Amazon (AMZN) reported its third quarter earnings after the bell on Thursday, beating on the top and bottom lines as its cloud business grew faster than expected.

The results come just a day after rivals Microsoft (MSFT) and Google (GOOG, GOOGL) announced their own results, with both companies saying they'll spend more on AI data centers going forward.

"You're going to see us continue to be very aggressive in investing in capacity because we see the demand," CEO Andy Jassy said on the company's earnings call with analysts.

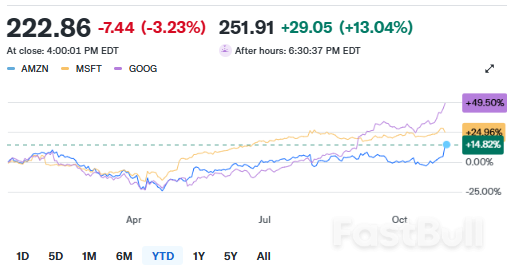

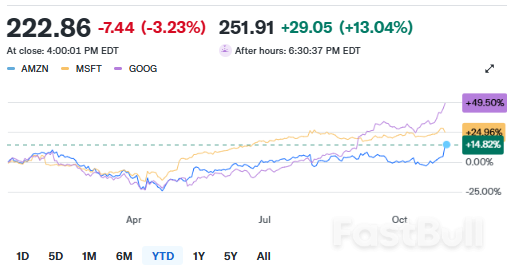

Amazon stock rose more than 13% following the report.

For the quarter, Amazon reported earnings per share (EPS) of $1.95 on revenue of $180.2 billion, better than analysts' expectations of EPS of $1.58 and revenue of $177.8 billion.

Amazon's AWS brought in $33.01 billion in revenue versus an anticipated $32.4 billion.

The company also said adoption of its Trainium2 AI chip has become a multibillion-dollar business that grew 150% quarter over quarter, and that it launched its Project Rainier AI cluster with 500,000 Trainium 2 chips.

Still, Amazon's stock is lagging both Microsoft's and Google's by a wide margin, climbing just 2.4% year to date versus Microsoft, which is up 24%, and Google, which has jumped 49%.

Part of that has to do with the perception that AWS simply isn't capturing as much of the AI market as its biggest rivals.

While Microsoft counts OpenAI (OPAI.PVT) among its most important AI clients, and Google has Gemini, Amazon relies on Anthropic for massive AI exposure. And the company splits that with Google, which also provides cloud computing services to Anthropic (ANTH.PVT).

On Wednesday, Amazon said the AI startup signed up to use 1 million custom Amazon chips to train and run its AI models. While that's a win for Amazon, Anthropic announced a similar deal with Google just last week.

Source: Yahoo Finance

Copyright © 2025 FastBull Ltd

News, historical chart data, and fundamental company data are provided by FastBull Ltd.

Risk Warnings and Disclaimers

You understand and acknowledge that there is a high degree of risk involved in trading. Following any strategies or investment methods may lead to potential losses. The content on the site is provided by our contributors and analysts for information purposes only. You are solely responsible for determining whether any trading assets, securities, strategy, or any other product is suitable for investing based on your own investment objectives and financial situation.