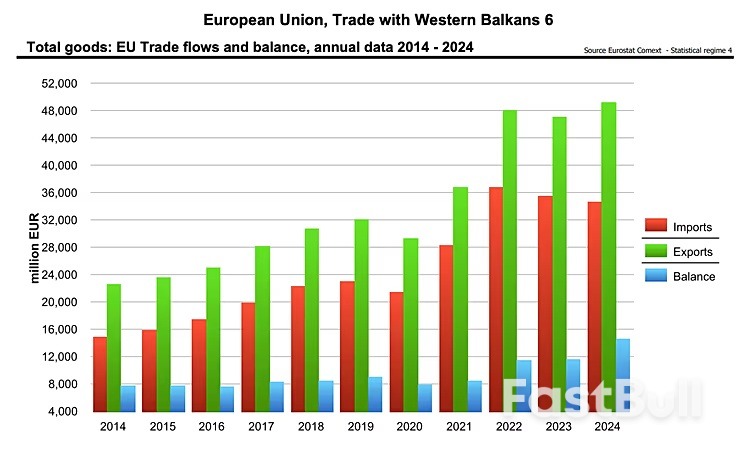

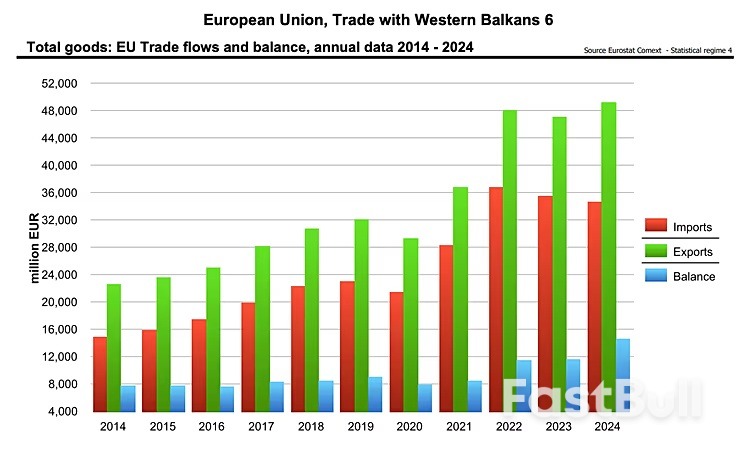

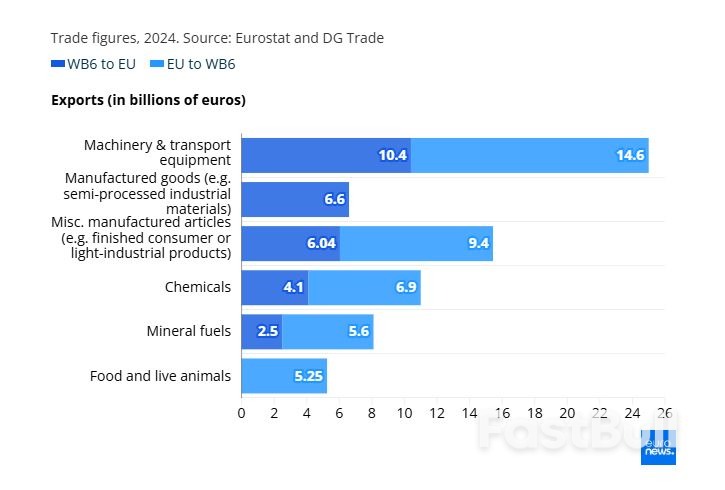

According to the European Commission’s 2025 Western Balkans trade factsheet, total trade in goods between the EU and the six Western Balkan partners reached €83.6 billion in 2024, up 28.6% since 2021.

Exports from the EU to the region stood at €49.06bn, while imports from the Western Balkans came to €34.52bn, leaving Brussels with a €14.54bn trade surplus.

The EU’s dominance as a market is overwhelming. It accounts for around 62% of all Western Balkan trade, whereas the region represents barely 1.7% of the EU’s external trade.

Import and export values between the Western Balkan countries and the EU over the years Source: Eurostat

For Serbia, Bosnia and Herzegovina, and Albania, between two-thirds and three-quarters of all exports go to EU countries.

"All (candidate) countries, with the curious exception of North Macedonia, have persistent trade deficits with the EU, meaning they import more from the EU than they export there," explained Branimir Jovanović, an expert with The Vienna Institute for International Economic Studies (WIIW).

"These are economies with small productive sectors. They do not produce enough of what they need, so they have to import, and they also do not produce enough to export," Jovanović continued.

Over the past decade, North Macedonia has become a production base for components that go straight into EU industry that qualify for preferential access to the EU market under the Stabilisation and Association framework (SAA).

The result is that North Macedonia can sell a relatively high share of what it makes directly into the EU without being blocked by technical standards.

This is very different from, say, Albania, which leans more on raw materials and low-value textiles, or Montenegro, which is tourism-heavy and import-dependent in goods.

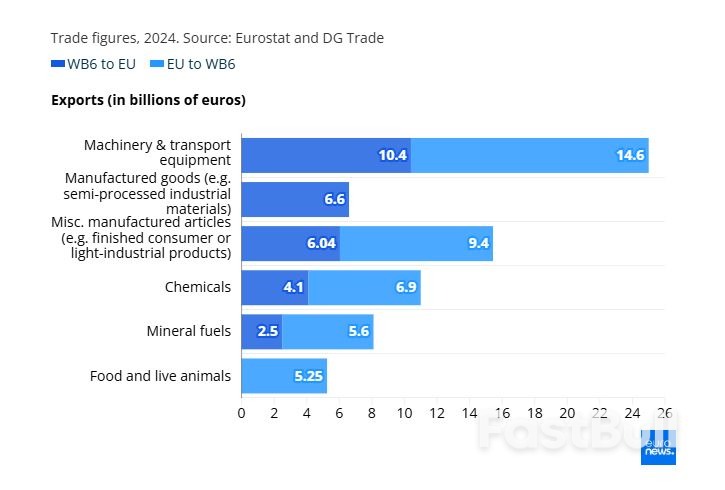

It is also different from Bosnia and Herzegovina and Serbia, which still import a lot of higher-value machinery from the EU and then export a more mixed, lower-value basket back.

Ukraine and Moldova import high-value EU machinery, vehicles and industrial equipment, while exporting mainly lower-margin goods. In essence, they supply raw materials and basic products, and the EU supplies the technology to produce them.

Barriers to trade

The Western Balkans trade with the EU under SAAs, which gradually remove tariffs and align national laws with EU rules as part of the formal accession process. By contrast, Ukraine and Moldova operate under Deep and Comprehensive Free Trade Areas (DCFTAs), broader deals that open large parts of the EU single market in exchange for adopting much of the EU’s regulatory framework.

In essence, SAAs are a pathway to membership, while DCFTAs offer deep EU market integration without full membership. This distinction has, however, become blurred — with Brussels indicating that it believes in full membership for Ukraine and Moldova after the full-scale invasion of Ukraine in 2022.

"Countries exporting to the EU face many barriers aside from tariffs. Economists call these technical barriers to trade, such as phytosanitary standards," Jovanović explained.

So even if they produce something that there is a demand for in the EU, it never reaches those markets because these companies might not have the necessary certificates.

"So, although unemployment has decreased, there is no real progress in development. There is also a real risk of a middle-income trap, in the sense that these economies remain assembly-line economies, with low wages and limited technological development and innovation."

The same debate now extends to Ukraine, which formally opened EU accession talks in 2024. Despite the war, trade between the EU and Ukraine has surged. Eurostat data shows the bloc exported €42.8bn worth of goods to Ukraine in 2024 and imported €24.5bn, yielding a €18.3bn surplus for the EU.

The composition of that trade has shifted dramatically since the Russian invasion. Agricultural commodities still dominate Ukrainian exports such but the EU has become its conduit for reconstruction materials and machinery.

Neighbouring Moldova, another candidate country since 2023, shows similar patterns. The EU is Moldova’s biggest trading partner, accounting for 54% of its total trade in goods in 2024. Some 65.6% of Moldovan exports head to the EU.

Trade turnover reached about €7.5bn last year, with EU exports to Moldova amounting to €5.1bn and imports to €2.4bn.

EU standards, a distant dream?

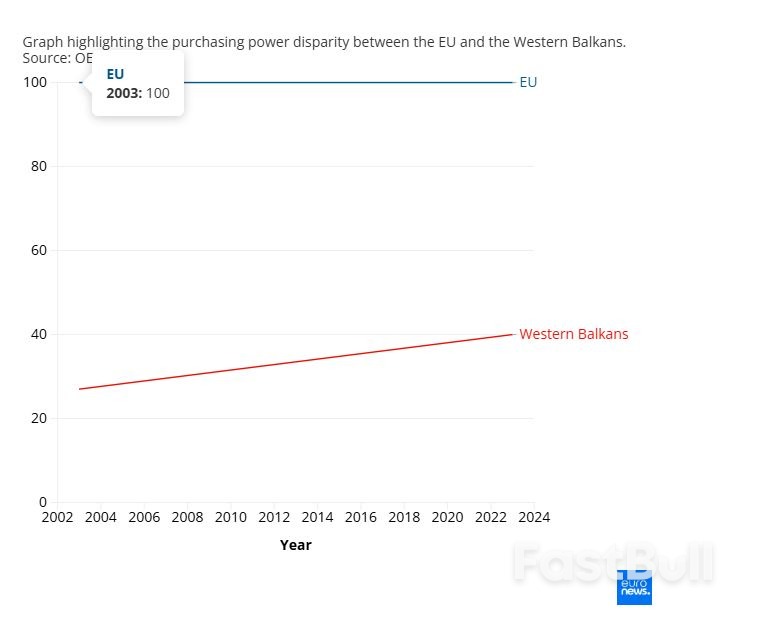

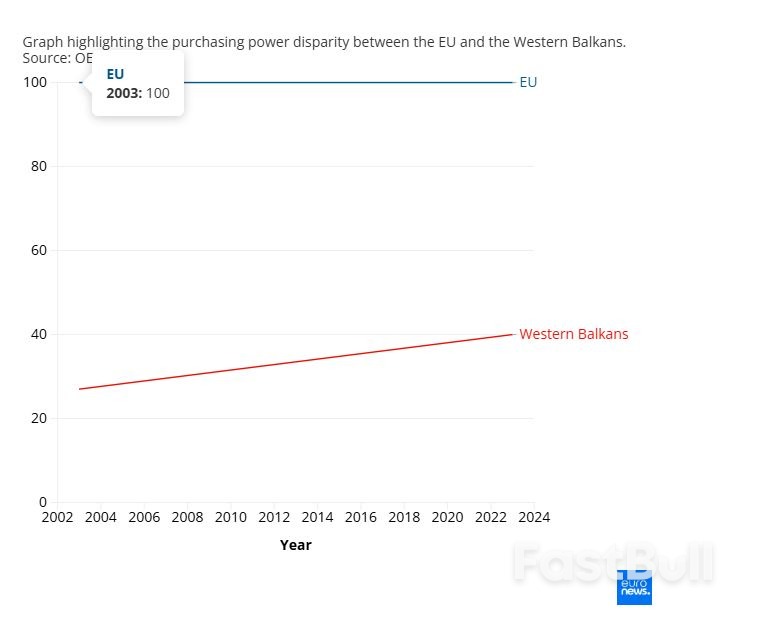

The Western Balkans have made solid progress since the early 2000s, but full convergence with the European Union remains a distant goal, warned the OECD’s Economic Convergence Scoreboard for 2025.

The six economies have more than doubled their output in two decades — yet the region still only reaches about 40% of the EU average. At current growth rates, full convergence won't arrive until 2074.

The region’s output per person (in purchasing-power parity terms) has more than doubled in 20 years, showing real improvement in productivity, investment, and living standards.

That means the Western Balkans are closing the gap, but painfully slowly, and the strong growth rates are offset by the much higher productivity and capital stock inside the EU.

Growth, on its own, is not enough for convergence. The Western Balkans need qualitatively different growth which is driven by innovation, skills, and higher-value industries.

Infrastructure and productivity are the region's weakest links.

According to the OECD report: "The insufficient quality and coverage of core public transport infrastructure can be a significant obstacle to higher economic growth...as inadequate transport networks can severely constrain the connectivity of producers and consumers to global and regional markets."

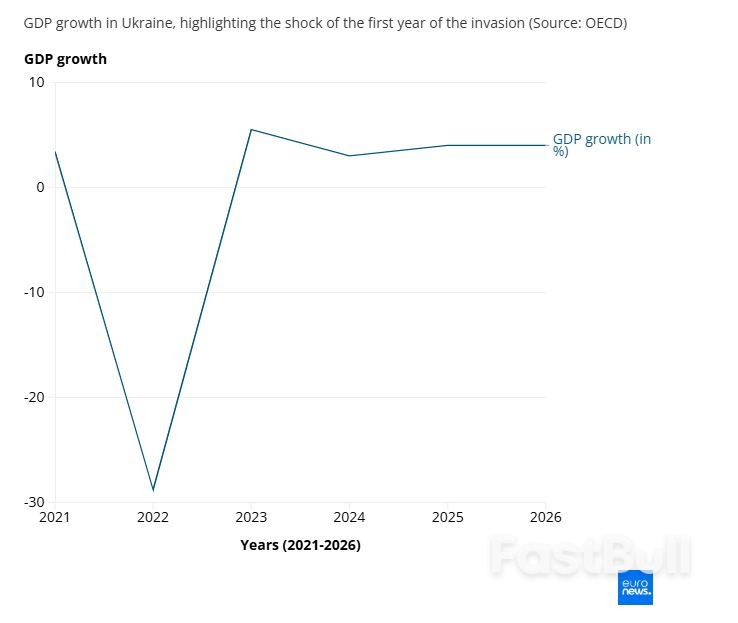

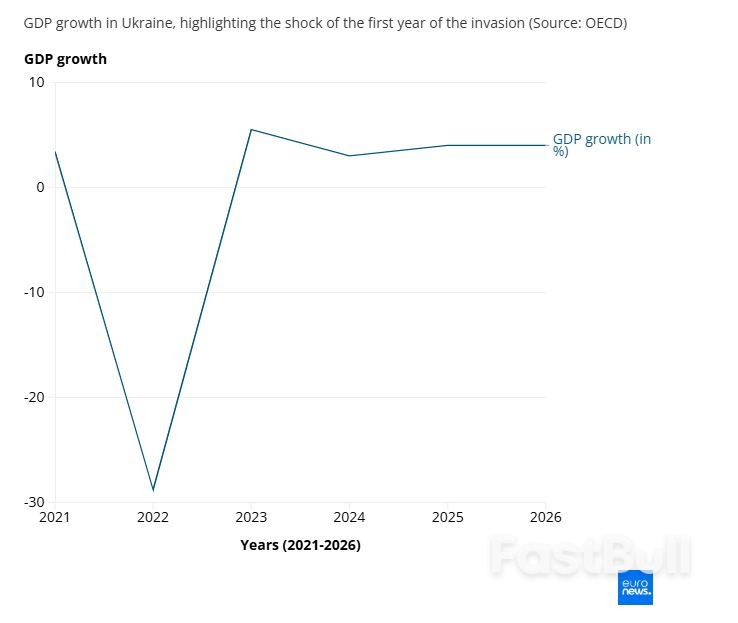

With regard to Ukraine, its economy has adapted after a historic shock, but the damage is staggering. Much of the population has been displaced and large swathes of infrastructure have been destroyed.

Output fell –28.8% in 2022 and rebounded +5.5% in 2023. Public finances are being stretched to the limit by defence needs, hindering convergence with EU member states.

Foreign investment: Friend or foe?

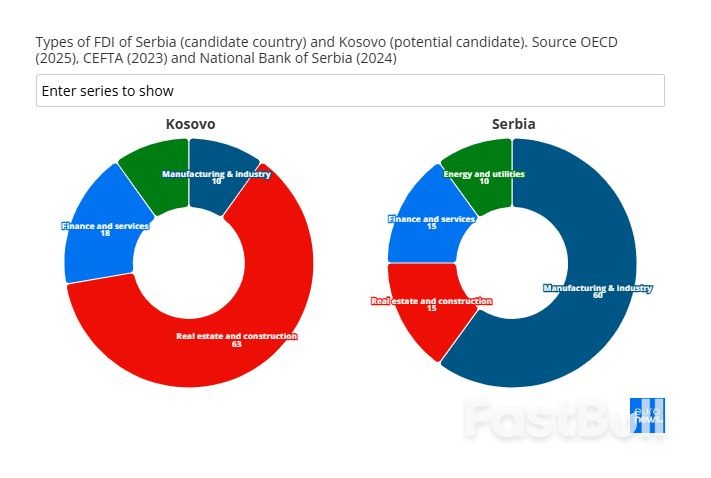

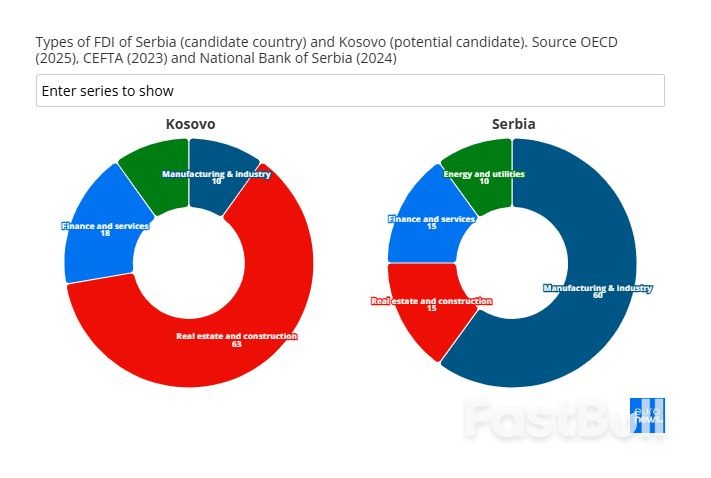

Foreign direct investment (FDI) brings factories and jobs to candidate countries, as well as building stronger links with existing EU member states. Even so, Jovanović argued that this has not led to "structural transformation" in the candidate nations.

The pattern is visible, for example, in Serbia — where car plants are boosting employment but the country is still importing high-tech machinery.

When FDI concentrates in lower-value stages of production and local supplier bases remain thin, wage gains are limited and more value is captured abroad.

“There is a duality in how FDI is perceived: politicians still see it as the key — sometimes even the only way — to develop the economy, while people are increasingly seeing it as a vicious circle," said Jovanović.

"Hence, a change in the economic model is long overdue — with a more selective approach towards FDI, focusing on high-quality and high-tech investment and a greater focus on domestic companies through industrial and innovation policies,” Jovanović added.

The argument is clear: while FDI raises employment and links these economies to EU markets, it becomes transformative only when it upgrades the local production base.

Otherwise, candidate countries risk remaining an assembly platform rather than a full partner in Europe’s value chains.

A test of Europe’s promise

In the end, the numbers tell both a success story and a warning. They show integration without transformation: Exports are up, factories are open, but productivity and infrastructure still lag.

The next phase will need to hinge on quality, not just quantity, say experts. This means selective FDI that upgrades supply chains, targeted single-market access tied to reforms, and faster investment in skills, energy, and transport.

If Brussels and the candidates can shift from assembly to innovation, the gap can narrow within a generation. If not, the candidate countries risk remaining a dependable workshop rather than a prosperous partner.

Source: Euronews