The Cuts Don't Work - Why The Fed May Pause In December

Federal Reserve Chair Jerome Powell surprised many market-watchers on Wednesday when he declared that another interest rate cut in December was not a slam dunk.

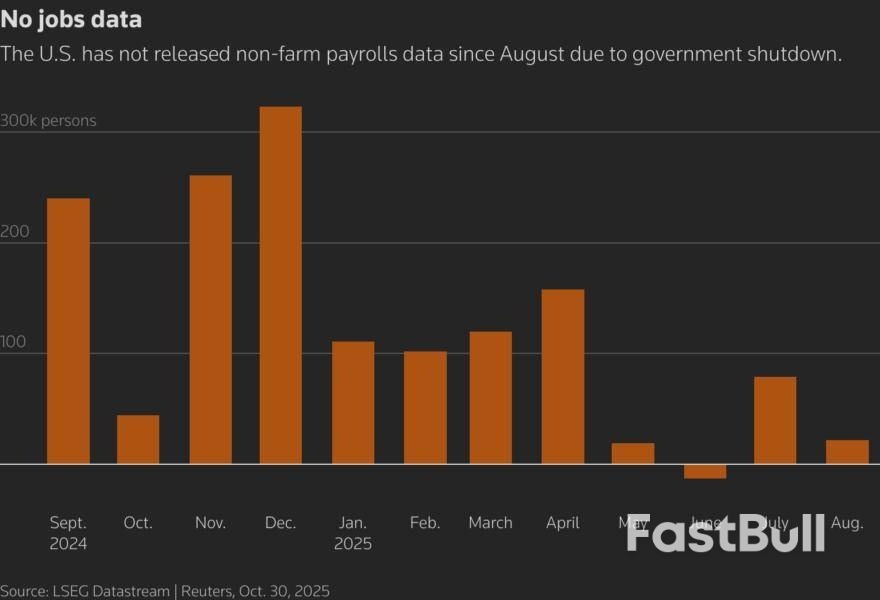

Federal Reserve Chair Jerome Powell surprised many market-watchers on Wednesday when he declared that another interest rate cut in December was not a slam dunk. Perhaps even more surprising was his apparent suggestion that if boosting the labor market is the goal, rate cuts might not be that useful.In the press conference after the central bank lowered its fed funds policy target range by 25 basis points, Powell cited several reasons why a similar move in December is "far from" a done deal. These included "strongly different" views among rate-setters, limited data visibility due to the government shutdown, above-target inflation, and doubts about how quickly the labor market is slowing. He also noted that policy may be close to neutral after 150 basis points of easing.

But perhaps the most telling reason was the most simple: cutting rates won't work. At least, doing so won't address the current problem, which is supporting the softening labor market.

Alluding to this, Powell admitted that the job market is weakening primarily because of shrinking labor supply rather than cooling demand for workers.But lower borrowing costs are designed to boost demand for workers. If the job market's problems are "mostly" a function of labor supply, as Powell said, then cutting interest rates is akin to pushing on a string."So the question then is what does our tool do, which supports demand? Some people argue that this is supply, and we really can't affect it much with our tools. But others argue, as I do, that ... we should use our tools to support the labor market when we see this happening," Powell told reporters.

"It's a complicated situation."

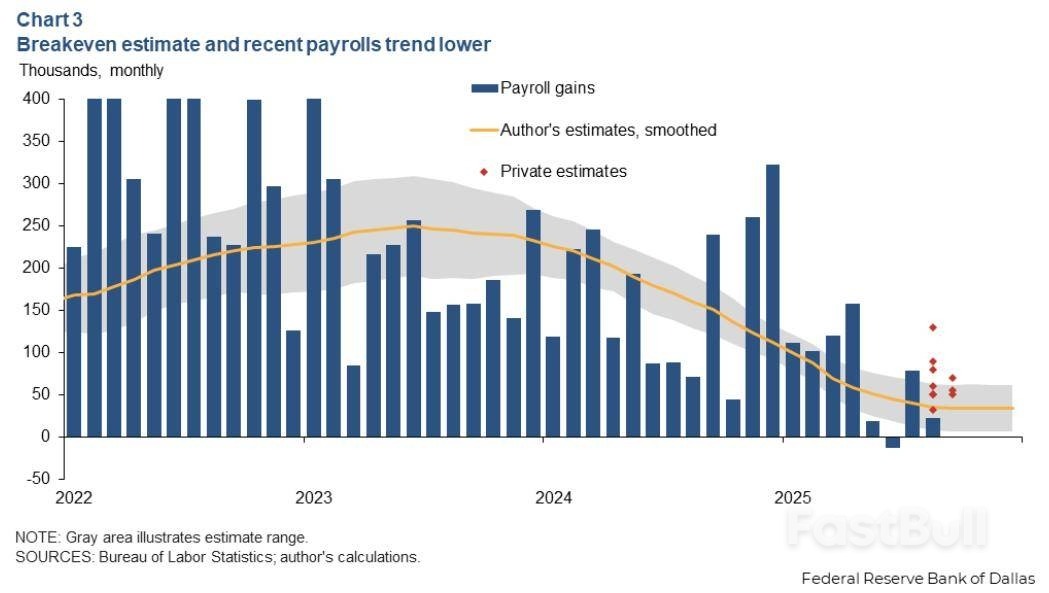

Thomson ReutersUS payrolls breakeven estimates - Dallas Fed

Thomson ReutersNo jobs data

'K-SHAPED' ECONOMY

The current U.S. economic picture is indeed complicated.

Job growth has slowed in the U.S. over the past year, but this has been offset by a steep decline in the number of people looking for work. That's a result of the tighter immigration controls, increased deportations, and both young people and retirees leaving the labor force.In the last official monthly jobs report, which was for August, the unemployment rate climbed to a four-year high of 4.3%. But that's only one tenth of a percentage point up on the previous year, and is still ultra-low by historical standards.Powell also said there's no evidence of a worrisome deterioration in the broader labor market, though the recent announcement of some high-profile corporate layoffs may suggest otherwise.

At the same time, economic indicators such as business investment and retail sales still appear fairly healthy. Both are strongly linked to the booming stock market - big companies' rising share price and profits fund their capex, and the asset-owning top 10% continue to drive around half of all U.S. consumer spending.What we appear to see taking shape is a so-called 'K-shaped' economy: the rich are getting richer from the asset price boom, while the rest are struggling.This curious balance is new for the Fed and a tricky one to navigate, especially with the government shutdown reducing visibility even further.

Just as the Fed's blunt interest rate tool doesn't fix supply-side issues in the jobs market, it may not do much to support lower-income households and individuals either, even though ensuring a stronger labor market is the "best thing" the Fed can do for the American people.Cheaper money is also likely to benefit the richest cohorts by inflating asset prices even more, which may also push already lofty valuations to unsustainable levels.Six weeks is a long way off, but a third successive rate cut in December is suddenly in the balance. If the subtext of Powell's press conference is anything to go by, that may be for the best.